El Salvador Stocks Up on Bitcoin and Instagram Explores NFT Marketplace as Markets Slide

There has been blood in the cryptocurrency streets this week as the total market cap of cryptocurrencies dipped back below $2 trillion. Fear was unleashed as equities experienced one of the most bearish weeks since the start of the pandemic and Russia proposed a ban on all crypto-related activity. However, for many crypto-enthusiasts – particularly in El Salvador – the news was greeted warmly as new market prices opened buying opportunities. Elsewhere, it was confirmed that one of the largest social media companies in the world has begun to explore NFT technology.

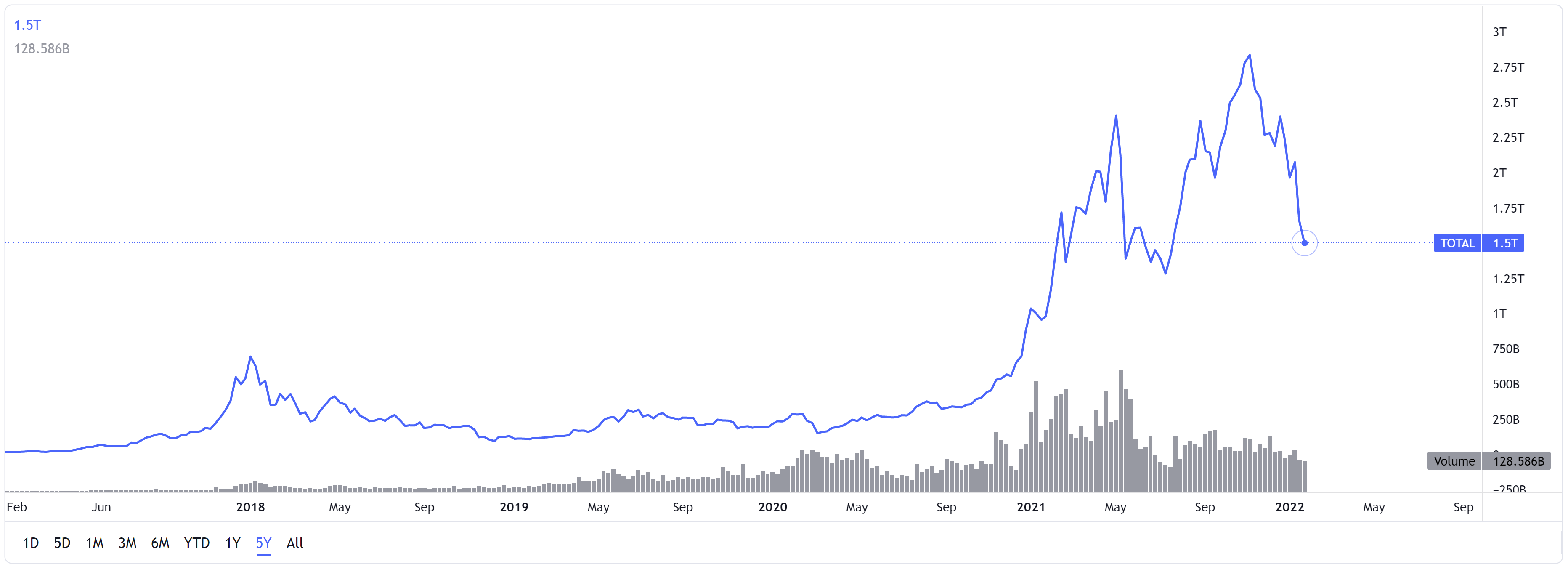

- Fear swells as the total market cap dips below $2 trillion

- El Salvador purchases 410 bitcoin for its treasury

- Central Bank of Russia proposes crypto ban as digital Ruble is rolled out for testing

