Bitcoin Finds a Floor as ETF Selling Pressure Eases

BlackRock’s, IBIT, has become the leading contender among recently launched spot Bitcoin products and has become the first ETF product to amass $2 billion in assets under management.

While ETFs continue to grow, a new report has highlighted that 2023 has set a record for acquiring on-chain users, with Ethereum, Polygon, and Bitcoin claiming the top positions in user acquisition.

Elsewhere, the outflows from Grayscale’s Bitcoin ETF have seen a significant decrease, attributed in part to FTX’s bankruptcy estate selling off its GBTC shares.

Lastly, the United States government’s announcement of the sale of approximately $118 million worth of Bitcoin seized from the Silk Road has stirred discussions.

With so much to cover in this week’s roundup, it’s time to get started!

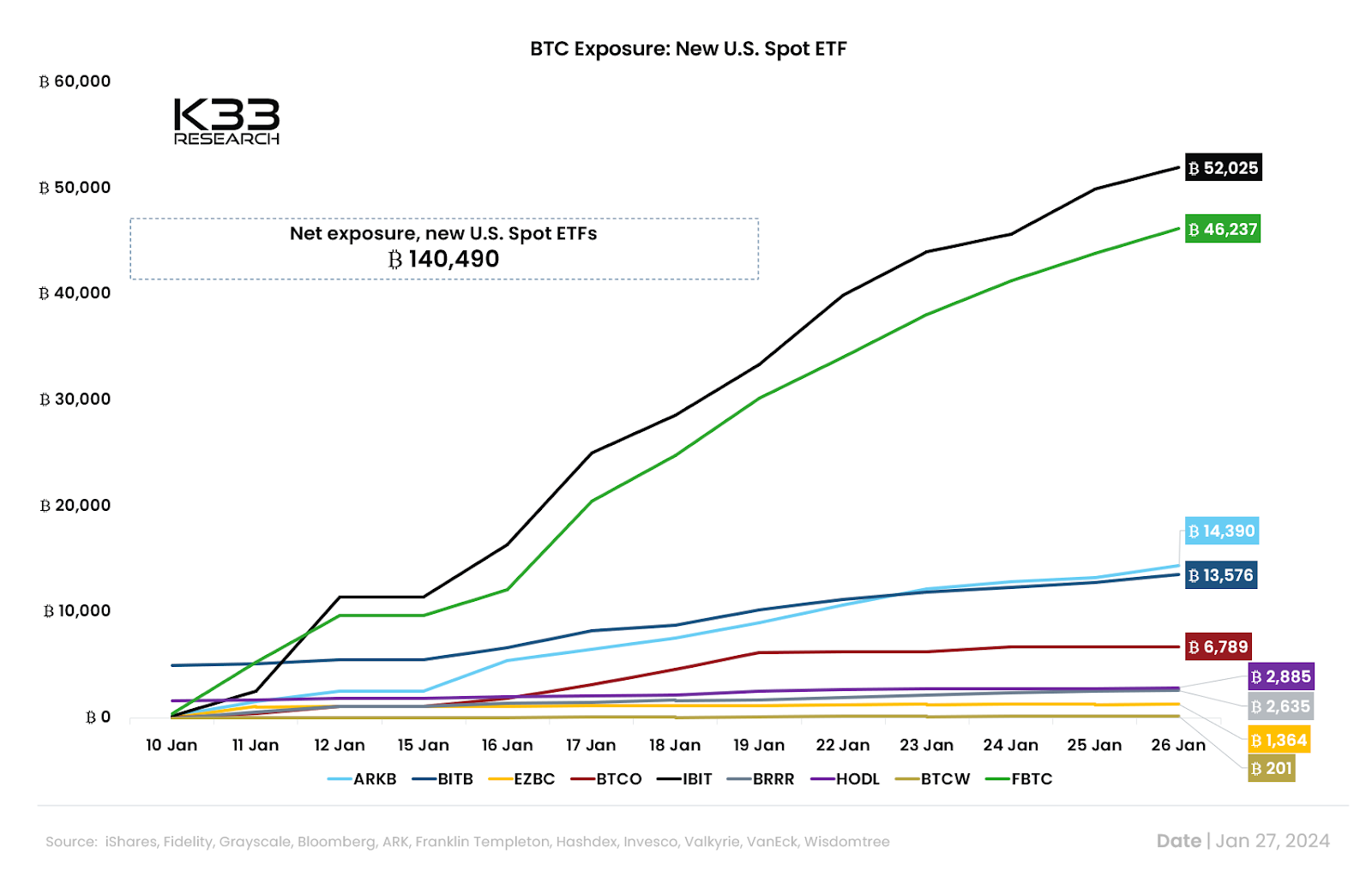

BlackRock leads as BTC locked in ETF products climbs above 140K

According to research analysts at K33 Research, new US ETFs now hold over 140,490 BTC – a total that has been accumulated in twelve days.

