What Does Quantum Computing Mean for Bitcoin?

Some worry that the advent of quantum computing could pose a threat to blockchain security. We examine the potential impact on Bitcoin and the work being done to prevent the risk from materialising.

The rapid growth of cryptocurrency over the last year has set the stage for digital currency to take over the world. More than 13 years on from the launch of Bitcoin, the world’s first cryptocurrency, its market cap has skyrocketed to over a trillion dollars and it has been joined by more than 8,000 other coins.

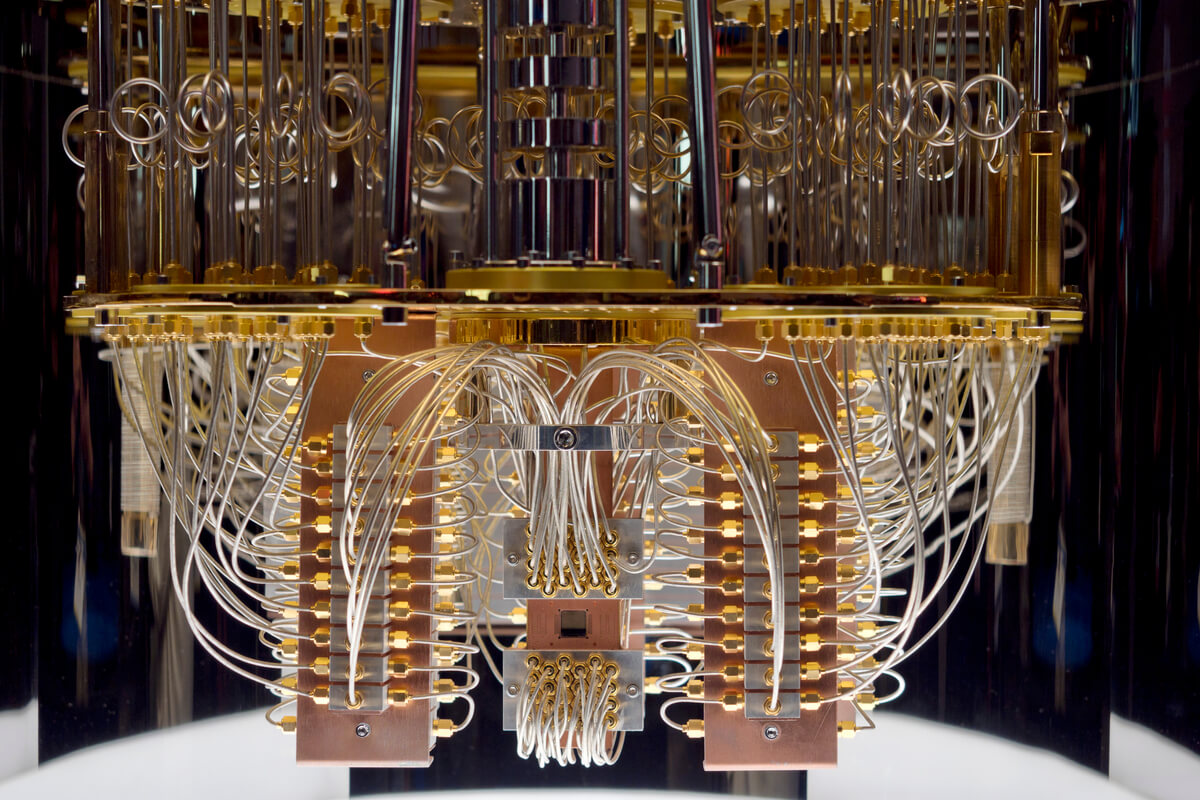

But some believe that one of the biggest dangers to the crypto market is just around the corner: quantum computers. While quantum computing is still in its infancy, governments and tech conglomerates such as Google and Microsoft are leading efforts to develop the technology. What does this mean for the future of Bitcoin and other cryptocurrencies? Read on to find out.

What is quantum computing?

To understand how powerful quantum computers will be, it’s easiest to compare them to how normal computers work.

