All You Need to Know About Ethereum in 2022

Bitcoin is undoubtedly the leader of the cryptocurrency pack, but what if you’re looking for a future-proof alternative that might have more growth potential?

Enter Ethereum, which has grown 1000% in value over the past two years. More than double the growth seen by Bitcoin in the same period.

Ethereum is far more than a conventional cryptocurrency, it’s an entire platform for building projects powered by a cryptocurrency called Ether.

It also has greater ambition than its precursors, which were designed to simply serve as currencies. It features smart contract scripting allowing software of almost any kind to be built on its public blockchain network.

The main difference between Bitcoin and Ethereum is that Bitcoin is simply a decentralised currency, whereas Ethereum is an entire ledger-based technology that allows for whole new programmes to be built on top of it.

There’s much to know and learn about Ethereum, enough to fill several books, but for the purposes of this article, we’ll focus on the most important aspects of Ethereum in 2022.

The History of Ethereum

Ethereum is a relatively new platform and has only been available to the public since 2015.

It all began in 2013 when a cryptocurrency programmer and researcher called Vitalik Buterin came up with the concept of Ethereum. He issued a whitepaper which outlined the rationale and technical design.

The following year, development was crowdfunded online, leading to Ethereum’s launch on 30 July 2015 when 72 million coins were created.

In 2016, Ethereum was split into separate blockchains, Ethereum (ETH) and Ethereum Classic (ETC). It was undertaken to reverse a theft of over $50 million of Ether. So the basic difference between Ethereum and Ethereum Classic is that ETH was created at this time, whereas ETC is the original version.

Most opted to support the new version of the cryptocurrency, including Ethereum creator Buterin.

Ethereum has seen tremendous growth since its creation, and 2017 was its big breakthrough year with its value growing by over 15,000%, increasing in price from $8.24 to over $1,314.

This year, in 2022, it looks like we could be heading towards an Ethereum bull run. At the time of writing, Ethereum is now worth $2,800.

While the terms Ether and Ethereum have become interchangeable, they’re not actually the same thing. Ether functions in a similar way to other cryptocurrencies such as Bitcoin, whereas Ethereum is a decentralised network with practically unlimited applications.

Here are some examples of how it can be used:

- Ethereum can be used to create Non-Fungible Tokens (NFTs), the explosion of which has been the basis for much of Ethereum’s recent growth.

- Automated market makers (AMMs) can run on Ethereum, enabling people to swap tokens on a decentralised exchange.

- Smart Contracts can be utilised to make direct transactions without any risk.

- Ethereum can be useful in building Decentralised Apps (known as dAPPs).

- The healthcare system can use Ethereum to share and store patient information securely.

- It can be utilised to power decentralised data storage.

- It has the potential to be used for improving election polling systems and also making them more secure and transparent.

The possibilities are endless, and it’s likely that the most significant uses of Ethereum haven’t even been conceived yet.

Ethereum pros and cons

Before investing, it’s important to have a good understanding of Ethereum’s advantages and disadvantages. That way you’ll have a better idea of what you’re getting into and whether or not you’re making the right decision.

Ethereum’s popularity is in part due to its multifunctionality, and the fact Ethereum makes Blockchain accessible to various types of developers and businesses means it has maintained its reputation for being useful.

Ethereum benefits:

Ethereum is greener than Bitcoin. The coming upgrade to Ethereum will reduce Ethereum’s energy use by 99% making Ethereum 7,000 times more energy-efficient than Bitcoin.

Ethereum can be staked. This means you can earn interest from your Ethereum on top of the gain it makes in price action!

Ethereum is exceptionally well planned. Many other cryptocurrencies are created spontaneously and appear and disappear quickly. Ethereum was built on a solid foundation. There’s a clear plan laid out for the next five years, which allows stakeholders to have confidence and understand how the blockchain is expected to develop.

The Ethereum blockchain is highly functional. It supports dAPPs, blockchain smart contracts, and decentralised autonomous organizations (DAOs), which makes it a practical choice. It has been a leader in ICO tokens since it introduced the ERC-20 standard that countless other tokens are built on or based on.

