BTC Records Broken as the World Celebrates Bitcoin Pizza Day

With over 1 million Bitcoin wallet addresses now holding at least 1 BTC, the adoption of Bitcoin is continuing to grow.

However, Ledger’s latest semi-custodial recovery option has left investors feeling uneasy, igniting debates about the security of their assets.

Meanwhile, in the world of Ethereum, staking returns have reached unprecedented heights thanks to the successful implementation of the Shanghai upgrade.

And let’s not forget the celebration of the 13th anniversary of Bitcoin Pizza Day, a nostalgic reminder of Bitcoin’s transformative journey.

- Bitcoin wallet addresses reach milestone figure

- Ledger unsettles investors with new semi-custodial recovery option

- Ethereum staking returns reach new all-time highs

- The 13th anniversary of Bitcoin pizza day

Bitcoin wallet addresses reach milestone figure

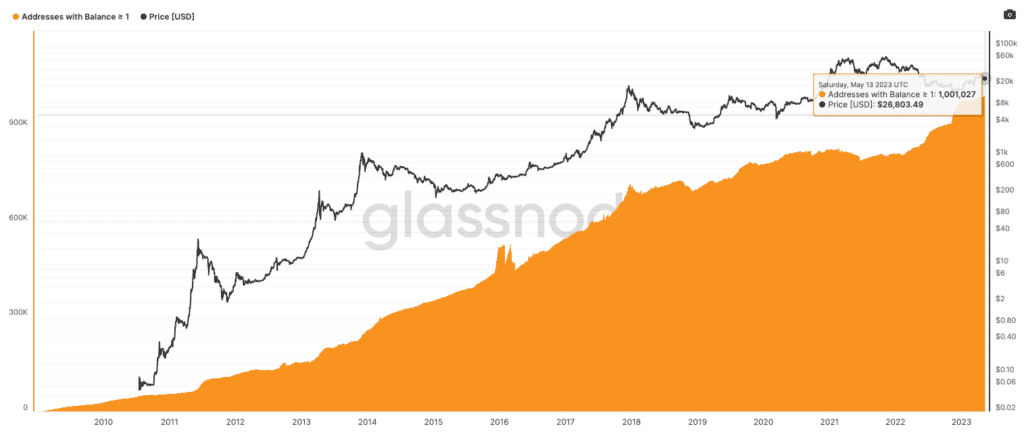

In a significant milestone for the cryptocurrency industry, the number of Bitcoin wallet addresses holding at least 1 BTC has exceeded 1 million for the first time ever.

According to data from Glassnode, the 1 million “wholecoiner” milestone was reached on May 13th 2023.

As described by members of the crypto community during the week, the development highlights the growing adoption of Bitcoin and the increasing number of individuals acquiring substantial amounts of the world’s largest cryptocurrency.

While it’s important to note that the number of addresses does not directly correspond to the number of users, as individuals can hold multiple wallets, the surge in the count of wallets holding 1 BTC or more suggests a promising trend toward adoption.

To celebrate the news, Adam Back, the CEO of Blockstream, took to Twitter to discuss the potential impact of 10 million people attempting to accumulate 1 BTC.

Considering the relatively small number of total bitcoins, Back suggested that such a massive influx of demand could push the price of Bitcoin to unforeseen heights, potentially rendering it unattainable for many.

Given the current scenario where more individuals are actively seeking to accumulate at least 1 BTC, coupled with existing holders refraining from selling, the extent of Bitcoin’s price movements as we head into the future will be particularly interesting.

Amidst ongoing discussions regarding Bitcoin’s adoption, the coin continued to test the resistance zone around $27,000, trading within a narrow range throughout the week.

Without a convincing breakthrough and daily close above this key level, the short-term outlook remains in question. However, when observing the weekly timeframe, the higher high and higher low structure remains in place alongside support from the 200-week moving average.

Ledger unsettles investors with new semi-custodial recovery option

Ledger was under the scrutiny of all cryptocurrency investors last week as the crypto wallet provider announced that it would be launching a brand new recovery option.

The feature at the center of attention is called Ledger Recover, a semi-custodial service that enables users to back up their private seed phrases using their personal identity, with the assistance of three external custodians.

However, the introduction of this service, which comes at a monthly cost of $9.99, has unsettled Ledger owners, raising questions about the security of the hardware wallet company.

A seed phrase consists of a set of words that serves as a crucial backup to recover the cryptocurrency stored in a hardware wallet in case of loss or theft.