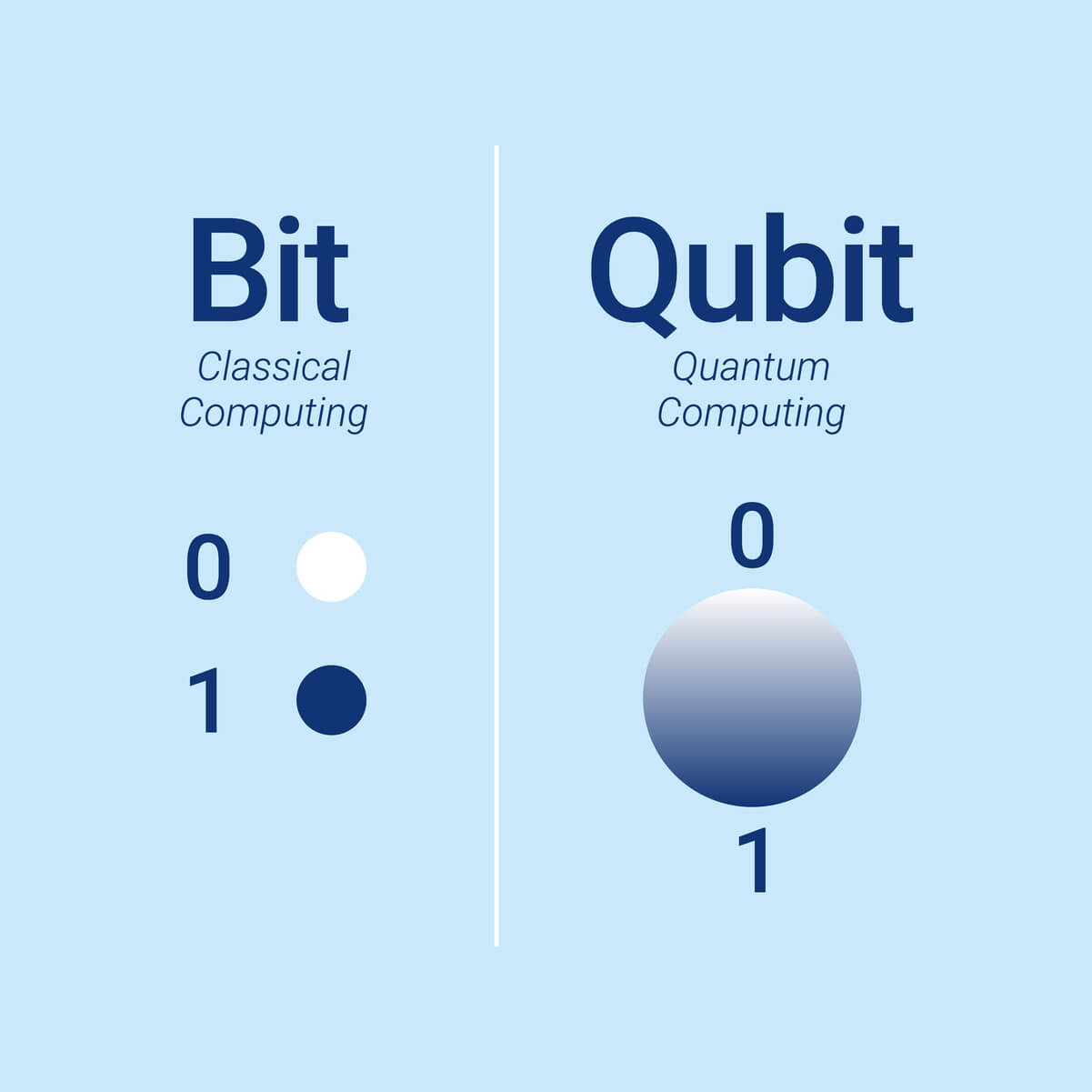

Ordinary, household computers contain computer chips that use “bits”. These bits are similar to small switches, which are binary, meaning that they operate on two positions: they’re either in the on position (indicated by a 0) or the off position (indicated by a 1). Any function that you perform on your computer, such as playing a game or visiting a website, happens as a result of millions of bits working together as a mixture of 0’s and 1’s.

However, not everything can be expressed as either on or off. As with anything in life, there are uncertainties that lie in between the two, but ordinary computers aren’t very good at expressing uncertainties. That’s where quantum computers come in.

Quantum computers use “qubits” rather than bits. As opposed to being in a clear position that’s either on or off, as ordinary computers are, quantum computers can be in something called a ‘superposition’, a state which allows them to be both on and off simultaneously or operate somewhere between the two positions. A real-world example of this is the in-between position of a coin when you flip it in the air before you find out whether it lands on heads or tails.

