Bitcoin Derivatives Fill Investors With Optimism

Investor sentiment remains high as Bitcoin defends its position above $34,500. Echoed by strong derivatives data, it appears that bulls remain in full control.

Momentum has also transferred across to many altcoins, including XRP, which, thanks to new regulatory approvals in Dubai, has witnessed an 18% increase over the course of the week.

In addition to that, MicroStategy has – once again – thrown its weight behind the world’s leading cryptocurrency with another BTC purchase.

There’s a lot to cover this week, so let’s get started.

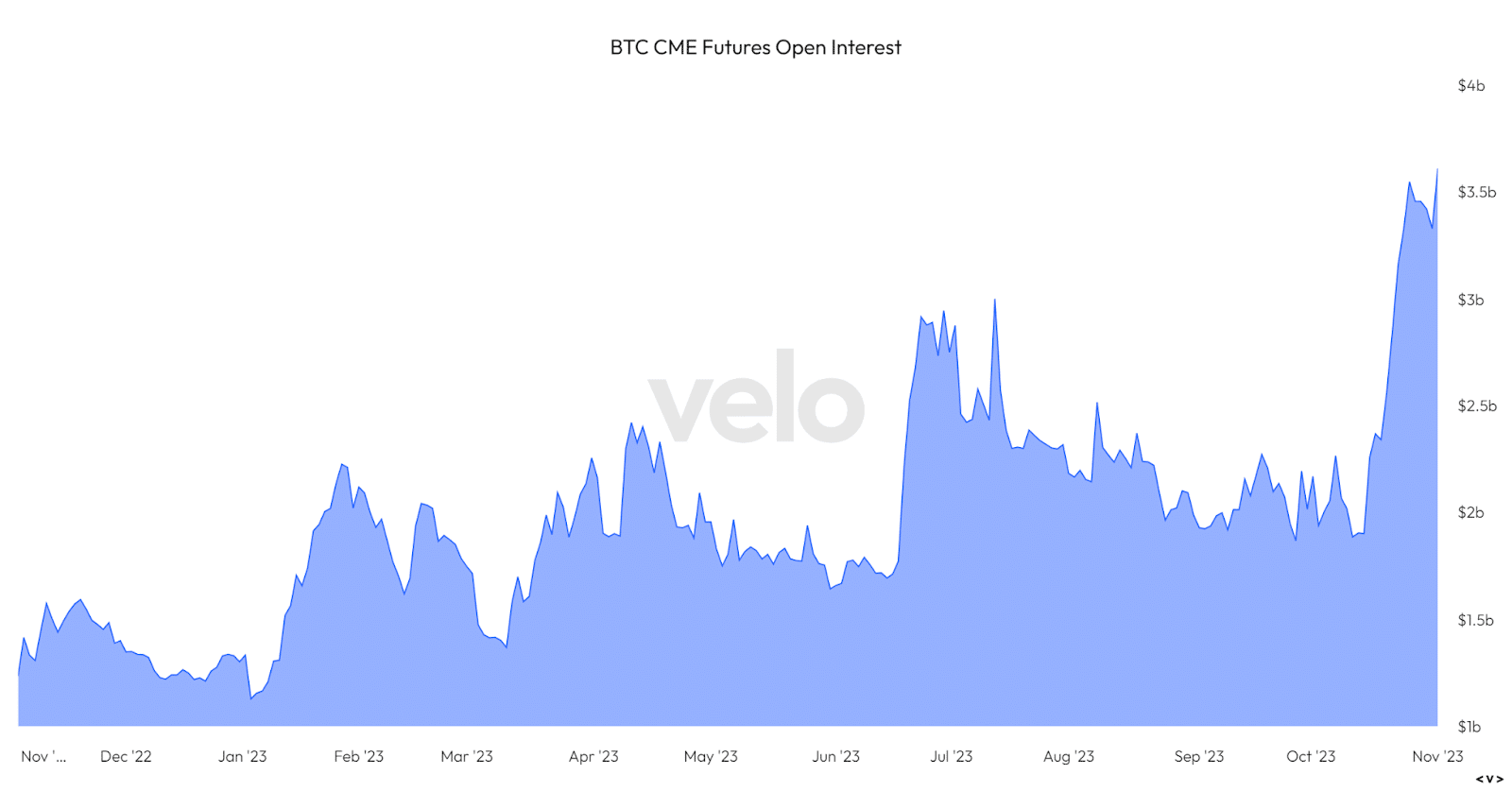

Bitcoin futures trade at premium as open interest hits record high

Bitcoin futures open interest at the Chicago Mercantile Exchange (CME) has reached an all-time high, surging to $3.65 billion, as the cryptocurrency market continues to attract institutional interest.