Remembering the typically random sequence of 12 words can be challenging for some, leading most people to write it down or store it in a secure storage device.

Despite Ledger’s assurance that this service is voluntary and users can continue to independently back up their seed phrases, concerns persist among Ledger owners regarding the potential impact on the company’s security.

Speculations have arisen regarding the possibility of a backdoor in Ledger’s devices, prompting questions about the potential security risks associated with opting into this service.

The company vehemently denies the existence of any backdoor on its devices and emphasizes that the service is entirely optional.

However, debates on Twitter continue, with some users arguing that the mere option to opt into the service poses its own security risks.

Ethereum staking returns reach new all-time highs

The returns from staked Ether (ETH) reached a brand new all-time high last week, defying initial concerns of a massive sell-off.

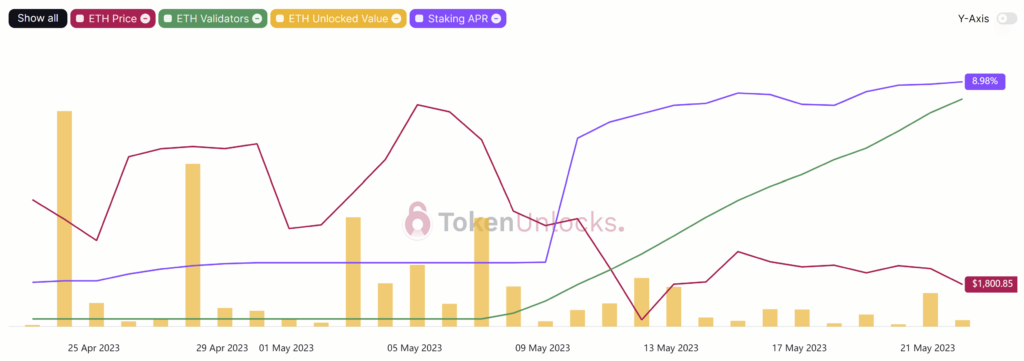

According to crypto info provider, Token Unlock, the annualized rate of return for ETH staking has reached a record high of 8.98%.

This achievement comes in the wake of a successful implementation of the Shanghai upgrade on the Ethereum network, which aimed to improve efficiency.

Notably, it allowed users to unstake and withdraw previously locked ETH that had been inaccessible since the transition from Proof of Work (PoW) to Proof of Stake (PoS) consensus.

According to new data, the change has sparked significant activity in the Ethereum ecosystem, with 4.8 million ETH being deposited into ETH staking contracts and 2.79 million ETH being withdrawn.

As of last week, this has resulted in a net pledge of 1.59 million ETH since the Merge, which is equivalent to a value of $2.8 billion.

With the current annualized rate of return of 8.98% stakers are now reaping higher rewards than ever before.

Liquid-staked ETH (stETH), which is offered by the liquid staking provider, Lido Finance, also jumped to 8%, further enhancing the earning potential for stakers.

These achievements reflect the potential of the Ethereum network, which has moved from strength to strength since the Merge in September 2022.

It appears that the ability to withdraw staked coins has reassured investors who had been hesitant to participate in staking during the initial rush.

The 13th anniversary of Bitcoin pizza day

Every year on May 22nd, cryptocurrency enthusiasts worldwide gather to celebrate a significant milestone in the history of Bitcoin – Bitcoin Pizza Day.

The annual event commemorates the first-ever documented Bitcoin transaction for a tangible product and highlights the remarkable journey of Bitcoin’s early adoption.

The story behind Bitcoin Pizza Day takes place in 2010, when Laszlo Hanyecz, a programmer and early Bitcoin adopter, set out to prove the viability of Bitcoin as a currency for everyday transactions.

To showcase this potential, he posted an offer on a Bitcoin Talk forum, pledging 10,000 BTC to anyone who would purchase a couple of pizzas for him.

Surprisingly, a forum user accepted the offer, leading to Hanyecz’s groundbreaking pizza purchase.

At the time, the value of 10,000 BTC was approximately $41. Little did they know that this transaction would become a pivotal moment in the history of Bitcoin, demonstrating its real-world utility and sparking discussions about its future potential.

Therefore, May 22nd holds a special place in the hearts of Bitcoin enthusiasts, serving as a reminder of the network’s humble beginnings and its subsequent global impact.

Reflecting on the numerical impact, the value of the 10,000 BTC used to purchase those pizzas in 2010 has experienced an astronomical increase.

Today, it would be worth a staggering $630 million.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.