BlackRock’s IBIT has become the frontrunner among recently launched spot Bitcoin products, reaching an impressive $2 billion in assets under management as of Friday.

This excludes Grayscale’s GBTC, which held nearly $30 billion in AUM during its transition from a closed-end fund to a spot ETF.

Investors displayed heightened confidence in IBIT on Friday, pouring approximately $170 million into the fund.

This surge in investment facilitated the purchase of nearly 4,300 additional Bitcoin, bringing the total tokens held by IBIT to 52,025.

The subsequent rise in the price of Bitcoin over the weekend, exceeding the $40,000 mark, propelled IBIT’s AUM to surpass $2 billion.

This remarkable achievement has positioned IBIT as the third-largest asset gatherer among the over 600 ETFs launched in the past year.

In a recent X post, ETF Store president Nate Geraci predicted that IBIT could soon ascend to the top spot in terms of asset gathering.

The next contender anticipated to cross the $2 billion mark is Fidelity’s Wise Origin Bitcoin Fund (FBTC), which reported holding just shy of 47,000 Bitcoin as of January 27.

2023 breaks records for acquiring on-chain users

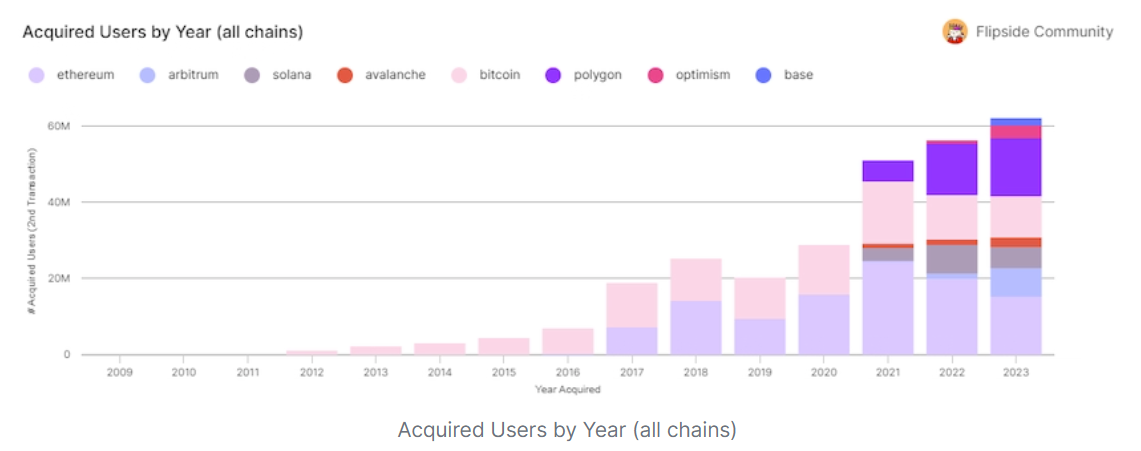

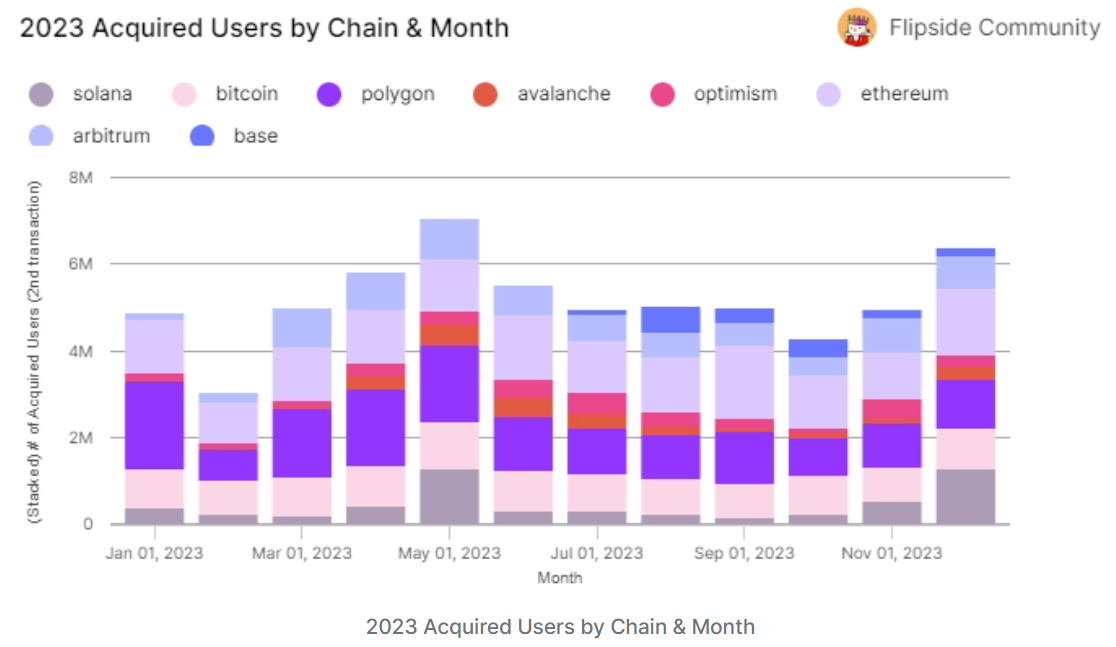

According to Flipside Crypto, an on-chain analytics platform, the crypto industry enjoyed unparalleled success in 2023, acquiring the largest number of on-chain users ever seen in a single year.

According to the report 62.1 million new users utilized blockchain infrastructure in comparison to the 58 million that were seen in 2022.

Taking the lead in this surge was Ethereum, boasting an impressive 15.4 million acquired users.

Not far behind, Polygon secured the second spot with 15.2 million, while Bitcoin claimed the third position with a notable 10.7 million.

Notably, Solana, experienced a resurgence in 2023, securing the fifth spot among the eight blockchains under scrutiny, acquiring 5.6 million users.

Remarkably, over 45% of Solana’s new user base was captured during the months of May and December.

According to the report, Flipside Crypto defines an acquired user as a blockchain address that initiated its second transaction in 2023, which should help to provide a more nuanced understanding of user engagement.

Traditionally, measuring a blockchain’s user count has proven challenging due to the possibility of a single user controlling unlimited addresses.

This complexity arises from crypto participants creating multiple wallets to maximize potential returns from airdrops.

Looking ahead, Flipside predicts a shift in user behavior, speculating that, akin to developers, users will adapt to utilizing multiple chains if a crypto bull run resurfaces.

This foresight suggests an evolving landscape where users explore diverse blockchain ecosystems, mirroring the dynamic and expanding nature of the cryptocurrency industry.