This surge in open interest comes alongside a series of contradictory signals from the derivatives market, leaving market participants cautiously optimistic about the future of Bitcoin.

BTC CME futures open interest

Alongside all-time highs in open interest, the Bitcoin CME futures premium also reached its highest level in over two years, defying expectations of a neutral market.

Traditionally, in neutral markets, the annualized premium for Bitcoin futures typically hovers between 5% and 10%. However, the current 15% premium for CME Bitcoin futures stands out, highlighting the strong demand for long positions.

This premium spike has raised concerns among analysts who worry that some may be banking on a guaranteed approval of a spot Bitcoin exchange-traded fund – which is still yet to be decided.

Despite the activity in the derivatives market, the ultimate determinant of Bitcoin’s price remains the spot exchange flows.

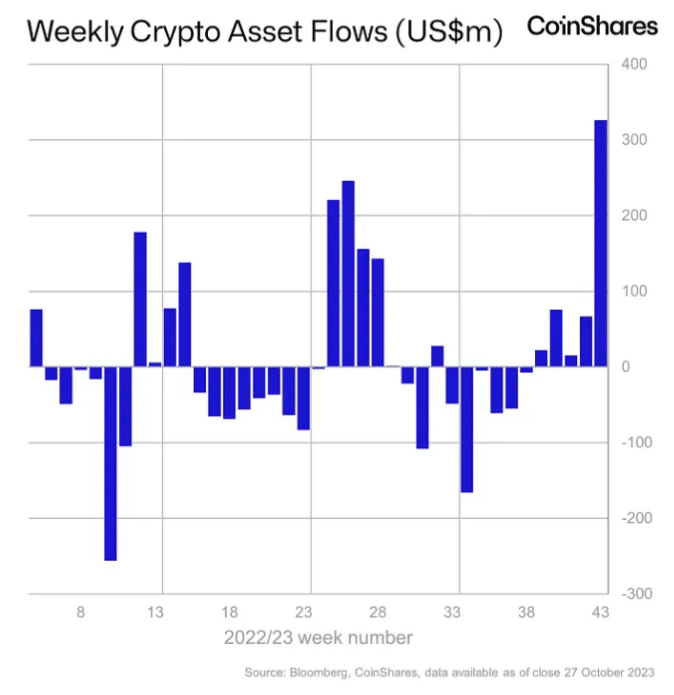

According to a recent report by CoinShares, excitement regarding Bitcoin ETFs has resulted in $326 million flowing into crypto investment funds globally over the last week, which is the largest influx since July 2022.

Of the $326 million inflows, $296 million flowed into Bitcoin.

Weekly crypto asset flows

Bitcoin volatility: it’s needed!

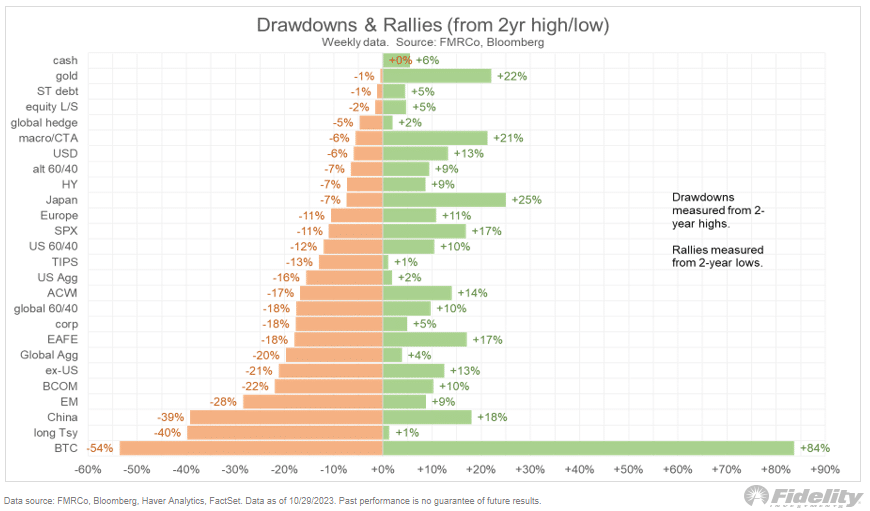

Over the years, Bitcoin’s renowned volatility has sparked numerous debates within the financial world.

