Tesla Launches Dogecoin Payments as Plans for Bitcoin Defence Fund Are Revealed

While cryptocurrency markets stabilized, crypto innovation pushed forward this week. In South America, the Mayor of Rio de Janeiro revealed his plans to make the city the main crypto hub for Brazil. Dogecoin prices spiked thanks to the launch of DOGE payments on Tesla’s merchandise store and the former CEO of Twitter, Jack Dorsey, outlined a legal defense fund for bitcoin developers.

- Rio de Janeiro to place 1% of state reserves into crypto

- Tesla launches Dogecoin payments

- Jack Dorsey creates Bitcoin Legal Defense Fund

- Visa survey finds 1 in 4 businesses to accept crypto payments in 2022

- US inflation figures reach 7% – highest in four decades

Rio de Janeiro to place 1% of state reserves into crypto

Following in the footsteps of Miami, Eduardo Paes, the Mayor of Rio de Janeiro, wants to make the city the hub of cryptocurrency development in Brazil. According to a report from local newspaper O Globo, part of that plan will involve placing 1% of the city’s treasury into cryptocurrencies.

The Mayor’s views were outlined during Rio Innovation Week where he sat on a panel with Miami’s crypto-bull Mayor, Francis Suarez. Suarez has implemented several bullish proposals for the city of Miami including a plan to pay residents a ‘bitcoin yield’ for holding the native Miami city coin. These are proposals that have encouraged Paes with his plan for Rio.

On Thursday, Paes reportedly said, “we are going to launch Crypto Rio and invest 1% of the treasury in cryptocurrency.” In further conversations with Rio’s Secretary of Finance and Planning, Pedro Paulo, it was suggested that the city was also looking to offer residents a 10% discount on property taxes paid in Bitcoin. In addition to benefits for residents, Paes also said that “the government has a role to play” when it comes to introducing tax exemptions for the entire cryptocurrency industry.