All of this has led it to be useful in diverse fields such as prediction markets and gambling and helped it gain a reputation as a great blockchain.

It’s an open-source system. This means that everyone can join this project to develop the ecosystem and improve upon it.

It’s free from regulatory control by the Securities and Exchange Commission (SEC) as, according to the Howey Test, Ethereum does not count as a security. This gives it a higher degree of flexibility in operating and frees it from the risk of setbacks that cryptocurrencies such as Ripple have experienced.

Its leadership is highly credible and known for competency. Ethereum creator Vitalik Buterin is visible and active in the cryptocurrency world, which lends credibility to his network. He, along with the community of developers, is responsible for Ethereum’s reputation for clarity of vision, making the network renowned for reliability.

It works differently than other cryptocurrencies. Ethereum does not require third parties and provides a full package service, which means exceptionally complex agreements are possible.

Ethereum has had some influential venture capitalists as backers. Big names such as AngelList founder Naval Ravikant, and private American venture capital company Andreessen Horowitz.

Ethereum downsides:

There’s a small chance of issues when the Ethereum update happens later this year. The switch from being a Proof of Work to a Proof of Stake consensus protocol has been on the cards for a long time and is a complicated process.

There’s a small but not impossible risk that the whole system could crash if the transition isn’t smooth. In the run-up to the switch, you can expect heavy price volatility as investors hedge their bets.

The market always has new competition emerging. In the same way that altcoins learned from Bitcoin and aimed to exploit its flaws, new competitors seek to do the same to Ethereum. There will always be a new option that aims to enhance the functionality of and be known as better than Ethereum.

Many of the tokens closest to Ethereum in market cap are in fact running on Ethereum technology. That said, no competitor has yet come anywhere close to unseating Ethereum from its position as the king of DeFi.

There’s too much reliance on Vitalik Buterin’s reputation. Buterin is so well known in the crypto world that even a rumour about his well-being or actions can have a dramatic effect on Ethereum’s price. We’ve seen significant amounts of Ethereum sold off due to false rumours of his death.

However, Buterin is famed for having fully given up control of Ethereum. He’s vocal about its direction but has committed himself to the ideals of decentralisation in a way unparalleled by any other crypto founder in the space since Satoshi himself.

Ethereum can be challenging to understand for newcomers. There’s a lack of straightforward information online which some can find confusing. It’s an issue that almost makes Ethereum feel like a “secret society” and prevents people from investing.

Some people believe that Ethereum has too many platforms. It allows for an endless range of possibilities including smart contracts, NFTs, AMMs, and many more services while also serving as a decentralised ledger, which some view as a weakness. Bitcoin, by comparison, is dedicated to offering one function and one function alone.

While there are cons as well as pros to Ethereum, on the whole, the advantages are substantial. The future of Ethereum is bright, and with the right research and planning, it remains a viable investment option.

What are the best Ethereum wallets?

It’s vital to choose the best Ethereum wallet for your needs, and the most reliable wallets provide a combination of both ease of use and proper security.

Your Ethereum wallet can be a hardware device, an online website or app, or a simple piece of paper with your code printed onto it.

Ethereum hardware wallet options include Trezor, Ledger Nano X, and KeepKey. You need to pay for these devices, and they’re physical wallets that let you store your Ether in an encrypted form.

These are the safest crypto wallets as they store your investment offline and never expose your data on the internet. They’re also the best choice available for the most serious investors of cryptocurrencies.

Online and web wallets are convenient to use and enable you to store your Ethereum investments securely online. Metamask is widely seen as the most popular Ethereum wallet in the Ethereum community for enabling access to the widest range of decentralised applications.

The only downside to these is that there’s a small risk of having your information exposed to hackers. Generally speaking, though, these wallets are a safe bet when it comes to storing smaller amounts online.

If you want to safely lock away your Ether, one of the best Ethereum wallet options is a paper wallet. These are incredibly secure as they’re similar to hardware wallets and don’t leave your sensitive data online where it could be susceptible to hackers.

They store your Ether addresses on paper, rather than needing hardware. The main downside is the risk of losing the piece of paper (so make backups!).

