![[filename]](https://xcoins.com/wp-content/uploads/2022/02/Bitcoin-image-scaled-1.webp)

How Many Bitcoins Are There and How Does It Affect You?

Created by the elusive Satoshi Nakamoto in 2009, Bitcoin was the first cryptocurrency and is by far the most famous.

Bitcoins enter into circulation through a process called Bitcoin mining, whereby computers solve complex maths puzzles and the first Bitcoin miner to solve that puzzle is rewarded with Bitcoin. But just how many Bitcoins are there and what does that mean long-term for anyone who owns the cryptocurrency?

How many Bitcoins are left?

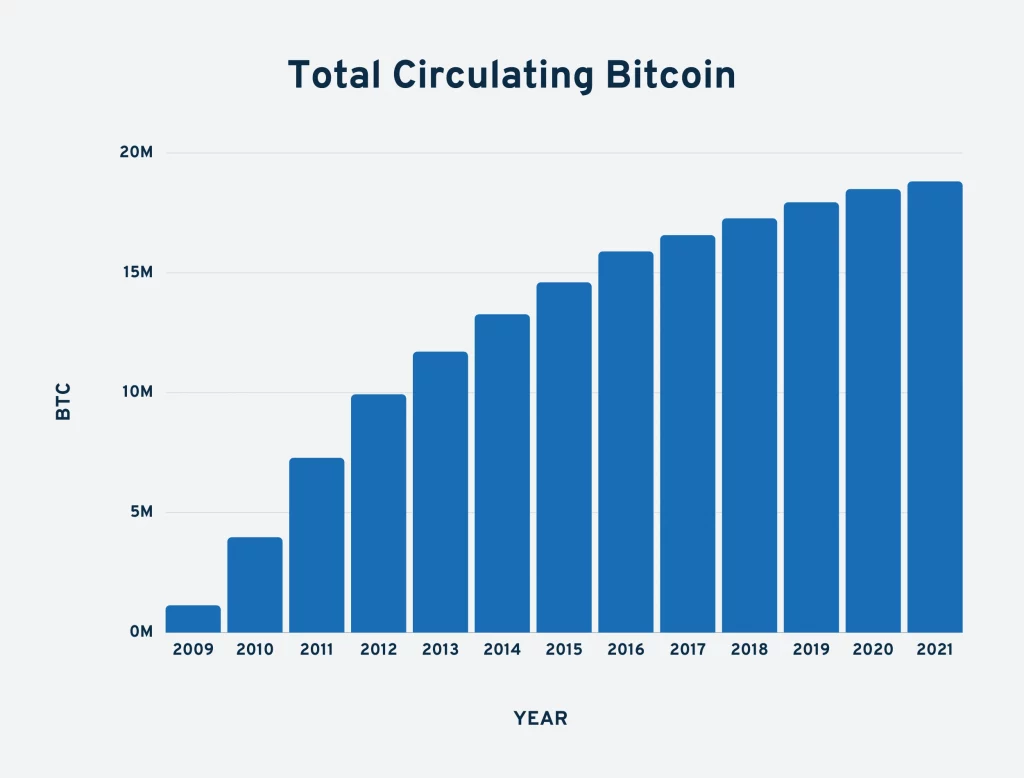

It’s been over a decade since Bitcoin appeared on the scene, and since its arrival, miners have been busy releasing this cryptocurrency into the world. So, how many bitcoins are left? As of January 2021, just over 18.9 million Bitcoins have been mined, which is approximately 90% of the 21 million Bitcoin limit set by Satoshi Nakamoto. That means there is roughly 2.1 million Bitcoin left still to be mined.

It takes, on average, 10 minutes to mine a Bitcoin, and there are an estimated 900 new Bitcoins mined every day (typically, 144 blocks are mined daily with each block containing 6.25 Bitcoins). Considering it took 12 years to mine 90% of all Bitcoin in existence, you could be forgiven for thinking the remaining 10% will be mined within the next few years, but this isn’t the case.

Total amount of Bitcoin in circulation. Source: explodingtopics.com

When will the last Bitcoin be mined?

The remaining Bitcoin will not be mined before 2140 due to ‘Bitcoin halving’, which is a process by which the rate of Bitcoin entering circulation is halved every 210,000 blocks mined (about every four years). In 2009 each mining block produced 50 Bitcoin, but by 2012 this had been reduced to 25 Bitcoin. Since May 11, 2020, miners have been awarded 6.25 Bitcoin per block mined, and by 2024 this will have reduced further to 3.12 Bitcoin.

In this way, Bitcoin has become harder to mine, with the value of the coins already in existence increasing dramatically as a result. Many experts believe that further halving events will only lead to further Bitcoin price gains. Bitcoin value has grown exponentially since its creation in 2009 and is now worth a million times more than it was then. To put that into perspective, the maximum value of one Bitcoin in 2011 was $30, while in 2021 it reached an all-time high of $60,000.

