JPMorgan Predicts $150K for Bitcoin as Canada Bill Aims to Attract Crypto Investment

Although equities were shaken due to the release of high U.S. inflation figures last week, cryptocurrency markets remained stable. Bolstered by a new all-time high hashrate, Bitcoin remained above the psychological $40,000 mark. Elsewhere, cryptocurrency innovation marched forward as McDonald’s filed patents for restaurants within the metaverse and an MP in Canada unveiled a new bill to encourage cryptocurrency growth within the country.

- Bitcoin hashrate presses to new all-time highs

- JPMorgan predicts $150K Bitcoin

- Canada introduces bill C-249 to encourage cryptocurrency industry growth

- Uber reveals plans to adopt crypto

- McDonald’s files trademarks for branches within the metaverse

- U.S. inflation jumps to 7.5%

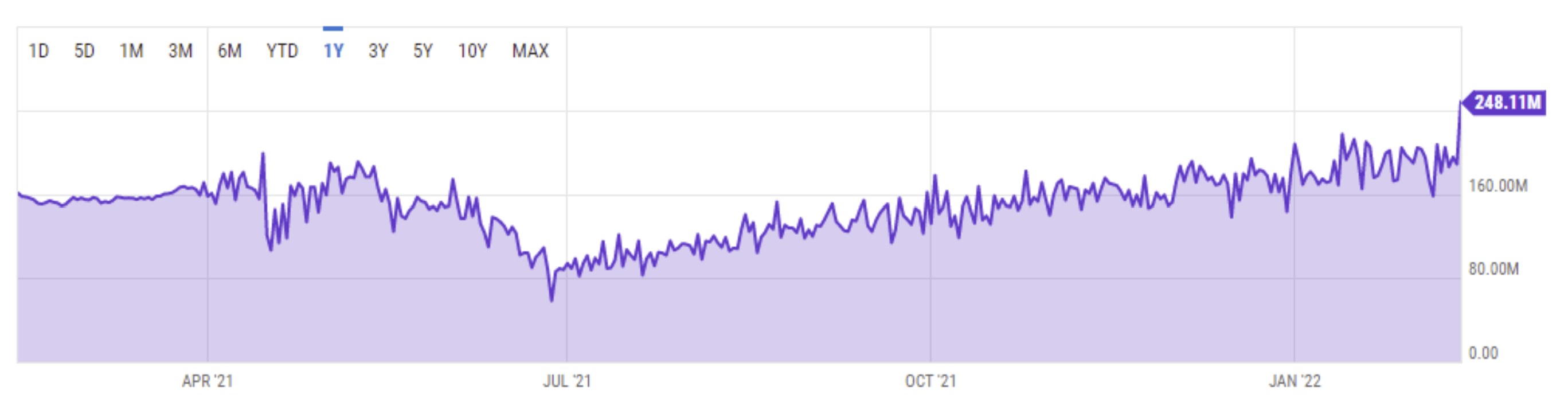

Bitcoin hash rate jumps to new all-time high

On Saturday, the hash rate for the Bitcoin network jumped 32% in 24 hours. This marked one of the biggest daily increases that the network has ever experienced and resulted in a new network high for the blockchain.

Hash rate is defined as the computing power used to support Bitcoin’s Proof-of-Work consensus mechanism. It is how new transactions are processed and added to the blockchain. The increasing number of Bitcoin miners is encouraging for the decentralization of the network as more miners mean that there are more entities sharing the security of the system. It also helps to deter bad behaviour such as trying to create fraudulent transactions.

According to YCharts, the network hash rate reached 248.11 terra hashes per second (TH/s) on Saturday. The previous high, which was posted in January, stood at 217 TH/s. The United States continues to be the largest contributor of Bitcoin mining power, providing over 35% of the total supply, a stark contrast to just last year when China hosted the most mining power.

Bitcoin network hash rate from February 2021 to February 2022. Source: YCharts

JPMorgan predicts $150K Bitcoin

The world-renowned investment bank, JPMorgan, has upped its long-term price prediction for the worlds leading cryptocurrency.

In a research note published by one of the company’s Chase & Co strategists, Nikolaos Panigirtzoglou, the bank outlined its belief that Bitcoin could reach $150,000 in the future. This is a $4,000 increase from the company’s prediction of $146,000 which was published last year.

