A Massive Value Transfer is Taking Place From Traders to HODLers

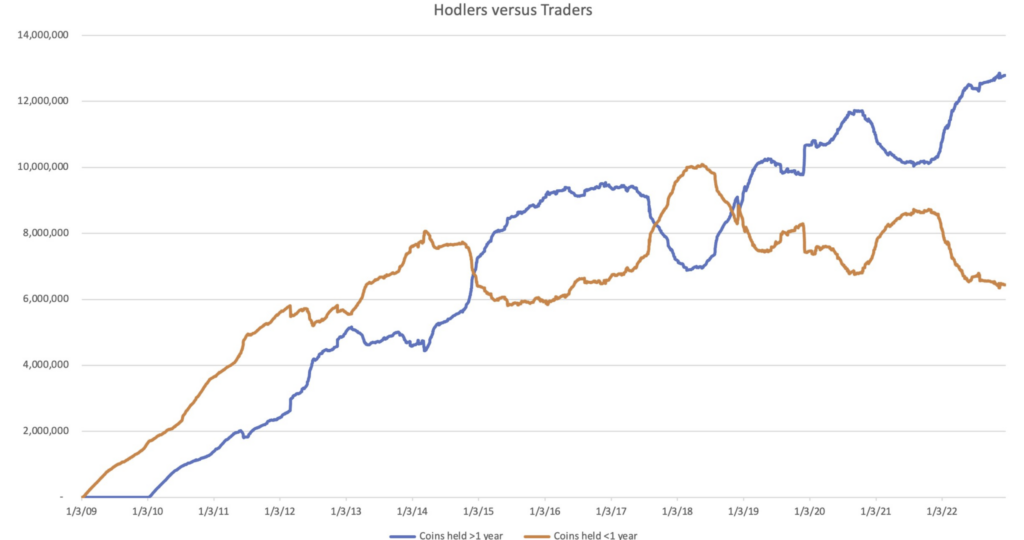

Bitcoin “hodlers” who have held their bitcoin for more than a year now hold the majority of all Bitcoin, and the gap is widening, according to on-chain data.

An apparent shift is taking place in which traders who maintain their holdings for under a year have been selling crypto, and that crypto has been picked up by stronger hands who seem to be far less willing to part with it.

Traders anticipate short-term price changes and establish trading positions to profit from variations in demand. Hodlers, on the other hand, buy with the intention of holding for the long-term. HODL is a misspelling of “hold” in the sense of buying and holding Bitcoin and other cryptocurrencies. It’s also come to stand for “hold on for dear life” among some cryptocurrency investors.

Data shows Bitcoin is being scooped up by “hodlers”

On chain data shows that Bitcoin investors holding Bitcoin for over six months now own 78% of the entire circulating supply, the highest number ever seen.

When we look at investors holding Bitcoin for over a year we can see that most coins are now held by hodlers and the gap between traders and hodlers is widening rapidly.

As illustrated in the graph above, the percentage of total Bitcoin supply owned by hodlers holding Bitcoin for over a year has increased recently, indicating that there has been a significant movement towards a HODLing attitude among investors.

What are the implications of an increase in Bitcoin hodling?

With the rate of hodling at an all-time high, selling pressure from traders is shrinking. If this trend continues, we could come to see a supply shock take place that could lead to a dramatic rise in Bitcoin’s price.

Some anticipated Bitcoin’s bottom in November 2022, while others predict further volatility, and an even lower bottom set to come in the coming months. For a bear market to reach its final bottom, coins held at a loss should shift predominantly to those that are the least price sensitive and have the most conviction.

The recent trend of long-term accumulation implies that many investors are buying BTC at low prices because they believe it will turn bullish on a long-term basis.

Three signs Bitcoin’s price will continue to increase

While the growing amount of Bitcoin being held on a long-term basis is a strong indicator that Bitcoin’s price is set to continue to rise, indicators such as these should never be looked at in isolation.

Here are a few other factors that might boost Bitcoin’s value even further.

1. There is currently rapid growth in the use of the Bitcoin Lightning Network, which makes transactions quicker and cheaper than the standard Bitcoin sending and receiving procedure, opening the path for increased usage.

2. America’s oldest bank, the Bank of New York Mellon recently said that it would hold, transfer, and issue Bitcoin, making it more straightforward for firms to invest a portion of their funds in Bitcoin.

3. The market capitalization of Bitcoin is now approaching $1 trillion. The greater the Bitcoin market grows, the more institutions can invest in it without worrying about liquidity. This could translate to higher prices and lesser volatility.

Where does the term “hodl” originate from?

Back in December 2013, a Bitcoin trader with the username GameKyuubi posted on a Bitcointalk forum a drunken, semi-coherent, typo-filled diatribe about the user’s terrible trading abilities and resolved to keep his Bitcoin from that point forward.

“You only sell in a bear market if you are a good day trader or an illusioned noob, he stated. The people in between hold. In a zero-sum game like this, traders can only take your money if you sell.”

Within an hour, “HODL” had become a meme. HODLing has evolved into a term used to describe confidence in the long-term possibilities of blockchain technology, cryptocurrencies, and the communities that have sprung up around them. To hodlers, the best time to HODL is now, always, and forever!

As always, this article does not constitute financial advice. You should be sure to do your research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.