Bitcoin Halving 2024: What to Expect

Bitcoin has captivated the attention of investors and technology enthusiasts since its inception in 2009. With its limited supply and the unique process of halving, Bitcoin has set itself apart from traditional fiat currencies.

As we approach the next halving event expected on 19 April 2024, it is crucial to explore the impact of halvings on the cryptocurrency ecosystem and understand the potential opportunities that arise from buying Bitcoin before the halving.

In this article, we will delve into the significance of Bitcoin halvings, examine historical patterns, and highlight the buying opportunity presented by this upcoming event.

Understanding Bitcoin Halving

Bitcoin halving is a fundamental aspect of the cryptocurrency’s monetary policy. Approximately every four years, the reward for mining new bitcoins is halved. This deliberate reduction in the creation rate of new bitcoins helps control inflation and maintain a predictable supply. By mimicking the scarcity of rare commodities, Bitcoin’s halving events create a sense of rarity and potential value appreciation over time.

During a halving, the reward for mining new bitcoins is cut in half. This means that miners receive fewer bitcoins for their computational efforts. The reduction in mining rewards serves the purpose of controlling the rate at which new bitcoins are introduced into circulation. With a limited supply of 21 million coins, the halving mechanism ensures that the creation of new bitcoins slows down over time. This deflationary nature sets Bitcoin apart from traditional fiat currencies, which can be subject to unpredictable inflation due to the discretion of central banks.

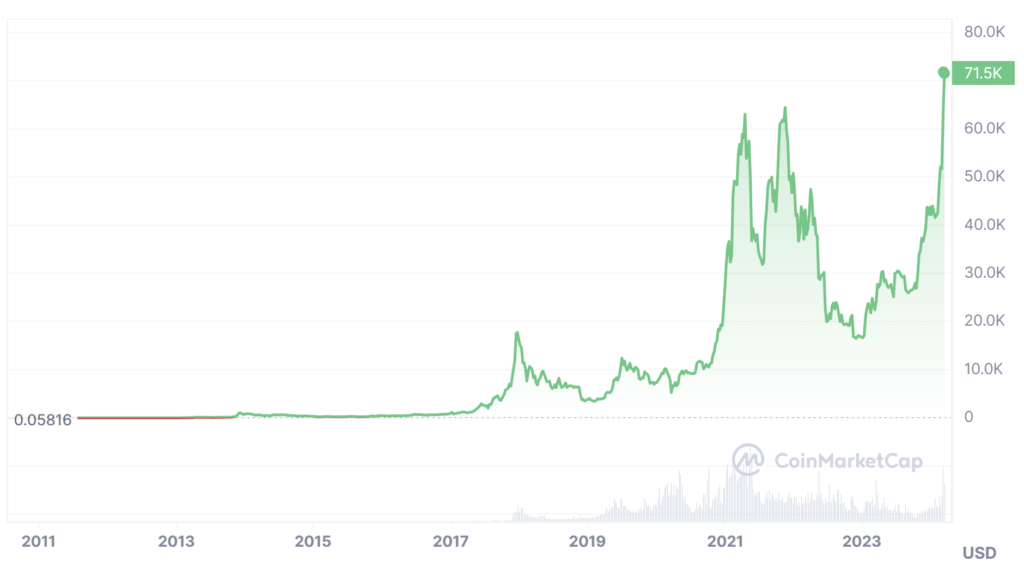

Historical Patterns and Price Action

Historical data indicate a consistent trend in Bitcoin’s price following each halving event. Past performance is not indicative of future results, but it provides valuable insights. In previous halvings, Bitcoin’s price has shown an upward trajectory in the months that follow. While it may seem counterintuitive in an efficient market, where events are anticipated and priced in, several factors explain this behavior.

The scarcity factor plays a significant role in Bitcoin’s price appreciation following a halving. As the creation rate of new bitcoins decreases, the existing supply becomes scarcer. This scarcity, coupled with increasing demand, can lead to a rise in Bitcoin’s value. The limited supply and the anticipation of reduced future supply create an environment where the demand for Bitcoin may outpace its availability, driving the price upwards.

