Bitcoin Holds the Line After Grayscale Surge

The cryptocurrency world has been buzzing after a federal judge yesterday overturned the SEC’s decision to deny Grayscale Investments a spot Bitcoin ETF.

This legal win, though not guaranteeing an immediate spot Bitcoin ETF, has sparked renewed interest among investors. It is a development that you don’t want to miss, especially if you’re looking to buy Bitcoin.

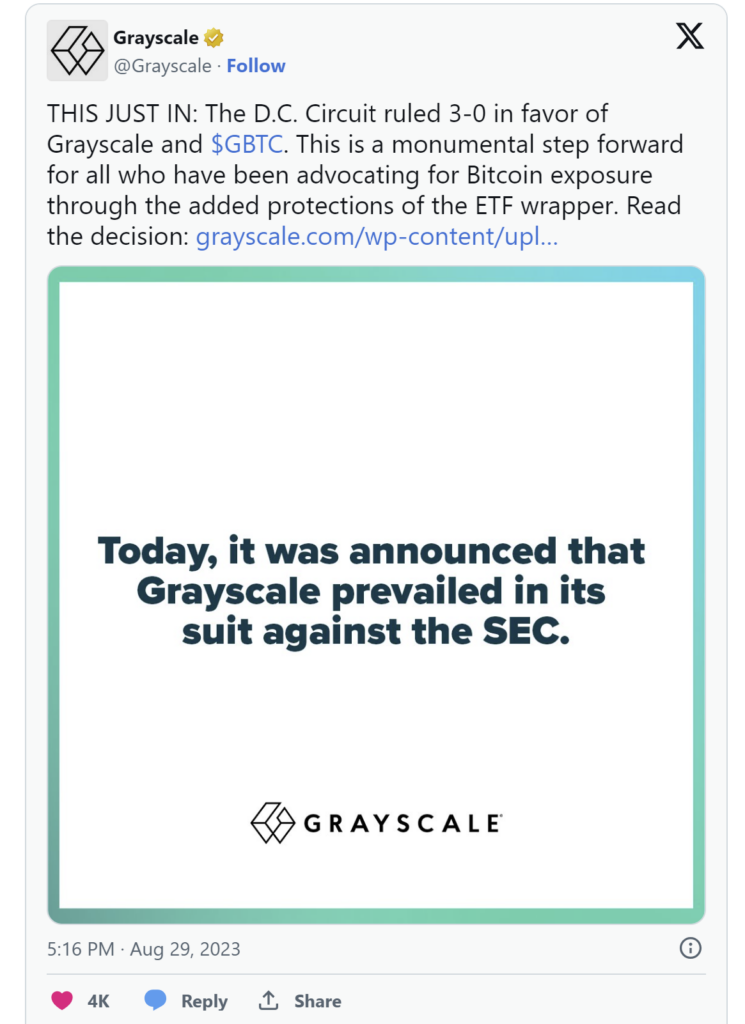

Grayscale’s Landmark Court Victory

Grayscale, a leading asset management firm specializing in cryptocurrency investments, yesterday secured a significant court victory. A U.S. federal judge ruled that the SEC’s reasons for previously denying Grayscale’s application for a spot Bitcoin ETF were insufficient.

The judgment has reignited enthusiasm among those planning to buy Bitcoin, as it points toward a maturing regulatory environment for cryptocurrency investments.

What This Means for Bitcoin ETFs

For years, the SEC has been hesitant to approve spot Bitcoin ETFs, citing concerns over fraud and manipulation. However, the court ruled that Grayscale’s proposal was “materially similar” to Bitcoin futures ETFs, which the SEC had already approved.

If spot Bitcoin ETFs gain approval, this will offer investors a regulated avenue for investment, adding a layer of legitimacy that could make buying Bitcoin more attractive to larger investors.

What Does This Mean for the Price of Bitcoin?

Momentum for Spot Bitcoin ETFs

The Grayscale court win isn’t just a victory for the asset management firm; it could be a tipping point for the entire cryptocurrency industry. This ruling challenges the SEC’s prior concerns and could set a precedent that pressures the agency to finally greenlight spot Bitcoin ETFs. For those aiming to buy Bitcoin through more conventional channels, this is exciting news.