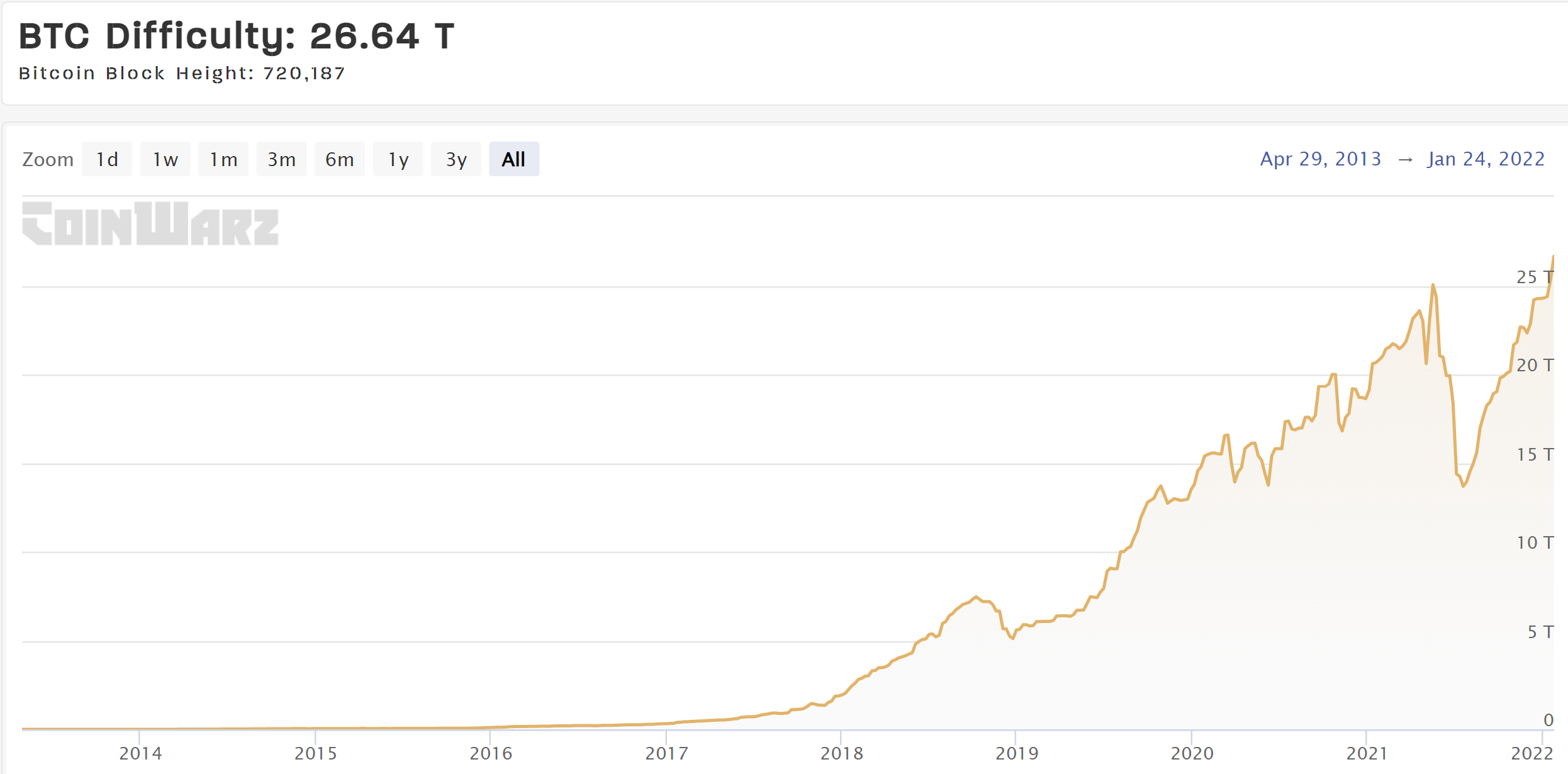

- The difficulty of Bitcoin mining hits new all-time high

- Meta and Instagram explore the possibilities of NFT tech

Fear swells as crypto markets dip back below $2 trillion

Bitcoin, along with the majority of other cryptocurrencies, plummeted to new yearly lows last week as $500 billion was wiped from the total cryptocurrency market cap. The loss of value resulted in the total market cap falling back under the psychological marker of $2 trillion. The total market cap had peaked at just under $3 trillion in late 2021. The increased bearish momentum left many investors questioning the cause of the most recent downturn.

Although no definitive piece of news was published last week, many experts have speculated on several factors that may have influenced the outpouring of funds.

At the forefront of many minds is the current removal of quantitative easing (QE) efforts by the Federal Reserve – a combative measure against rising inflation. In parallel, the Fed has also suggested there will be two interest rate hikes during 2022, which has left many investors worried as to the effects on crypto markets.

