Bitcoin 200-Day Moving Average Hits All-Time High: How High Will Bitcoin Go?

In the world of cryptocurrencies, Bitcoin continues to lead the pack, dominating the attention of investors and analysts.

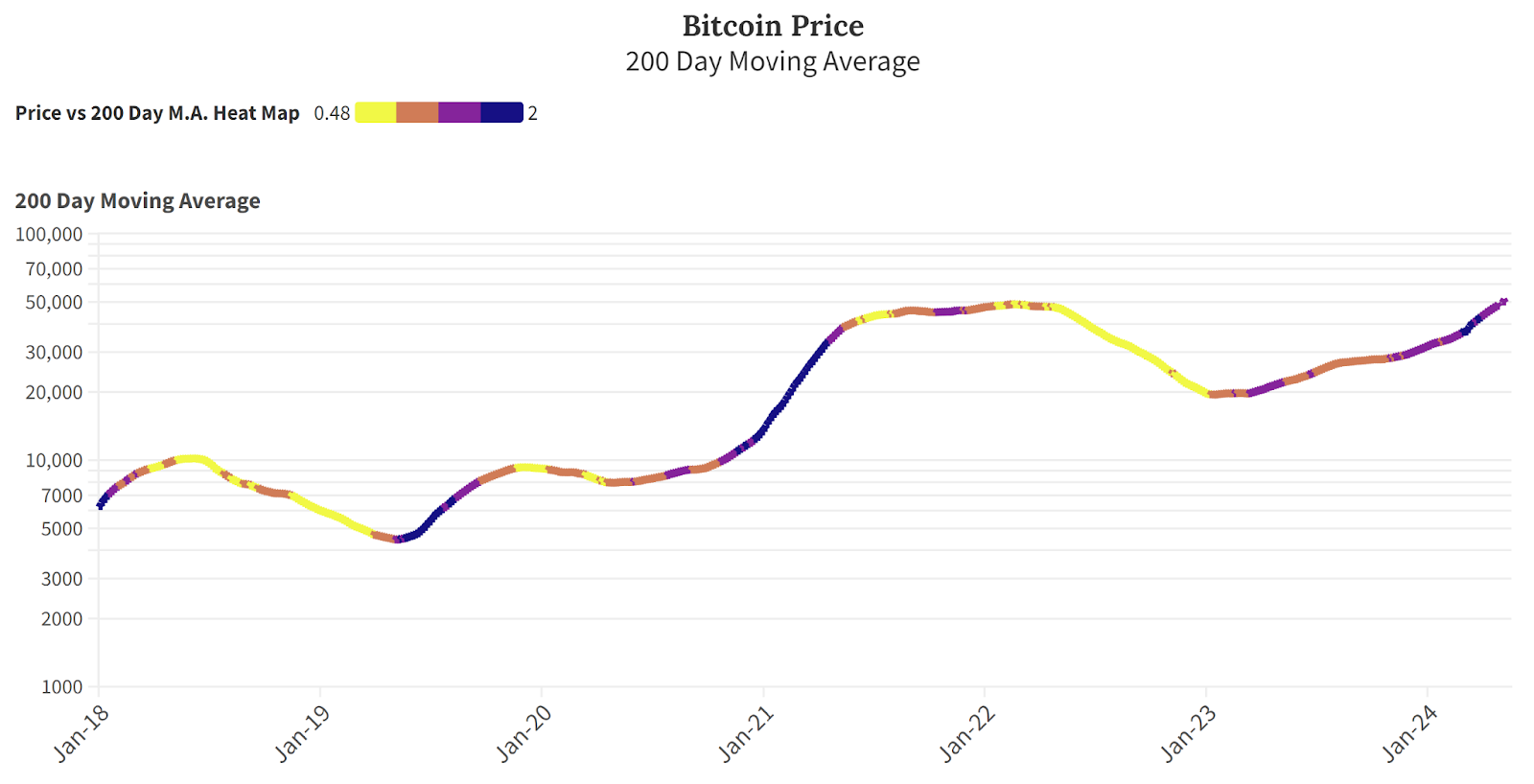

Bitcoin has just achieved a significant milestone by recording a new all-time high in its 200-day Moving Average (MA), surpassing $50,000 for the first time in history.

This landmark development signifies a robust bullish trend and is causing analysts to ask the question: “will bitcoin ever go below $50K again?”

Let’s explore the factors driving Bitcoin’s price surge and what this means for potential investors.

Understanding the Surge in Bitcoin’s 200-day Moving Average

The 200-day MA is a critical indicator in the financial markets, especially for assets like Bitcoin that are highly volatile.

It represents the average closing prices over the past 200 days and is used to determine the overall market trend. A rising 200-day MA indicates a long-term upward trend, suggesting that Bitcoin is not only experiencing temporary spikes but sustained growth. This trend is a strong signal to investors that the market sentiment is growing increasingly positive.

Psychological and Market Sentiments

Breaking past the $60,000 psychological barrier has further fueled positive market sentiment. This level is not just a technical resistance point but also a significant milestone that, when surpassed, tends to generate increased investor interest.

Currently, as Bitcoin trends upwards towards its all-time high of $73,737, the market is buzzing with optimism, attracting both seasoned traders and new entrants who have been swept into Bitcoin by the advent of Bitcoin ETFs.

Is It Too Late to Invest in Bitcoin?