Broader Acceptance

Spot Bitcoin ETFs have the potential to attract traditional investors who’ve been sitting on the sideline due to the volatile and somewhat murky nature of cryptocurrency markets. If approved, these ETFs would offer a regulated vehicle for investment, thereby increasing trust and encouraging broader market participation. This could be a significant step toward mainstream acceptance, further stabilizing Bitcoin’s price and offering a compelling reason to buy Bitcoin.

Competition

Grayscale isn’t the only player in this field; other financial powerhouses like BlackRock, ARK Invest, and Fidelity have spot crypto ETF applications under review. A favorable decision for Grayscale could crack open the door for these firms, injecting the market with a variety of investment options. The upshot? An increasingly competitive landscape that could benefit investors looking to buy Bitcoin.

Regulatory Pressure

The SEC’s previous stance on Bitcoin ETFs has been somewhat conservative, citing concerns of fraud and market manipulation. However, this court ruling shines a spotlight on the SEC’s decision-making processes. The judge’s decision could be seen as a challenge to the SEC to either provide more substantial justification for their denials or reconsider their stance. The SEC is now under increased scrutiny, and their next moves will be closely watched by investors and regulatory experts alike.

Timeline

While the court ruling is undoubtedly a win for Grayscale and potential Bitcoin investors, it’s essential to note that the SEC can still delay decisions on most pending applications until March 2024. This means that while the regulatory environment appears to be warming up, we might not see immediate changes. Still, the wheels are in motion, and those interested in buying Bitcoin should keep a close eye on developments.

Next Steps

So, what happens now? The SEC has been mum on the court’s decision but has several options at its disposal. They could appeal the ruling, stretching out the legal process even further. Grayscale also has the opportunity to refile its application, potentially strengthening its case for approval. Furthermore, the SEC could opt for an “en banc” hearing involving all judges on the D.C. circuit, which could offer a more comprehensive judicial review of the matter.

Grayscale’s court victory has set the stage for potential seismic shifts in how Bitcoin and other cryptocurrencies are viewed by both regulatory bodies and traditional investors. If you’ve been considering whether to buy Bitcoin, these unfolding events could shape the landscape in ways that make entering the market more appealing and secure than ever.

Why Buy Bitcoin Now?

Price Stability

The Bitcoin market reacted positively to the Grayscale news, and the current price sits in the $27K range. The relatively stable price range offers a less volatile entry point for new investors.

Regulatory Clarity

The court’s ruling against the SEC’s decision adds a layer of regulatory clarity to the Bitcoin market. While the journey is far from over, positive legal judgments make it less likely that harsh, unexpected regulations will derail the Bitcoin market.

Get Ahead of the Curve

As Grayscale and other financial giants like BlackRock and ARK Invest queue up with their spot Bitcoin ETF applications, mainstream adoption inches closer. Being an early adopter by choosing to buy Bitcoin now could place you ahead of the curve.

Preparing to Buy Bitcoin: A Quick Guide

Before jumping in, it’s crucial to prepare adequately. Here’s a brief guide to get you started:

- Choose a Reputable Exchange: Platforms like Xcoins that send your crypto to a wallet you and only you control are safest.

- Secure Your Investment: Utilize hardware wallets to best protect your assets.

- Diversify: Don’t put all your eggs in one basket. Diversifying your investment can mitigate risks.

- Consult a Financial Advisor: If you’re new to cryptocurrencies, it’s always good to consult a financial advisor experienced in cryptocurrencies before making significant investments.

Risks and Rewards

While buying Bitcoin presents opportunities, remember that all investments come with risks. The cryptocurrency market is volatile, and while regulatory clarity is improving, it’s still an evolving landscape. Always invest money that you can afford to lose.

The Bottom Line: An Opportunity Not to Miss

With Bitcoin maintaining its value and even gaining renewed interest from institutional investors, now could be an opportune time to buy Bitcoin.

The Grayscale court victory is a pivotal moment, adding a layer of regulatory clarity that could pave the way for broader mainstream adoption.

As the old saying goes, “The best time to plant a tree was 20 years ago; the second-best time is now.”

In the context of Bitcoin, this proverb has never been more relevant. Take advantage of this regulatory milestone to diversify your portfolio by investing in Bitcoin.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.