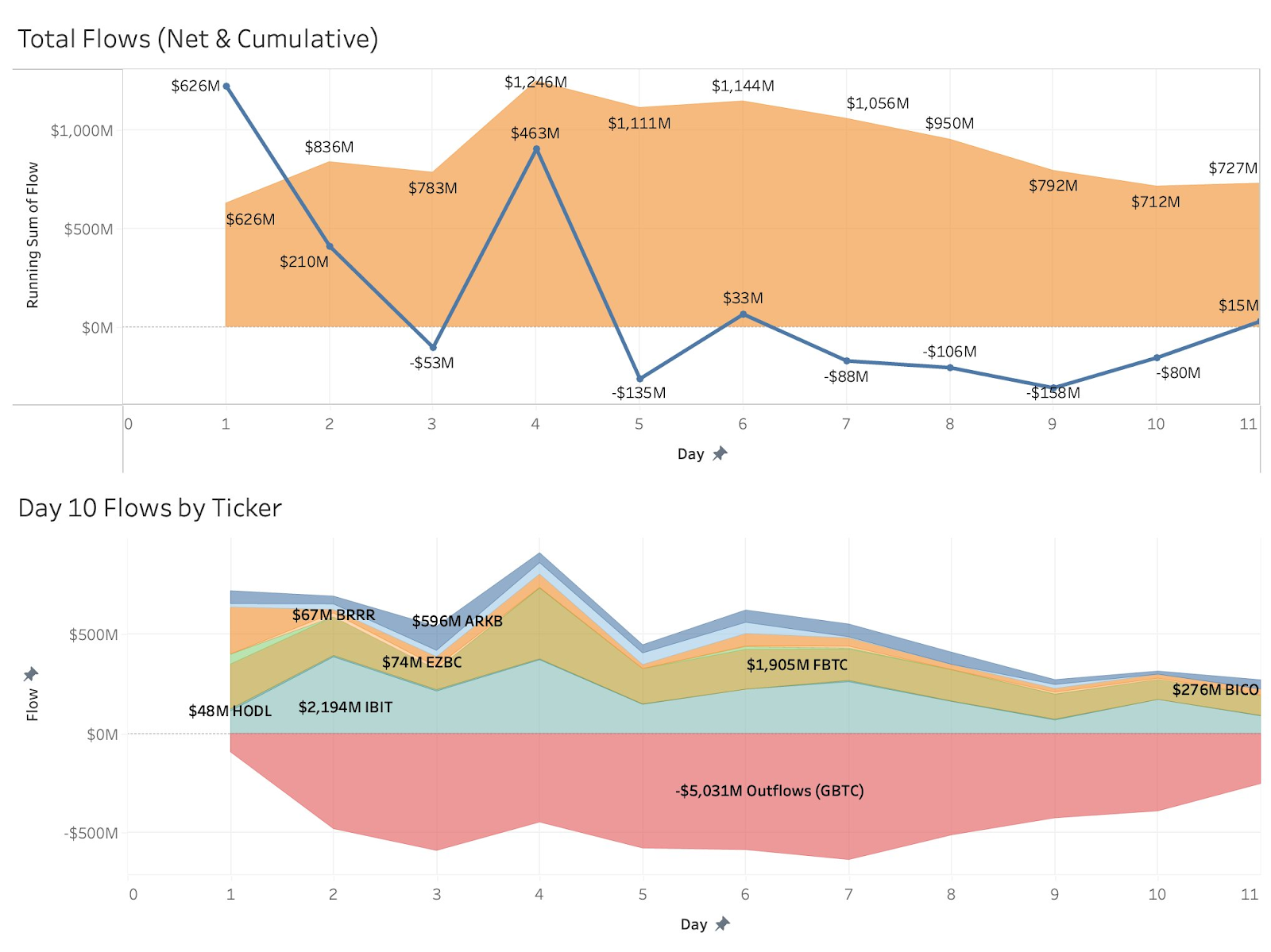

GBTC outflows lower as FTX bankruptcy estate sells off

The price of Bitcoin has fallen since Bitcoin ETFs were first launched on January. 11th and, according to many analysts, one of the most significant reasons for selling pressure has been Grayscale’s Bitcoin ETF.

Since Grayscale’s Bitcoin Trust (GBTC) was converted into a Bitcoin ETF, more than $2 billion worth of shares have been sold.

GBTC had already existed for more than a decade, however, it was structured as a closed-end fund. This meant that the price of GBTC shares was sometimes less than the price of Bitcoin. It also meant that investors couldn’t readily convert shares directly into the underlying asset.

Upon conversion, many investors used the opportunity to capitalize on the disparity between the price of GBTC and the net asset value of the underlying Bitcoin, which has resulted in consistent outflows from Grayscales Bitcoin ETF.

However, according to a recent report filed by CoinDesk, a large percentage of those outflows has stemmed from FTX’s bankruptcy estate.

FTX held shares in five of Grayscale’s trusts, and according to a filing in November 2023, the company held 22.3 million GBTC, which equated to $597 million at the time.

In January 2023, those same shares were worth approximately $1 billion, which CoinDesk believes has now been sold.

On Friday, Grayscale’s Bitcoin ETF recorded the lowest outflows since the first day that it launched with just $255 million GBTC sold.

US government to sell Bitcoin linked to Silk Road

The United States government has disclosed its intention to sell approximately $118 million worth of Bitcoin seized from the Silk Road.