However, this week Fidelity’s Jurrien Timmer delved into the topic, and offered an intriguing perspective on Bitcoin’s price swings.

Timmer, a prominent executive at Fidelity, shared an enlightening analysis on Twitter, breaking down Bitcoin’s volatility over the pandemic and post-pandemic era (2020-2023).

Using weekly return data, Timmer first compared Bitcoin to liquid alternative asset classes.

In comparison, it was evident that Bitcoin operates in a league of its own when it comes to price fluctuations.

Bitcoin’s detractors often criticize its high volatility, but, as Timmer emphasizes, it’s crucial to recognize that this volatility is a double-edged sword.

To provide a comprehensive view, Timmer presented two key metrics: drawdowns (from a two-year high) and gains (from a two-year low), with the data ranked from the smallest to the largest drawdown.

As of last week, Bitcoin has experienced a 54% decline from its two-year high. However, the flip side of this coin is that it has surged by an impressive 84% from its two-year low.

As Trimmer described, these figures create a unique risk-reward profile that few other asset classes can match.

In comparison to gold, which is often seen as a stable store of value, the precious metal had only exhibited a 22% increase from its two-year low.

Drawdowns and rallies of multiple financial assets

XRP up 18% as coin receives green light in Dubai

According to a report from Businesswire, Ripple, a leader in enterprise blockchain and crypto solutions, received approval from the Dubai Financial Services Authority on Thursday to use its digital asset XRP within the Dubai International Financial Centre.

This development marks a pivotal moment for the crypto ecosystem within Dubai, as XRP becomes the first virtual asset to gain approval under the DFSA’s virtual assets regime, joining other cryptocurrencies such as BTC, ETH, and LTC.

With this regulatory green light, licensed virtual asset firms operating within the DIFC are now empowered to integrate XRP into their virtual asset services.

Brad Garlinghouse, CEO of Ripple, commended Dubai’s leadership in the regulation of virtual assets and innovation, stating, “It’s refreshing to see the DFSA encourage the adoption and use of digital assets such as XRP to position Dubai as a leading financial services hub intent on attracting foreign investment and accelerating economic growth.”

The listing of XRP in Dubai carries the potential to unlock new regional payments and other virtual asset use cases on the XRP Ledger.

This momentous announcement coincides with the upcoming Ripple Swell event scheduled to take place in Dubai this upcoming week on November 8-9.

Ripple Swell, known for bringing together influential voices in the financial industry and regulatory space, has previously seen hundreds of Ripple’s customers and partners convene in major global financial centers like London and Singapore.

Thanks to the excitement of new regulatory approval, XRP printed an impressive 18% weekly increase – the largest weekly increase since XRP was deemed ‘not a security’ by a US Federal Court judge.

![[filename]](https://xcoins.com/wp-content/uploads/2023/11/image.jpeg)