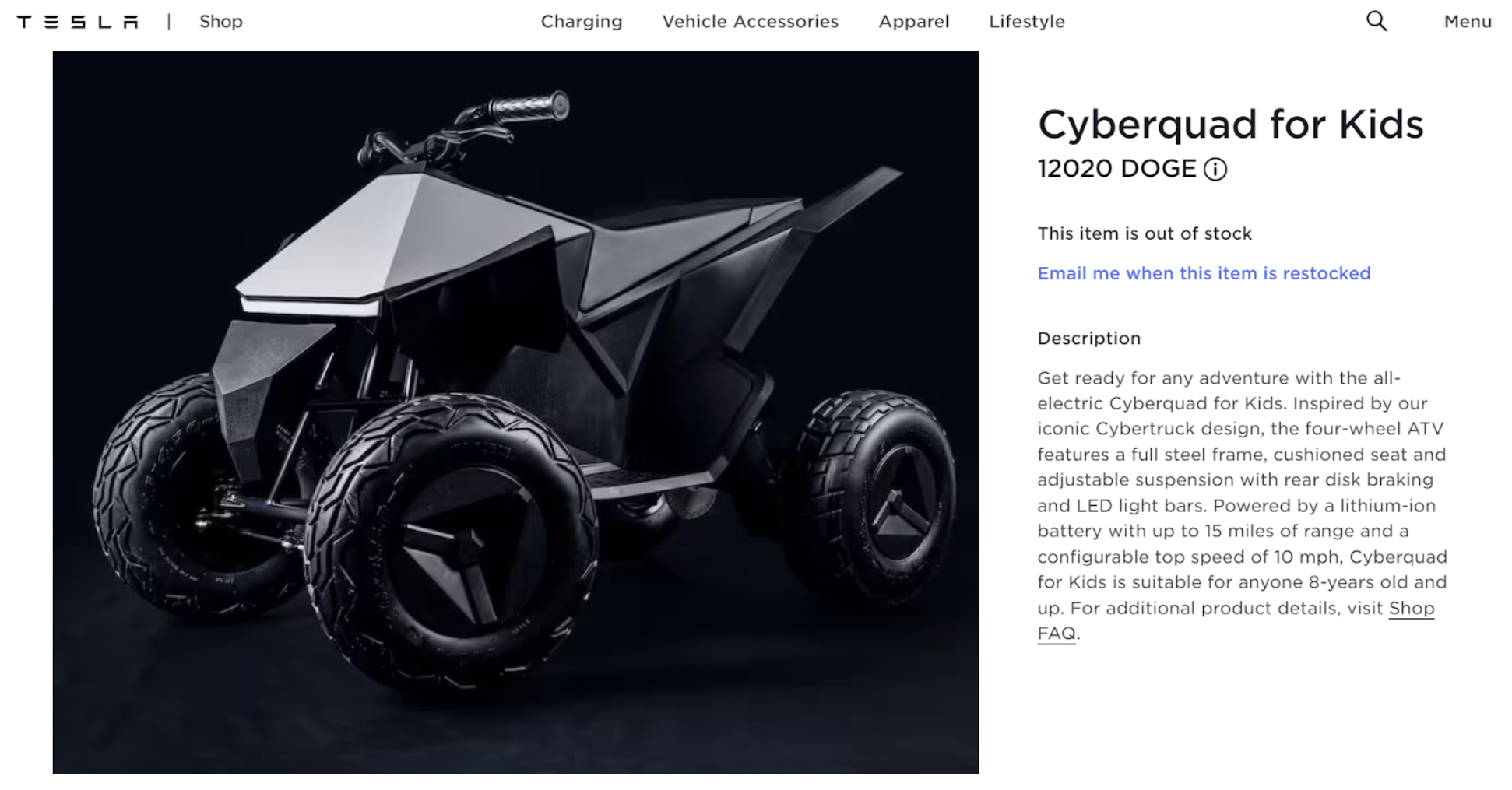

Tesla launches Dogecoin payments

It was a bullish week for Dogecoin as the meme-based cryptocurrency was integrated with Tesla’s online merchandise store. The announcement was made by the company’s CEO, Elon Musk, via Twitter on Friday. As soon as news broke, Dogecoin prices soared to $0.19 – a rise of 11% for the day.

The experiment for using Dogecoin was first outlined by Musk back in December. Since then, Dogecoin fans worldwide have been waiting in anticipation of the launch to see how Dogecoin would be integrated. It is Musk’s long-held belief that Dogecoin is far more useable for everyday transactions than the world’s leading cryptocurrency – Bitcoin. A sentiment that will now be put to the test.

Some items can now only be purchased using the meme cryptocurrency. These products include a Giga Texas Belt Buckle that costs 835 DOGE, a kids Cyberquad that costs 12,020 DOGE, a Cybertruck Graffiti Cuffed Beanie that costs 205 DOGE, and a Cyberwhistle that costs 300 DOGE.

If the experiment is a success it is possible that the company may expand the range of products available for Dogecoin payments. Before the Dogecoin payment launch, it was noticed that the word ‘dogecoin’ was also listed within the source code of the Tesla vehicle payment page. The company has so far not commented on this addition.

Back in Q1 2021, Tesla purchased $1.5 billion Bitcoin for the company’s balance sheet and began accepting Bitcoin for vehicle purchases. However, the option for payment was quickly removed due to the environmental concerns related to Bitcoin mining.

Jack Dorsey unveils plans for Bitcoin Defense Fund

The founder of Block and former CEO of Twitter, Jack Dorsey, this week shared plans regarding a “Bitcoin Legal Defense Fund.” The fund will be created in partnership with Chaincode Labs founder Alex Morcos and Martin White.

Evidence of the fund was first seen in an email sent to Bitcoin developers. The email explained that the fund will be there to help bitcoin developers who are “currently the subject of multi-front litigation.”

As outlined in the email, the sentiment behind the fund is to allow bitcoin developers to focus on what they do best: the development of the bitcoin ecosystem. Bitcoin developers’ who are independent often have to stop work when legal pressure is too high.

Continuing, the email stated that the fund plans to be a “nonprofit entity that aims to minimize legal headaches that discourage software developers from actively developing Bitcoin and related projects. The main purpose of this fund is to defend developers from lawsuits regarding their activities in the Bitcoin ecosystem, including finding and retaining defense counsel, developing litigation strategy, and paying legal bills.”

Visa survey shows 1 in 4 businesses plan to accept cryptocurrencies

The global payment giant, Visa, announced last week that it had conducted a global survey focused on small businesses globally. As part of the survey, businesses were questioned on their intentions to accept cryptocurrency payments. Results from the survey showed that 24% were preparing to accept crypto payments in 2022.

The survey, which was conducted with 2,250 businesses located across 9 countries including the United States, Ireland, Brazil, and Germany, highlighted that cryptocurrencies are beginning to be accepted as a form of payment. The report detailed that an “overwhelming 82% of SMBs surveyed said they plan to accept some form of digital option in 2022 and 73% see accepting new forms of payments as fundamental to their business growth.”

Jeni Mundy, Visa’s Global Head of Merchant Sales commented on the reasons why small businesses are coming around to cryptocurrency payments. “I think more people are feeling more confident with crypto.”

In addition to small businesses, Visa also questioned the consumers within the countries. Out of these consumers, 13% are expecting cryptocurrency payments to be available when they shop in 2022.

US inflation rates reach 7%

On Tuesday, the U.S. Labor Department published the Consumer Price Index (CPI) figures for the month of December. CPI, which measures the price of a basket of goods and services, is often used by investors as a proxy for inflation. The results published for December showed that the rate of inflation had increased 7% year-on-year – the highest annual increase in CPI figures since 1982.

Throughout 2021, the Federal Reserve had described the effects of inflation as transitory: an element that would pass as supply chains equilibrate after the pandemic. However, a leveling in prices is yet to be seen. The continual increase in CPI figures is now drastically reducing the purchasing power of U.S. citizens.

The Federal Reserve has previously outlined plans to drastically reduce government spending and has signaled the use of several interest rate hikes throughout 2022. Most experts now believe that several interest rate hikes in 2022 are extremely likely to tackle the rising inflation figures. The next meeting of the Federal Reserve is set to take place on 25-26th January.

After the release of CPI figures, crypto markets – in particular Bitcoin – experienced an immediate increase. The price of the leading cryptocurrency rose to $44,000. Bitcoin is often viewed as a hedge against inflation due to its limited circulating supply.

To stay up to date on all things crypto, like Xcoins on Facebook and follow us on Twitter, Instagram and LinkedIn.