Who has the most Bitcoin?

You can see which addresses hold the most Bitcoin by going to the bitinfocharts rich list. Satoshi Nakamoto (whether that’s one person or a group of people) is/are thought to own approximately 1 million BTC, which, at a Bitcoin value of $45,000 per BTC, would put their Bitcoin worth at a staggering $4.5 billion. At the time of writing, the richest single Bitcoin address holds 252,597 BTC.

In truth, who has the most Bitcoin is not a straightforward question. Exactly who owns most of these Bitcoin addresses and the Bitcoins held within, no one knows for sure. It’s thought that 10,000 individuals control about one-third of the Bitcoin in circulation. Often the largest addresses aren’t a single entity, but rather are holding Bitcoin on behalf of individual investors.

Many large companies are also seeing the investment potential of Bitcoin. As of 2021, Microstrategy owned 108,992 BTC, the most of any publicly traded company, Tesla had purchased 42,902 BTC, while Galaxy Digital Holdings had 16,400 BTC.

Many big-name investors, including Elon Musk and the Winklevoss twins, have made no secret of their love for Bitcoin, and even celebrities are getting in on the act, with the likes of Steven Seagal and Snoop Dogg now owning the cryptocurrency.

Of the 18.9 million Bitcoins that have been mined, it’s thought that between 2.78 and 3.79 million are lost forever. That’s 20% of the entire mined supply. Most of the missing Bitcoin is due to private keys being lost or simply forgotten. This lost Bitcoin is worth billions of dollars, and there have been high-profile cases of carelessly discarded private keys, including a man who threw away a hard drive containing 7,500 BTC, thought to now be worth in the order of half a billion dollars.

Since it’s virtually impossible to recover the lost Bitcoin, those coins are, essentially, out of circulation. Between that and Satoshi’s stash, the overall available supply of Bitcoin has been reduced. If this Bitcoin remains locked away, it could drive Bitcoin value up even higher as those permanently out of action make the remaining coins even more valuable.

What does Bitcoin’s limited supply mean for investors?

There is a finite supply of Bitcoin. It was likely designed that way for a number of reasons, but perhaps the most important is that it keeps the cryptocurrency scarce and therefore the Bitcoin value high. That’s the theory, anyway. But is it as simple as that? Will this ‘digital gold’ simply continue to grow in value? With only 10% of Bitcoin left to mine, and demand increasing, it would look that way. But supply and demand aren’t the only factors influencing Bitcoin value. The cost of production, competition with other cryptocurrencies, as well as regulatory developments can all exert negative as well as positive pressures on Bitcoin value.

Perhaps one of Bitcoin’s greatest advantages is that it can operate as a hedge against inflation. Governments and Central Banks can choose to print fiat currency, often causing that currency to depreciate. Whereas Bitcoin’s limited and fixed availability makes it far less vulnerable to inflation.

Gold has traditionally been the go-to for combating inflation, but Bitcoin does have advantages over gold, not least because it’s not controlled by any country and offers the freedom of being portable and transferrable. Not everyone is convinced though, and the hedging debate continues, with some suggesting that the cryptocurrency’s recent volatility and relative newness make it a bit of an unknown quantity.

Some are now choosing Bitcoin over gold as an inflation hedge

What does the future hold for Bitcoin?

No one can say for sure what will happen to Bitcoin in the long term. However, large public companies such as MicroStrategy and Tesla are beginning to invest in Bitcoin, and top brands, including Microsoft and Starbucks, are now allowing crypto payments. All this evidence seems to point towards one thing: cryptocurrency is starting to go mainstream.

Banks and governments may try to prevent the legitimising of Bitcoin, but with the momentum Bitcoin is gathering, it might already be out of their control and arguably would not be in their interests. The last Bitcoin to be mined is a long way off, and between now and 2140, Bitcoin will likely continue to evolve. By then, what its primary function will be is anyone’s guess.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.

Frequently Asked Questions (FAQs)

Of the 21 million Bitcoin that will ever be in existence, 18.9 million have been mined and are currently in circulation. That’s 90% of the total number of possible Bitcoin.

It’s estimated that between 2.78 and 3.79 million Bitcoin have been lost for good. Most lost Bitcoin is due to misplaced hardware or forgotten passwords.

Due to how the source code has been written, the total Bitcoin supply sits at 21 million. Given the way the Bitcoin mining system works, the last Bitcoin is expected to be mined in 2140.

With over 1 million BTC, Bitcoin founder Satoshi Nakamoto (whether that be an individual or a group of people) owns more of this cryptocurrency than anyone else.