Because ordinary computer systems are binary, when you give them a task to do, they’ll attempt each individual scenario one by one in order to find the solution. What makes quantum computers so powerful is that they can attempt multiple scenarios at once, meaning that they’re able to process infinitely more data, at a much faster rate.

Quantum computers use qubits while traditional computers use bits, allowing them to process data more efficiently.

Could quantum computing threaten Bitcoin?

You may be wondering what this has to do with Bitcoin. In short, some fear that the power harnessed by quantum computers could be enough to crack the encryption that blockchains, such as Bitcoin are built on.

The security of Bitcoin transactions and wallet creation is based on a cryptographic algorithm called Elliptic Curve Digital Signature Algorithm (ECDSA). Every individual transacting in Bitcoin has a private key that corresponds with a public key. The private key is used to sign off and validate transactions, which is why it has to be kept a secret, however public keys can be shared with others so they can send you your crypto.

What makes cryptocurrency transactions secure is that it’s not possible to work out an individual’s private key from their public key – which is composed of large prime numbers. This is partly because ordinary binary computers can’t factor in large prime numbers easily.

However, one of the main algorithms that quantum computers use is Shor’s algorithm. This means factorization can be done at an exponentially faster rate than ordinary computers, as they can attempt multiple solutions at once.

Some fear that a hacker with a quantum computer could attain a private key from its public key pair. Once they’ve got a private key, the hacker could hypothetically use a legitimate owner’s Bitcoin funds.

This is no mean feat. In order to decrypt Bitcoin’s encryption, it is estimated a quantum computer would need to be a million times more powerful than the most powerful quantum computer is today.

Quantum computers will have the power to crack encrypted data, which could pose a security threat to Bitcoin.

What are the risks?

The biggest risk is that Bitcoin’s decentralized structure could make it difficult to coordinate a defence against quantum computers.

In order to execute a major upgrade on the network, the majority of miners need to agree on a change, which then leads to either a soft or hard fork. If this process of obtaining unanimous agreement takes too long, quantum computers could hypothetically compromise the security of Bitcoin’s blockchain before it can be updated to prevent such an attack.

Should Bitcoin holders be worried?

The short answer is “no”. Although any new technology is worth watching out for, here are a few reasons why hearing the words “quantum computing” shouldn’t make you rush to sell your holdings.

There is a solution

Specific types of encryption, namely post-quantum cryptography, can be deployed to create an impenetrable barrier against future quantum-related attacks.

Work is underway

Developers of Bitcoin and other cryptocurrencies are well aware of the impact that quantum computers could have once they’re fully developed and widely available. For that reason, they’re actively working on quantum-safe security solutions.

The National Institute for Standards and Technology (NIST) has begun work on the standards for post-quantum cryptography, with a 2024 rollout in mind. It’s also reported that the Ethereum Foundation, behind the Ethereum cryptocurrency, is mapping out quantum-resistant solutions.

Fear is premature

What’s most important to understand is that the current fear of quantum computing is premature. We’re several years away from its emergence in any meaningful form when it comes to impacting crypto, and work is already being done to ensure that cryptocurrencies remain secure upon its arrival.

This type of technology isn’t something that will be available overnight. We have plenty of advance notice, so researchers and developers have time to build and integrate quantum-safe cryptography.

The risks of quantum hacking go far beyond crypto

While Bitcoin leads the cryptocurrency market, quantum computers are a topic of interest for the whole market, so it’s in the interest of a wide range of parties to coordinate towards the development of reliable solutions.

One of those parties is institutional investors who account for approximately 63% of crypto trading and counting. That’s a big increase from only 10% in 2017. A crypto collapse would have a ripple effect on the whole financial system so it’s likely that very powerful forces will be heavily invested in arriving at a solution.

It’s worth noting that the issue isn’t limited to crypto, in fact, crypto may actually be one of the safest sectors when it comes to the risks of quantum hacking. Quantum computers will also be able to breach the cryptographic encryption which we use for other secured products, such as traditional bank accounts and email addresses.

It’s more than likely that protective measures will be taken across industries and as Bitcoin is the world’s biggest cryptocurrency, we can expect that keeping it stable will be top of mind for a huge range of stakeholders.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.