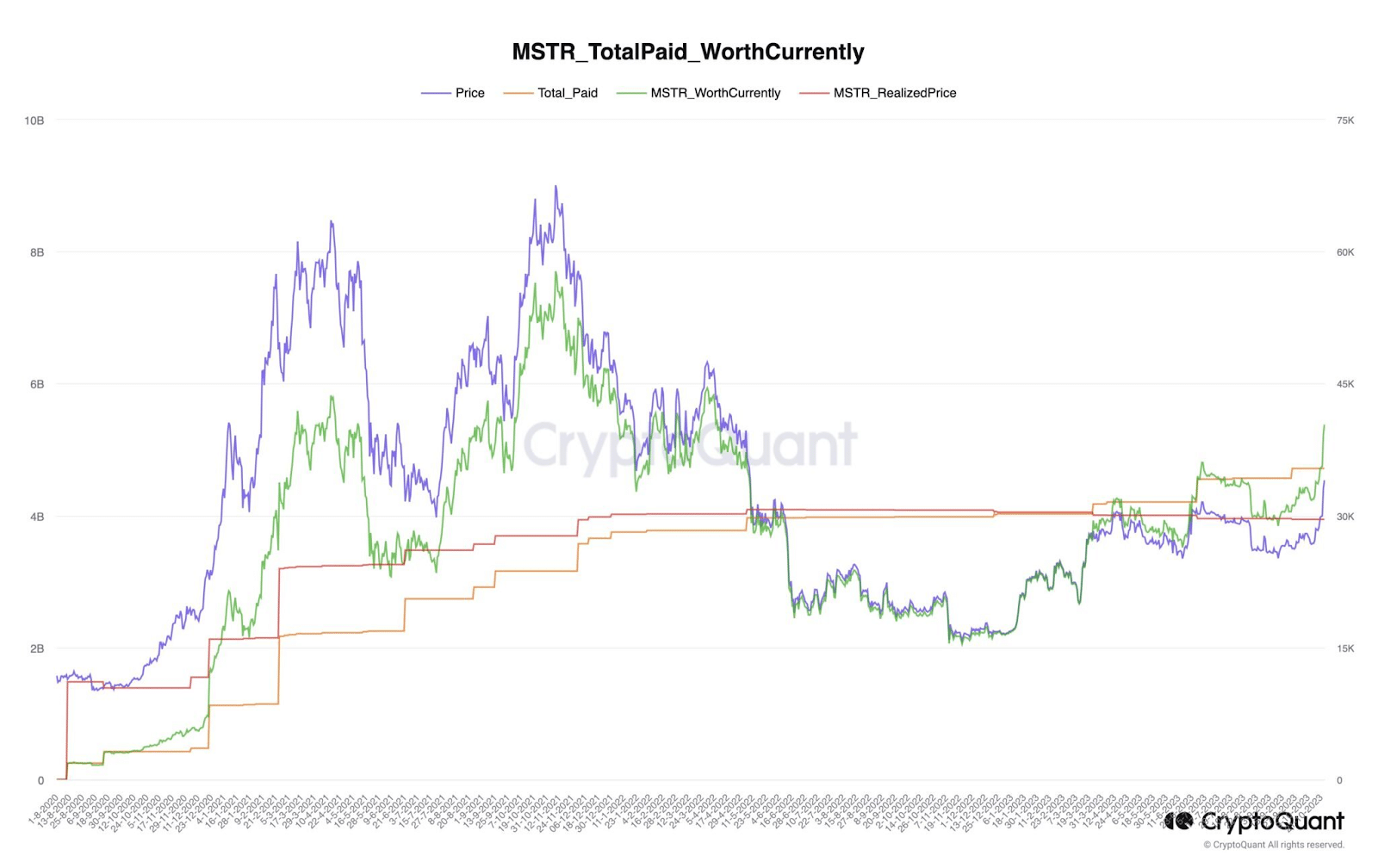

MicroStategy buys more BTC as Saylor eyes bullish future

MicroStrategy, the software development company co-founded by Michael Saylor, has acquired an additional 155 bitcoins during October, according to their recent third-quarter earnings report.

As of the end of October, MicroStrategy boasts ownership of a substantial 158,400 bitcoins, obtained at a total cost of $4.69 billion. This accumulation was at an average cost of $29,586 per bitcoin.

During an earnings call, Michael Saylor expressed his confidence in the cryptocurrency market’s future, citing the increasing regulatory clarity within the industry as a positive factor.

Saylor anticipates that the crypto industry will see positive regulatory initiatives in the coming year, which will create more clarity and consistency, ultimately providing institutional investors with greater comfort and confidence to participate.

Apart from MicroStrategy’s relentless Bitcoin accumulation, Michael Saylor has also made an extraordinary prediction about Bitcoin’s future price performance.

He firmly believes that Bitcoin is on the cusp of experiencing unprecedented growth, unlike anything seen in modern financial history.

Saylor’s optimism is grounded in several key factors. Firstly, he points to the upcoming “halving” event in April, which will cut Bitcoin mining rewards in half.

This reduction will significantly decrease the supply of new Bitcoins entering the market, potentially driving up demand.

Furthermore, there are rumors circulating on Wall Street that the U.S. regulators might finally approve the first spot Bitcoin ETF, potentially as early as Christmas.

This approval would open the doors for mainstream investors to enter the cryptocurrency market, increasing demand for Bitcoin.

Saylor stated, “You’re going to see $12 billion of natural selling per year converted into $6 billion of natural selling a year—at the same time as things like spot Bitcoin ETFs increase the demand for Bitcoin. So that’s why all of us are fairly bullish over the next 12 months: demand’s going to increase, supply’s going to contract, and this is fairly unprecedented in the history of Wall Street.”

Total paid for MicroStrategy’s BTC holdings against market price

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.