The risk of rising interest rates has also plagued equity markets, which experienced one of the most bearish weeks since the global pandemic began. In addition to fears from the Fed, falling equities are often considered to be a contributing factor to the downward pressure on cryptocurrency prices.

Finally, to add to an already heavy market, Russia announced on Thursday that it would be proposing a ban on all crypto-related activity. While current plans are not finalized, the news did nothing to quell the bearish sentiment flooding the markets.

While painful for many investors, the recent price dip has been seen as an opportunity for many, including the country of El Salvador – who added to their treasury reserves by purchasing another 410 bitcoin last week.

Russia proposes ban on cryptocurrency use and mining

According to a consultation report released on Thursday, the Central Bank of Russia (CBR) has proposed a complete ban on the use, and mining, of all cryptocurrencies within the country’s borders. Within the report, financial instability fears were cited as the prominent reason for the ban.

While the ban won’t prevent citizens from holding cryptocurrency, the purchase of digital assets using fiat will be much more restricted. In addition to transactional restrictions, the ban may significantly impact the hash rate of the world’s largest cryptocurrency – as Russia currently sits as the third-largest contributor to Bitcoin mining. The potential outcomes weighed heavily on an already subdued cryptocurrency market.

In 2020, Russia had made steps towards accepting the reality of cryptocurrencies by giving them legal status. Although a step in the right direction, it was made clear the digital assets would never be used as a means of payment. In December 2021, the CBR then upped the surveillance of cryptocurrency payments between commercial banks and cryptocurrency exchanges. Many crypto-related activities had remained unregulated within the country, which is something the government had reportedly wanted to change. However, with this latest proposal, the country has shown a clear intention to move away from cryptocurrency adoption.

Many cryptocurrency analysts were quick to thwart concerns, stating that a ban in Russia would have similar negligible impacts that we have witnessed from bans in the past, such as China. The Head of Solrise Group, Joseph Edwards, played down fears by stating “Moscow, like Beijing, is always rattling its sabre over ‘crypto bans’, but Russia has never been a pillar of any facet of the industry in the same way China has been at times”

Russia begins testing Central Bank Digital Currency

Interestingly, the potential cryptocurrency ban from Russia came during the same week that the country announced a pilot of its native Central Bank Digital Currency (CBDC) – the digital Ruble.

According to Russian media provider TASS, the new digital Ruble platform, which was completed in December, will be rolled out to 12 different Russian banks over the next couple of weeks. Some banks are already using the digital currency for customer-to-customer transactions. If the trial is a success the new CBDC will then expand to other financial service providers.

Bitcoin mining difficulty reaches ATH

As the price of Bitcoin sank during the week, the difficulty of mining the world’s leading currency reached a new all-time high. On January 20th, 2022, the mining difficulty peaked at 26.64 trillion. The previous all-time high had been set in May 2021 at a height of 25 trillion.

Bitcoin mining difficulty is increased when the power of bitcoin miners grows too quickly. Bitcoin block production is programmed to occur consistently every 10 minutes. The new jump in difficulty means that it is now even harder for miners to earn BTC rewards.

The new difficulty marks the 357th adjustment that the blockchain has experienced. Although finding a BTC reward may be harder for miners, the mining difficulty could also easily drop in the future. In 2021, the ban on Bitcoin mining in China resulted in a significant decline in bitcoin mining difficulty, however the fall quickly recovered as miners moved elsewhere.

Meta and Instagram explore possibilities of NFT tech

According to a report released by the Financial Times (FT), Meta, formerly known as Facebook, is exploring the use of NFT technology with one of the company’s subsidiaries – Instagram. The news was met by excitement from NFT-enthusiasts as it would mean one of the largest social media platforms joining the NFT sector.

The report, which quotes unnamed sources, outlines that Meta and Instagram are looking to launch their own native NFT marketplace, where users of the application will be able to buy and sell digital assets. Although Meta has not mentioned NFT technology previously, this is not the first time NFTs have been mentioned with regards to Instagram.

The social media platform’s CEO, Adam Mosseri, acknowledged during a December interview that the company wants to make NFTs “more accessible to a wider audience.” There have also been several screenshots shared by software developer, Alessandro Paluzzi that highlight a future Instagram NFT platform.

To stay up to date on all things crypto, like Xcoins on Facebook and follow us on Twitter, Instagram and LinkedIn.