Ethereum vs Bitcoin: Which should I invest in?

Bitcoin and Ether are two of the most reliable cryptocurrencies to invest in today. They’re similar in some ways, so you’ll have to study the current market conditions to decide which shows more promise for investment in the current climate.

If you’re looking for reasons to buy Ether over Bitcoin, though, there are a few:

- Ethereum has a particularly sturdy platform. The Auger Blockchain was developed especially for Ethereum mining. It’s now considered more innovative and technically more robust than the Bitcoin mining platform.

- Ethereum’s growth is actually outpacing Bitcoin’s, and its value has grown by a whopping 1000% in the last two years.

- There are many powerful backers of Ethereum in the business community, who will continually have input to make it a reliable option.

Ethereum future predictions

Ethereum has come a long way in a short amount of time. Like all cryptocurrencies, there have been turbulent periods of great highs and lows.

It is, however, built upon a strong foundation with an excellent long-term strategy for surviving and growing. And it makes for an exciting alternative to Bitcoin when it comes to choosing cryptocurrency investments.

Experts are predicting that 2022 will be a good year for Ethereum and that the value of Ether could grow by as much as 400%. If the Ethereum update due to take place later this year goes well, it could become an even more popular choice amongst crypto investors.

In November 2021, Ethereum soared to an all-time high of $4,800, and many have suggested that it will come near to that in 2022. Some have gone even further, forecasting that Ethereum will break the $10,000 mark by year’s end.

Whether or not we’re heading for an Ethereum bull run remains to be seen, but it’s looking good for Ethereum in 2022.

How do I buy and sell Ethereum?

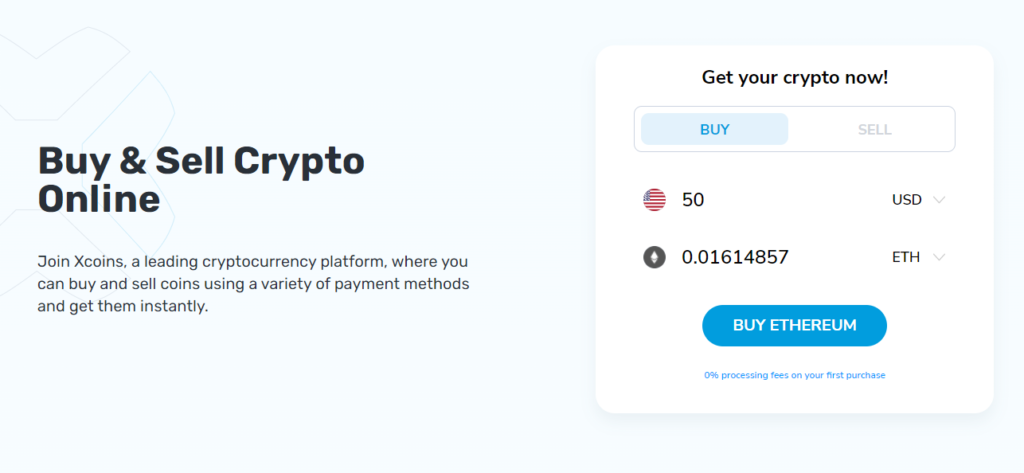

One of the easiest ways to buy and sell Ethereum is through a cryptocurrency exchange like xcoins.com. You can trade your Ethereum securely and in a matter of minutes using a variety of payment methods. Just follow these steps:

Step One: If you don’t have an xcoins.com account yet, it’s quick and easy to sign up.

Step Two: Once you’ve completed the verification process and your account is up and running, click “Buy Ethereum” or “Sell Ethereum”.

Step Three: Choose the amount of Ethereum you want to buy/sell and the currency you’d like to buy it in/sell it for, then select the payment method.

Step Four: Once payment has been approved, we’ll send your Ether to your wallet or, for sales, the cash to your debit/credit card or bank account.

As always, this article does not constitute financial advice and you should be sure to do your own research and consult a professional financial advisor before making any investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn. Sign up here today to start buying and selling cryptocurrencies instantly.