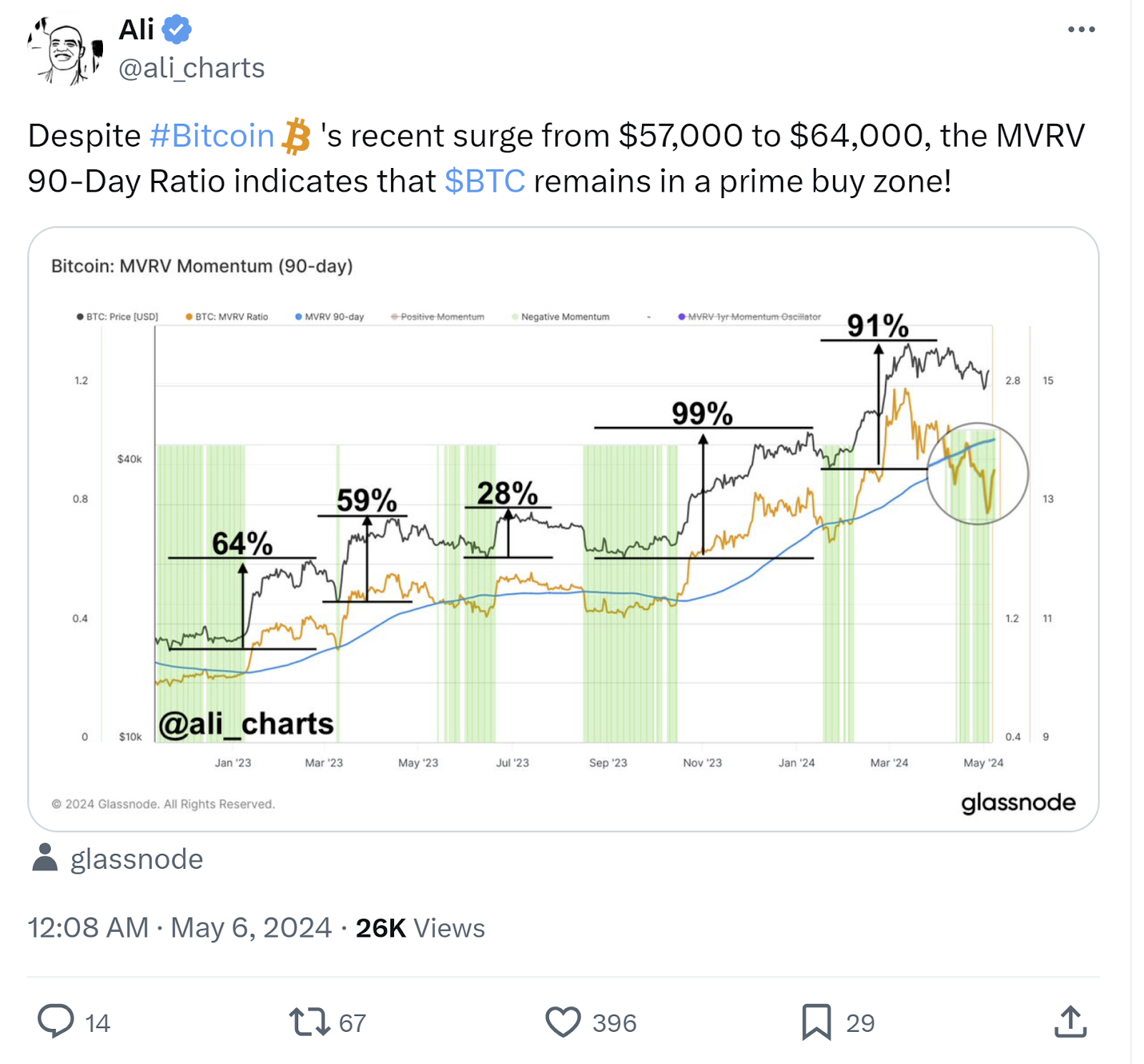

Insights from the MVRV 90-Day Ratio

Despite recent price increases, the MVRV 90-Day Ratio, which measures the market value against the realized value over the last 90 days, suggests Bitcoin is still undervalued according to many analysts.

This ratio is a potent tool for investors, indicating that despite the rally, Bitcoin could still be a compelling buy.

What Price is Bitcoin’s Bottom?

The fear-induced drop to around $57,000 last week, which was quickly recovered, marked a potential cycle bottom given the tendency of Bitcoin to surge in price exponentially in the 12 months after Bitcoin Halvings.

Such moments are often ideal for buying, as they may precede significant bullish runs. This pattern aligns with historical behaviors observed in both crypto and traditional financial markets, indicating strong potential for growth.

When to Buy Bitcoin

Investors looking to enter the Bitcoin market might consider the following strategies:

- Buying During Dips: This approach allows investors to enter the market at a lower cost, capitalizing on Bitcoin’s price volatility.

- Dollar-Cost Averaging: To mitigate risks associated with volatility, investing a consistent amount periodically can average out the buying price, providing a more stable entry point.

- Using Technical Indicators: Tools like the 200-day MA can help identify trends and make informed decisions about when to buy.

Factors That Could Influence Bitcoin’s Price

- Institutional Investment: Increased investment from large institutions can significantly influence Bitcoin’s price, driving it upwards. Many analysts are expecting Bitcoin prices to skyrocket this cycle as this is the first cycle after the first Bitcoin ETFs opened the Bitcoin market to institutions and unsophisticated investors. This happened before with Gold after the first gold ETF, and it could happen again with Bitcoin!

- Limited Supply: Bitcoin’s capped supply at 21 million coins introduces scarcity to the market, which could lead to price increases as demand grows.

- Regulatory Environment: Positive developments in regulation could enhance investor confidence, potentially leading to price increases.

Harnessing Bitcoin’s Potential

As Bitcoin’s 200-day MA hits an all-time high, the outlook for its future price remains promising.

For those considering investing in Bitcoin, the current market conditions and historical performance suggest that there is still substantial room for growth.

By staying informed and strategically entering the market, investors can potentially reap significant rewards as Bitcoin continues to navigate its upward trajectory.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, TikTok, and LinkedIn.