Bitcoin Is at an All-Time High for Over a Billion People Around the World

Over a billion people worldwide are witnessing an all-time high (ATH) in the value of Bitcoin (BTC) in their local currency.

This phenomenon is especially pronounced in countries like Argentina, Venezuela, Lebanon, Egypt, Turkey, and Nigeria, each struggling with issues such as rampant inflation, stringent capital controls, or the introduction of Central Bank Digital Currencies (CBDCs).

Bitcoin’s Surge in Economies Plagued by Inflation

The largest economy in Latin America, Argentina, currently grapples with a staggering 130% inflation. With Bitcoin’s value multiplying by over 35 times since March 2020 in the Argentine Peso, nearly 46 million citizens are waking up to new Bitcoin ATHs.

In Venezuela, the situation is not too different. Having endured a colossal 430% annual inflation rate, Venezuelans have seen Bitcoin’s value soar by 700% in the last year alone, setting another record high.

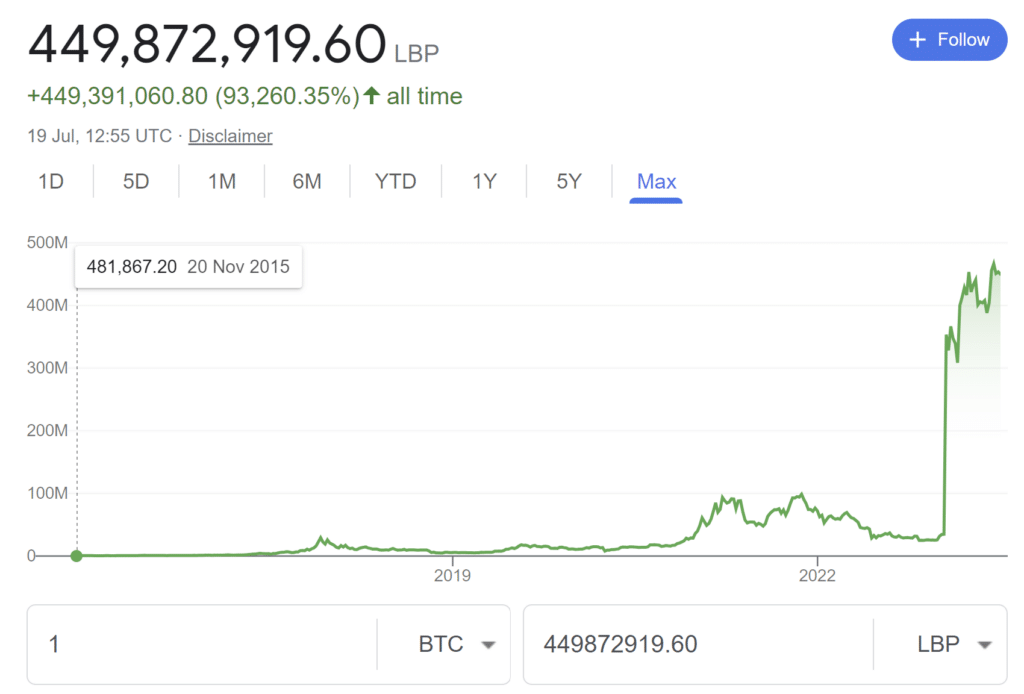

Meanwhile, in the Middle East, Lebanon experienced its Bitcoin ATH in a dramatic way.

As the local economy faltered, Bitcoin’s value sky-rocketed from 25 million Lebanese Pounds in January 2023 to an astounding 360 million just one month later. Desperate to protect their wealth from evaporating, Lebanese citizens have turned to mining Bitcoin to accumulate unseizable assets.

Bitcoin Nearing ATH in Additional Economies

While Bitcoin has already reached an ATH in some countries, it is poised to do the same in others. In Egypt, Bitcoin is a mere 12% away from smashing another record.

Turkey, with its annual inflation at 80%, has seen similar trends. Over the past three years, the Bitcoin price in Turkish Lira has steadily climbed from ₺85,000 in September 2020, to ₺354,000 in September 2021, and to ₺354,000 again in September 2022. Bitcoin is just 12% off an ATH in this struggling economy.

Bitcoin’s Resilience Amidst Government Interventions

Nigeria, Africa’s most populous country, has also seen a significant Bitcoin surge.

Despite being the first country on the continent to introduce a CBDC and attempting to ban Bitcoin, the Nigerian government has been unable to stop its 80 million citizens from adopting the leading cryptocurrency, in fact, Nigeria has some of the highest rates of Bitcoin adoption worldwide, and Bitcoin is now just 14% away from setting a new ATH in Nigeria.

These countries are unified by their struggle with high inflation, and many of them have launched open attacks on Bitcoin. Yet these attacks have only fueled Bitcoin adoption and led to successive new ATHs.

What does the future hold for Bitcoin and CBDCs in the West?

As we speculate about the future, the question arises: Will the same pattern unfold in Western economies as CBDCs become increasingly prevalent?

Historically, state attempts to attack or control decentralized technologies have met with failure, from the Internet to BitTorrent. The resilience of these networks gives us insight into Bitcoin’s potential path. The world’s preeminent cryptocurrency is likely to weather any future governmental attempts to control or disrupt it.

While we await the potential rollout of CBDCs in the West, one thing is certain: Bitcoin’s all-time highs in countries around the globe testify to its growing adoption and its resilience amidst economic turbulence.

As citizens of struggling economies turn to Bitcoin for financial stability, the stage is set for the cryptocurrency to continue to reach unprecedented heights.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.