It’s Uptober: Why October is One of the Best Performing Months for Bitcoin

October, affectionately known as ‘Uptober’ in cryptocurrency circles, has once again arrived with a bang, with prices already surging sharply as the month kicked off.

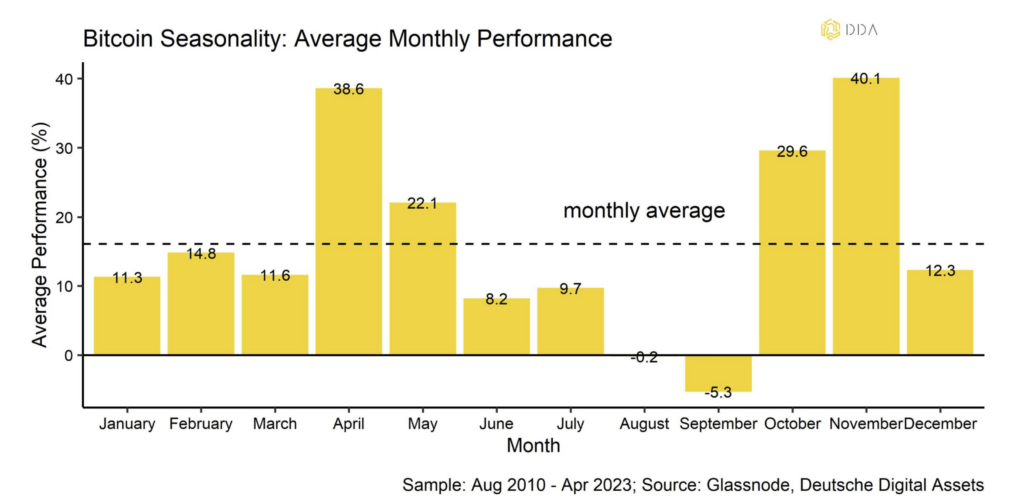

Historically, this month has witnessed particularly strong returns for Bitcoin, making it historically a great time to buy Bitcoin. In fact, October is the single most consistently green month for Bitcoin!

This article delves into the historical performance of Bitcoin in October, the breaking of the ‘Rektember’ curse in 2023, and the promising onset of ‘Uptober’ this year.

Historical Performance: October’s Green Run

Bitcoin has traditionally reveled in the arrival of October, with an average return of +29%, barring two instances of negative returns in 2014 and 2018. The consistency of positive performance in October contrasted with the often dismal returns in September, coined the term ‘Uptober’ among the cryptocurrency community.

The recent closing of September with a 4% increase in Bitcoin’s price has broken the historical trend of ‘Rektember’, a term adopted due to Bitcoin’s consistent downturn in September over the past six years. This break from the norm has ignited renewed optimism in the markets as we step into October.

Understanding the ‘Uptober’ Phenomenon

The historically favorable shift from ‘Rektember’ to ‘Uptober’ is often associated with renewed market optimism. The end of the third quarter brings about a fresh start, with retail activity picking up as the festive season approaches, further propelling Bitcoin’s market performance.

Historical trends can sometimes shape market sentiment. If investors have observed that October tends to be a profitable month for Bitcoin, they might be more inclined to buy during this period, thus driving up prices. The psychological factor of transitioning from a historically poor-performing month (September, often referred to as “Rektember”) to a historically better-performing month (October) might create a sense of optimism among investors, driving up demand and, subsequently, prices.

This may have been compounded in 2023 by strategic moves by influential players in the crypto space, like MicroStrategy’s recent acquisition of an additional 5,445 BTC, which has provided a significant boost. Such sizable investments reaffirm the bullish sentiment surrounding Bitcoin, setting a positive tone as we transition into October.

The September Indicator: A Green Signal

The September Indicator, underscored by the recent break of the ‘Rektember’ curse, suggests we might expect a bullish last quarter. Historically, a green September for Bitcoin on the rare occasion that it has occurred, has always been followed by positive performance in the subsequent months—October, November, and December. In fact, this has only ever happened twice before in the history of Bitcoin!

This trend is further bolstered by rising anticipation surrounding potential regulatory advancements, such as the approval of Bitcoin Spot ETFs by the U.S. Securities and Exchange Commission (SEC), which could significantly impact Bitcoin’s market dynamics.

The Ethereum Coattail

The synergy between Bitcoin and Ethereum’s performance showcases a broader market trend. Ethereum has also historically enjoyed positive returns in October, with both BTC and ETH having ended October in the green for the last 5 years, reflecting a market-wide optimism that often extends to other altcoins, painting October as a month of broad market optimism.

Is Now the Time to Buy Bitcoin?

The breaking of the ‘Rektember’ curse and the onset of ‘Uptober’ present a compelling narrative for those contemplating buying Bitcoin now. The historical trend, coupled with recent favorable developments like MicroStrategy’s ongoing substantial investments and the potential approval of Bitcoin Spot ETFs, adds to the allure.

Moreover, the evolving landscape with potential regulatory clarity and growing institutional adoption lays a promising foundation for robust market performance, making the prospect of buying Bitcoin in October even more enticing.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.