Crypto Slang Series: What Does HODL Mean and How Can You Profit From It?

Even if you’re new to crypto, you’ve probably heard the term HODL bandied about. It’s just one of many crypto terms that have become common parlance in cryptocurrency circles, but what does HODL mean? What exactly does this strategy involve and how is it something you can make a profit from?

HODL meaning and origins

HODL stands for ‘hold on for dear life’, but the HODL meaning as we know it today was not the original intention. If it looks like a typo to you, that’s because it is, or, rather, was.

Back in December 2013, a drunk, ranting Bitcoin trader with the username GameKyuubi posted on a Bitcointalk forum “I AM HODLING” in response to a dramatic drop in the value of Bitcoin. He had meant to type ‘holding’, but in that moment of whisky-fuelled (as GameKyuubi himself admitted) frustration, the term ‘HODL’ was born.

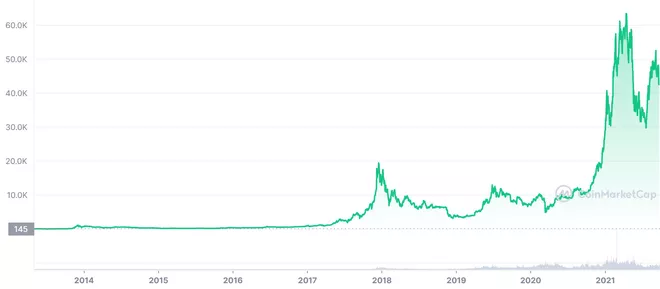

The price of Bitcoin was extremely volatile in 2013. When GameKyuubi wrote his now infamous post, Bitcoin’s value had fallen 39% from $716 to $438 in the previous 24 hours. This followed a year-long bull run where Bitcoin surged from $15 in January to more than $1,100 in the December of that year.

“WHY AM I HOLDING? I’LL TELL YOU WHY,” he continued. “It’s because I’m a bad trader and I KNOW I’M A BAD TRADER. Yeah you good traders can spot the highs and the lows … Just like that and make a millino bucks sure no problem bro.”

He was articulating a feeling many Bitcoin investors had at the time. That it was getting too difficult to predict the price fluctuations in the Bitcoin market, and instead the best course of action was to ‘hold’. GameKyuubi went on to explain his position:

“You only sell in a bear market if you are a good day trader or an illusioned noob. The people in between hold. In a zero-sum game such as this, traders can only take your money if you sell.”

In less than an hour, HODL had morphed into an internet meme and was on its way to becoming a genuine crypto industry term. Now, HODL can be defined as the intention to hold on to your Bitcoin or other cryptocurrencies, refusing to sell irrespective of swings in price.

What does HODL mean for you as an investor?

HODLers, as they’re now known, are motivated to maintain their investments whether the market goes up or down. These people believe in the potential of crypto and trust that the value of established cryptocurrencies like Bitcoin and Ethereum will only increase in the long term, making HODL the best of all options.

They resist falling prey to the fear-mongering in the market associated with FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt).

This buy-and-hold approach isn’t a new one (it has long been a stock market strategy), and whether your investments are in traditional stocks or the new world of cryptocurrencies, the principle of not panic selling is always a good one. Many HODLers, however, have taken this to the extreme and seem impervious to those predicting both price dips and surges.

Critics of the crypto HODL strategy would say these HODLers are crazy to sit and do nothing as the price of their favourite crypto plummets, but if you look at the price trajectory of many cryptocurrencies over recent years, you would have to conclude that these HODLers are onto something.

While extreme fluctuations in price are frequently seen in the short-term crypto markets, if you had, for example, bought $10,000 worth of Bitcoin in late 2015 when the coin was enjoying a substantial rally, that investment would be worth $143,829 today.

But then hindsight is 20/20. We can all wish we’d bought a couple of Bitcoins back in 2015 for HODLing. As with any investment, the ultimate aim is to buy low and sell high (easier said than done), but just like any other investment, you need to go into it with your eyes open, and that means understanding the pros and cons.

So, can HODLing work for you as a strategy?

The pros of HODLing

There are undoubtedly advantages to adopting a crypto HODL strategy, the main one being that HODLing isn’t dependent on timing the market. Unless you’re an expert, it can be extremely difficult to know when is a good time to buy and sell. Fortunes have been made by accurately timing the crypto markets, but they’ve been lost too, and it’s a risky strategy for anyone, not least an amateur.

The beauty of HODLing is that once you’ve bought, you can just leave your investment to (hopefully) appreciate in the long term, and in the meantime educate yourself as to the complexities of the market and various trading strategies.

Buy-and-hold is a proven stock market investment strategy and is often recommended by financial experts. The approach has a good track record, and its main advantage is the protection it offers against market volatility.

Even buying crypto during a bear market (when the price is trending down) can work in the favour of a HODLer. Those convinced of a cryptocurrency’s long-term potential are likely to be of the view that it’s an even better time to buy and then HODL.

If you’re looking for a safer investment option and are comfortable with having your capital tied up for the foreseeable future, then HODL could be the right move for you.

The cons of HODLing crypto

On the flip side of the buy-and-hold strategy, with traditional investments, there are decades, sometimes even a couple of hundred years, of performance to look back on.

When we look at the performance history of, say, Bitcoin, there’s only a decade or so of data to work with. Yes, there has been an upward trend in the value of Bitcoin, but there’s no way to know for sure whether this will continue into the future and if HODLing will prove profitable.

This, of course, can be said of any investment, but cryptocurrency doesn’t yet have a proven track record and so is harder to gauge. There are no guarantees in anything, and realistically we can only base our decisions on the information we have.

Another downside of HODLing is that your capital will be locked away for years, maybe even decades. It takes time to profit from HODL, and when your money is invested in one option, it’s unavailable for others, so you need to be sure it’s the right strategy for you.

If you’re focused on faster investment returns or happy to take more risk, then there are short-term crypto investing strategies worth considering. And, while it’s possible to make substantial profits from short-term investing, inevitably, with big profit potential comes big risks.

To HODL or not to HODL?

No one crypto investing strategy is the right one. Whichever you opt for will depend on a number of factors, including the extent of your crypto market knowledge, investing goals, and risk appetite. The coins you choose to HODL will probably be the most important decision you make.

As always, do your research before investing, and don’t get caught up in the hype of a particular coin. This isn’t day-trading, it’s an investment with a long-term goal in mind, so take your time before you begin your crypto HODL journey.

Like with any investment, there is always an element of risk involved and you should seek professional financial advice before making any decisions. As always, our articles should not be taken as financial advice and you should do your own research before making a purchase.

Frequently Asked Questions (FAQs)

HODL stands for ‘hold on for dear life’. It originated as a typo on a Bitcoin forum but has come to mean holding on to your cryptocurrency and refusing to sell it no matter what the current market price is.

HODLing is a good option for those who don’t feel confident timing the market. They can instead hold their coins for the long term, allowing their investment to appreciate. Also, buy-and-hold, as it’s known in traditional investing, is a tried and tested investment strategy.

While the buy-and-hold strategy has a proven track record, cryptocurrency is still in its infancy and so there’s little data to look back on when trying to predict the future movements of the market. If you are going to HODL, you need to be aware that your capital will be tied up for a long time.

HODLing is often seen as the safer investment option, as the short term volatility of cryptocurrencies can lead to greater risk. As with any investment, you should always do your research before deciding on the best option for you.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter and LinkedIn. Sign up here to start buying and selling cryptocurrencies instantly today.