According to Bloomberg, the company’s valuation was calculated using comparisons to the market capitalization of gold. Panigirtzoglou’s long-term target for Bitcoin would put its total market value on par with that of all gold held privately for investment purposes, increasing the prediction to $150,000, up from $146,000 a year ago.

In addition to the long-term price prediction, analysts also provided what they termed “a fair value” estimate for the coin. According to the notes, Bitcoin is four times as volatile as gold. As a result, Bitcoin’s fair value currently stands at $38,000.

Alongside the valuation, the strategist hypothesized that volatility was one of the most significant problems the leading cryptocurrency currently faces. Panigirtzoglou said, “the biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption.”

Canadian MP chases cryptocurrency growth with proposal of new bill

On Wednesday, Canadian parliament member, Michelle Rempel Garner, introduced a new bill to encourage the growth of the cryptocurrency industry within the country. The bill, known as C-249, will require members of the Canadian parliament to work with industry leaders to create a new set of cryptocurrency regulations.

Garner announced news of the bill via Twitter stating that “Canada should be attracting billions of dollars in investment in the fast-growing crypto-asset industry. Today I introduced a bill, the first of its kind in Canada, to make sure this becomes a reality.” It is Garner’s hope that all crypto regulations will be guided by those within the industry rather than the government.

In addition to the written post, Garner outlined in a brief video exactly what the bill plans to introduce. “This enactment requires the Minister of Finance to develop a national framework to encourage the growth of the crypto asset sector and, in developing the framework, to consult with persons working in the sector who are designated by provinces and territories. The enactment also provides for reporting requirements in relation to the framework.”

The new proposal has been praised by cryptocurrency-focused organizations within the country such as Hut8, the digital asset miner.

Uber suggests cryptocurrency adoption is coming in the future

The CEO of Uber Technologies, Dara Khosrowshahi, announced that the company would “absolutely” one day accept cryptocurrency payments for their services. As one of the world’s largest mobility service providers, acceptance from Uber could significantly enhance worldwide cryptocurrency adoption.

Khosrowshahi’s views were expressed during an interview with Bloomberg Markets that took place on Friday. According to the CEO, cryptocurrencies are continually being spoken about inside the company. While seeing the promise and adoption of cryptocurrencies as a store of value, Khosrowshahi pointed out that exchanging digital assets is not quite at the level required for the company to offer them as a payment method.

Khosrowshahi continued “as the exchange mechanism becomes less expensive, becomes more environmentally friendly, I think you will see us lean into crypto a little bit more.”

Uber now joins a growing list of companies exploring the use of cryptocurrencies as a payment method including Tesla, AMC Theatres, and Microsoft.

McDonald’s files trademarks for virtual reality metaverse restaurants

The fast-food giant, McDonald’s, has filed trademarks for restaurants that will be located within the metaverse. According to reports, virtual restaurants will be used to deliver food online that can then be delivered in the real world.

The patents cover both McDonald’s and McCafe branches and were submitted for a range of different services including virtual food and beverage products, operating a virtual restaurant online featuring home delivery, and online actual and virtual concerts.

According to Josh Gerban, a trademark lawyer, the idea behind the trademarks is to protect the McDonalds brand even within the virtual world. Gerban tweeted “You are hanging out in the metaverse and get hungry. You don’t have to put down your headset. You walk into a McDonald’s and place an order. It arrives at your door a little while later.”

In an interview conducted by Forbes magazine, Gerben reiterated that he expects more companies to do the same in the future. “I think you’re going to see every brand that you can think of making these filings within the next 12 months. I don’t think anyone wants to be the next Blockbuster and just completely ignore a new technology that’s coming.”

