Economic Turmoil in Nigeria and Lebanon Accelerates Adoption of Bitcoin

Bitcoin is becoming increasingly popular among citizens of countries facing turbulent economic conditions.

While those in developed countries have enjoyed relatively stable economic conditions for much of the 20th and 21st centuries, those in a growing number of developing countries face hyperinflation, bank runs, and full-scale depressions that can make economic well-being seem like an unattainable dream.

In countries like Nigeria and Lebanon, people are looking for alternatives to traditional currencies and seem to have found it with Bitcoin.

Capital controls are driving Nigerians to BTC

Nigeria is currently limiting the total amount of withdrawals from banks as a way to speed up the implementation of a government-backed digital currency and to get a handle on inflation, which is currently at about 18%.

Businesses in Nigeria can’t withdraw more than $11,000 per week, and individuals can’t withdraw more than $44 per week. Meanwhile, in Lebanon, the central bank recently weakened the exchange rate of its lira by 90%, debasing the currency overnight and causing those with money in a Lebanese bank to lose the vast majority of their purchasing power.

In this situation, Bitcoin offers an alternative to traditional currencies that are subject to manipulation by central banks. Bitcoin’s decentralization makes it resistant to manipulation, and the fact that no agency or government can inflate its supply is particularly appealing to citizens of developing countries.

Bitcoin’s code is written with a concrete ceiling of just 21 million bitcoin, meaning that the purchasing power of Bitcoin holders is likely to increase with time.

As citizens in a growing number of developing countries are forced to endure the pain of policies like those in Nigeria and Lebanon, Bitcoin offers a safe haven.

Over the past few weeks, the price of Bitcoin in Nigeria has increased disproportionately compared to the rest of the world, as demand skyrocketed and people looked to circumvent overreaching policies.

In Lebanon, citizens are increasingly utilizing Bitcoin to maintain their purchasing power and even serve as their own bank accounts.

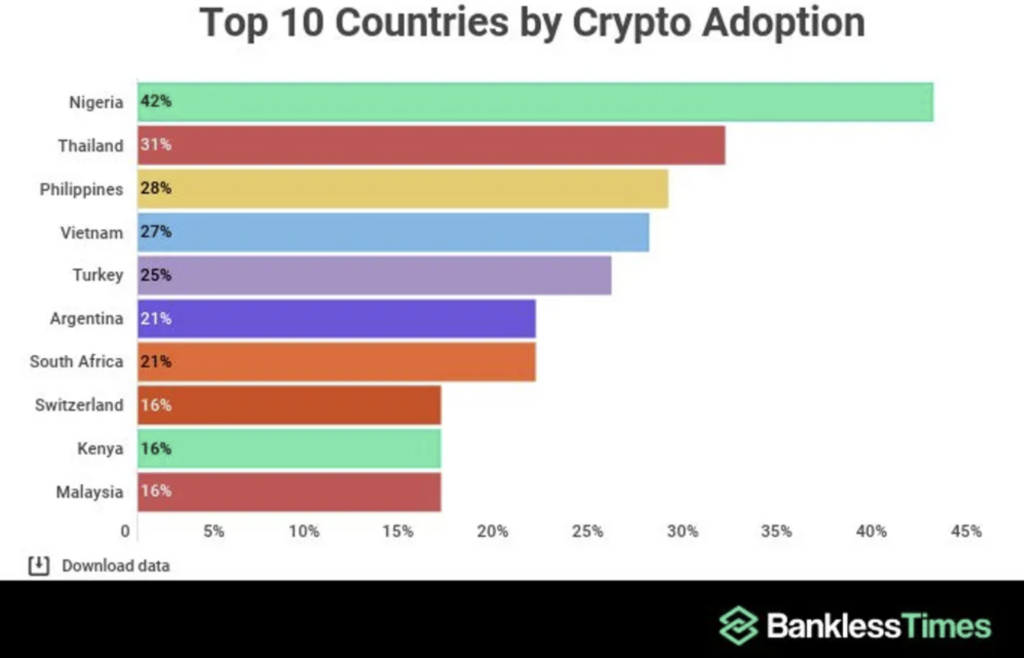

Bitcoin offers stability and reliability in a volatile economy, in spite of a government ban on buying and selling Bitcoin in Nigeria, which only had the effect of increasing demand and driving black market prices upwards by over 60% compared to prices in other countries. Already, 42% of Nigerians own crypto, the highest rate of use in the entire world.

Bitcoin’s appeal in Nigeria and Lebanon is its ability to offer an escape and alternative to traditional currencies.

As more people are forced to look for alternatives, the use cases for Bitcoin are likely to increase. Citizens in developing countries may spur widespread adoption of Bitcoin at a much faster rate than people in developed countries, simply out of necessity.

Nigeria tops the list of countries with the highest rates of crypto adoption, despite a government ban. Graph via Bankless Times.

Why Bitcoin is the answer

The beauty of Bitcoin is that it offers an escape in turbulent economic conditions from the whims of central bankers who have the ability to decimate life savings at the drop of a hat.

One of Bitcoin’s main advantages in protecting against hyperinflation is its decentralized nature. Unlike traditional currencies, which are controlled by governments and central banks, Bitcoin is not controlled by any single entity. Instead, it is a peer-to-peer network of computers that collectively maintain the Bitcoin blockchain, a public ledger of all Bitcoin transactions. This means that no single entity can manipulate the supply or value of Bitcoin, making it resistant to hyperinflation.

Additionally, Bitcoin has a fixed supply of 21 million coins, which is programmed into its code. This means that the supply of Bitcoin is limited, and unlike fiat currencies, it cannot be printed at will by governments or central banks. This fixed supply ensures that Bitcoin cannot be devalued through inflation, making it a hedge against hyperinflation.

Bitcoin’s divisibility is another factor that makes it useful in protecting against hyperinflation. Each Bitcoin can be divided into 100 million smaller units, called satoshis. This means that even if the price of Bitcoin were to rise significantly, it would still be possible to use it for everyday transactions. In a hyperinflationary environment where the value of a currency rapidly decreases, the ability to make small transactions is crucial.

Lastly, Bitcoin can be stored and transferred without the need for a centralized intermediary, such as a bank. This means that in a hyperinflationary environment, where the banking system may be unstable or unreliable, Bitcoin can still be accessed and used for transactions.

Bitcoin’s decentralized nature, fixed supply, divisibility, and ease of storage and transfer make it a valuable asset in protecting against hyperinflation. As more people become aware of its benefits, Bitcoin may become an increasingly popular choice for those seeking a hedge against hyperinflation and other economic uncertainties. And as demand grows, the BTC price is likely to be driven ever higher.

As always, this article doesn’t constitute financial advice and you should do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.