![[filename]](https://xcoins.com/wp-content/uploads/2024/01/image-8.png)

Tweet from Watcher.Guru breaking news on the US government Bitcoin sale

After news broke, market analysts were quick to dispel concerns, asserting that the move was not a cause for alarm within the cryptocurrency community.

The forfeiture notice, dated January 10, gained attention on social media by January 24, revealing the government’s plan to liquidate 2,934 BTC after the January 8 sentencing of Silk Road Xanax dealer Ryan Farace and his father Joseph Farace, aged 72, for money laundering conspiracy.

Despite a few apprehensions within the community regarding a potential substantial Bitcoin “dump” resulting from the auction, Steven Lubka, the Managing Director at Bitcoin exchange Swan Bitcoin, dismissed such concerns.

Lubka argued that the sale would be inconsequential when compared to the significant outflows that the market has witnessed from Grayscale’s Bitcoin ETF, observed over the past week.

“Peanuts, we have been eating GBTC sales 4x this for breakfast,” remarked Lubka.

The GBTC has recently offloaded 106,575 BTC, amounting to $4.2 billion, since its transition to a spot Bitcoin exchange-traded fund on January 11.

Furthermore, data from crypto firm 21.co reveals that the U.S. government’s planned sale constitutes merely 1.5% of its total holdings, estimated at 194,188 BTC or $7.7 billion, acquired through three seizures in criminal cases.

Importantly, this total remains less than 1% of Bitcoin’s circulating supply.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.