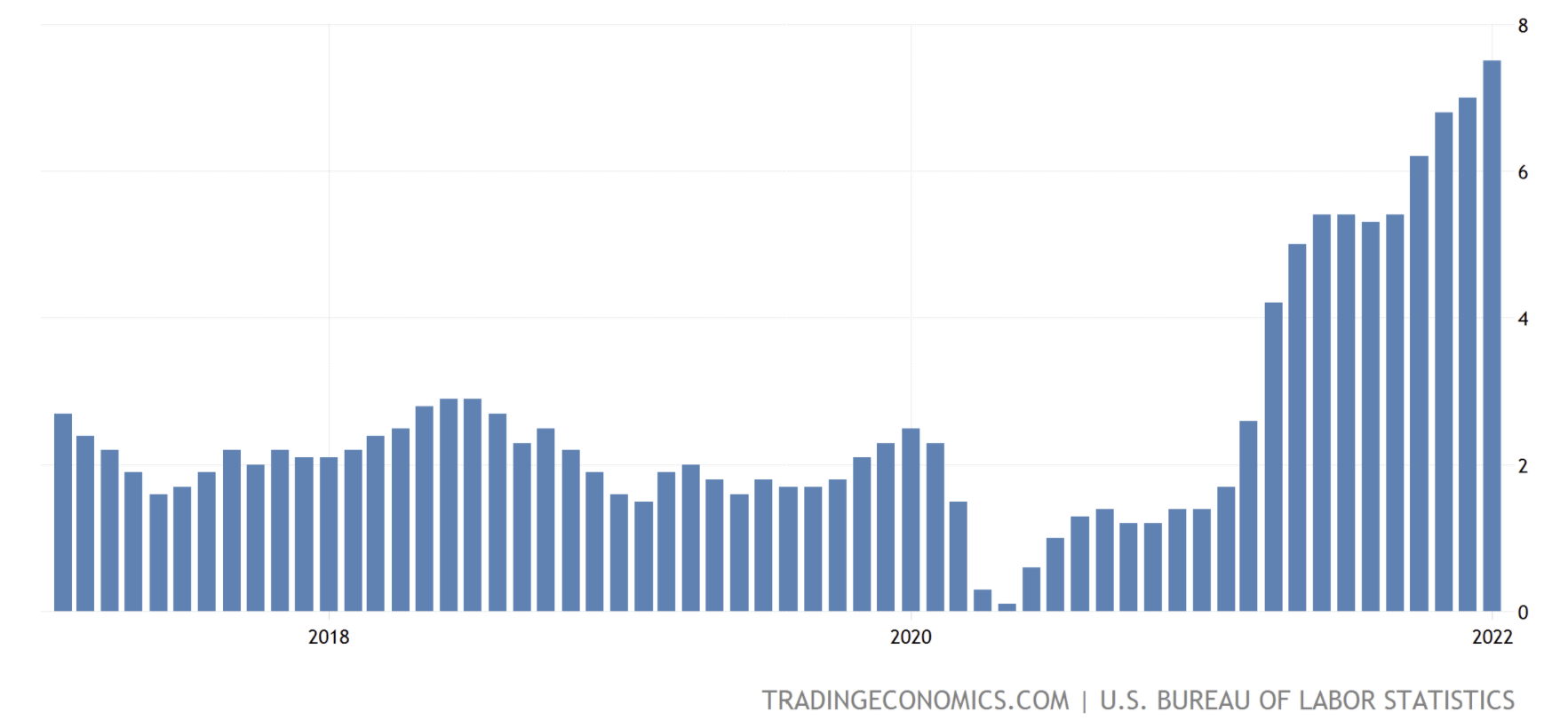

U.S. inflation figures hit 7.5% for January

New CPI figures released last week highlighted that inflation within the U.S. has continued to soar higher. The latest results created a new 40-year high. The Consumer Price Index , which indicates what consumers pay for goods and services, experienced a 0.6% increase in comparison to the 0.4% that was expected. The new results moved the year-on-year figure to 7.5%, outpacing December 2021’s posting of 7%. January’s inflation figures had been expected to be much lower.

Experts believe that the continued jump in inflation is the result of strong consumer demand and supply chain disruptions – an effect that the Federal Reserve had believed would be transitory. Before the pandemic, the average annual inflation figure had been 1.8%.

Many experts now predict that the possibility of a March interest rate hike is almost a certainty. As a result of the increased interest rate fears, many risk-off assets experienced a drop in price during the week. Although equities were shaken particularly badly, cryptocurrencies faired better.

During an interview with CNBC, Global Chief Economist of Citi Research, Nathan Sheets said “This inflation data today came like a punch in the stomach for Jay Powell and his colleagues. Their narrative is that as the year progresses, we should see inflation start to abate and come on down. And there was not even a hint of that in the January data.”

According to reports, both Goldman Sachs and Bank of America are now expecting 7 consecutive rate hikes throughout the remainder of 2022.

U.S. inflation figures from 2018 to 2022. Source: TradingEconomics.com

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.