Furthermore, halvings introduce a level of predictability and anticipation within the Bitcoin ecosystem. The event is widely known and followed by the cryptocurrency community, leading to increased attention and speculation. This heightened interest and speculation can contribute to price movements as investors and traders adjust their strategies based on the upcoming halving. The combination of scarcity and market dynamics during halvings creates an environment that has historically favored price appreciation for Bitcoin.

Stock-to-Flow: Quantifying Scarcity

One popular framework used to understand the impact of halvings on Bitcoin’s price is the Stock-to-Flow (S2F) model. This model quantifies the scarcity of a resource by comparing the available supply (stock) to the new supply added over time (flow). Bitcoin’s halving events effectively decrease the flow of new bitcoins, doubling the S2F ratio and increasing scarcity. Historical data supports the correlation between Bitcoin’s price and the S2F model, indicating that as scarcity increases, the price tends to rise.

The S2F model suggests that Bitcoin’s scarcity, as quantified by the S2F ratio, is a key driver of its price. The higher the S2F ratio, the scarcer the resource is perceived to be, potentially leading to higher demand and value. Proponents of the S2F model argue that Bitcoin’s scarcity is a fundamental characteristic that differentiates it from traditional fiat currencies and positions it as a store of value similar to precious metals like gold.

Plan B, the creator of the stock-to-flow model recently predicted that Bitcoin will actually exceed the Stock-to-Flow Model this cycle, as it has in the past after periods of underperforming the model.

It is important to note, however, that the S2F model has its limitations. It simplifies the relationship between scarcity and price, assuming that scarcity is the primary determinant of Bitcoin’s value. While scarcity is a significant factor, other variables such as market sentiment, adoption rates, regulatory developments, and macroeconomic conditions can also influence Bitcoin’s price. The model’s predictive power is based on historical data, which might not necessarily persist in the future. Therefore, while the S2F model provides a valuable perspective, it should not be the sole basis for investment decisions.

Macro Influence on Bitcoin’s Price:

While the S2F model provides a useful lens for assessing Bitcoin’s scarcity, it is essential to consider macroeconomic factors that surround Bitcoin halvings. Global economic volatility, shifts in monetary policy, and broader economic conditions can significantly influence Bitcoin’s price. Historical analysis of previous halvings reveals that heightened economic uncertainty often coincides with increased interest in Bitcoin, potentially amplifying the price effects of halvings.

The macroeconomic context surrounding Bitcoin halvings is crucial to understanding their impact on price. Economic factors such as inflation, monetary policy decisions, and geopolitical events can shape market sentiment and investor behavior. For example, during the 2020 Bitcoin halving, the COVID-19 pandemic led to large-scale stimulus measures and increased inflation expectations. As a result, individuals turned to Bitcoin as a potential hedge against inflation, driving up demand and contributing to its price appreciation.

Each halving event occurs in a unique economic landscape, and its effects are intertwined with broader market dynamics. Understanding the macroeconomic influences on Bitcoin’s price can provide valuable insights into the potential opportunities presented by halvings.

Many analysts are anticipating a different trajectory for Bitcoin this halving, after the recent wave of Bitcoin ETFs opened Bitcoin to a wider spread of institutional investors.

A Bitcoin Buying Opportunity

As we approach the 2024 Bitcoin halving, an opportunity arises for investors looking to buy Bitcoin. The historical patterns and the potential scarcity created by halvings suggest that Bitcoin’s price could experience an upward trajectory. While price appreciation is not guaranteed, understanding the dynamics at play can help inform investment decisions.

The buying opportunity presented by the 2024 halving stems from the combination of scarcity, historical patterns, and macroeconomic influences. Bitcoin’s limited supply and deflationary nature make it an attractive long-term investment option for those seeking an alternative store of value. The anticipation of reduced future supply, coupled with increasing demand, may contribute to the price appreciation observed in previous halvings.

As we count down to the Bitcoin halving event expected in April 2024, investors have a small window of opportunity to consider buying Bitcoin before the halving takes place. Historical patterns and the scarcity created by halvings suggest that Bitcoin’s price is likely to experience a strong upward trajectory following the halving event.

However, it is essential to approach investment decisions with a comprehensive understanding of the complex dynamics at play. Factors such as global economic conditions, technological advancements, and market sentiment should be considered alongside the halving event. By carefully evaluating these factors, you can make informed decisions regarding the potential benefits of buying Bitcoin.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, TikTok, and LinkedIn.