Meme Coin Mania Pushes Ethereum Burn Rate to New Heights

After successfully navigating the Federal Reserve’s monetary policy decision last week, Bitcoin and the cryptocurrency market must now await the release of key inflation data this week; inflation data that may or may not signal the end of the Fed’s inflation-fighting campaign to tighten financial conditions.

Meanwhile, Bitcoin’s dominance rate has surged to a 22-month high, as investors search for an anti-dollar liquid play amid the ongoing banking crisis in the US, and the recent craze around meme coins has resulted in a rapid increase in the burn rate of Ether (ETH).

- Bitcoin rises after Fed decision, but inflation concerns remain

- Bitcoin’s dominance shoots to new yearly heights

- Memecoin craze triggers Ethereum burn rate surge

Bitcoin rises after Fed decision, but inflation concerns remain

Bitcoin and other digital assets were on the rise last week after the Federal Reserve’s implemented its latest monetary policy decision. However, the market is now eagerly anticipating inflation data that is set to be released this week.

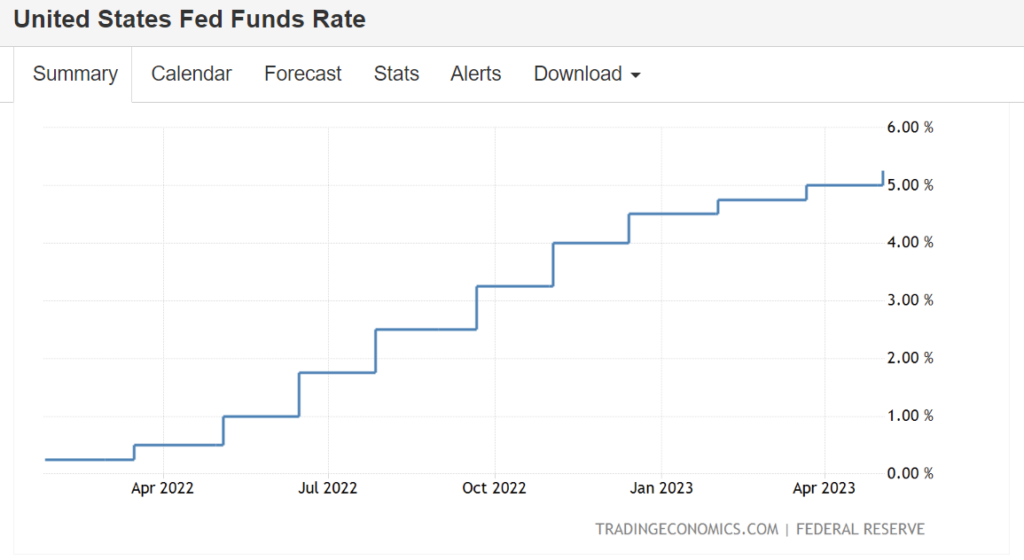

In the 3 days following the Fed’s 10th consecutive interest rate decision, the price of BTC rose, climbing over 2.5% into Friday.

Although markets have now retraced due to other macro news, Bitcoin investors seemed unphased by the 0.25% interest rate hike, which may have already been priced into the market.

The dramatic rise in interest rates over the past year has been a significant headwind for digital assets, hastening Bitcoin’s downward spiral from its all-time high near $69,000 in late 2021.

But, the Fed indicated that the latest interest rate hike could mark the end of its inflation-fighting campaign to tighten financial conditions.

Many economists predict that the Fed will become more accommodative, possibly even lowering rates this year, which has already partly fueled Bitcoin’s remarkable 70% rally during 2023.

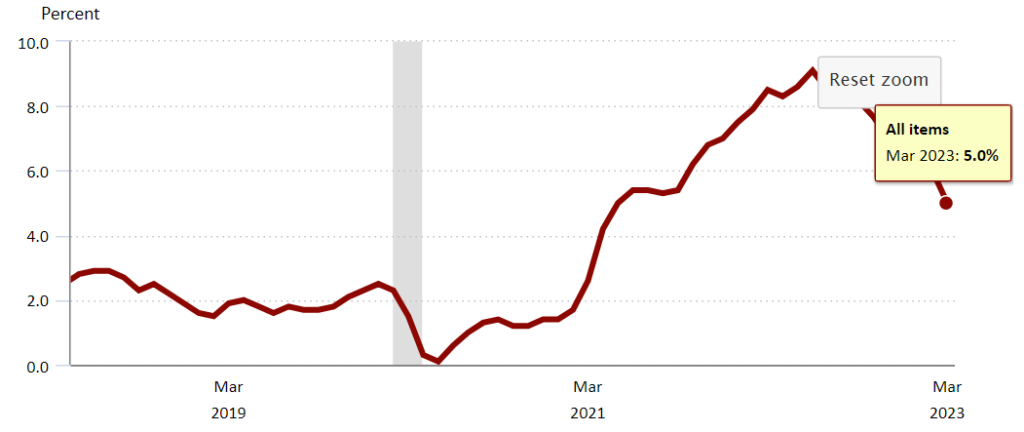

However, the crypto community is now focusing on the consumer-price index (CPI) reading for April, which is expected to be released next week on 10th May.

CPI figures, which track the cost of a basket of goods and services in the US, have been slowly falling for several months now, which indicates the Fed’s monetary tightening policies are working.

However, past performance is never an indication of what is to come, which means that all eyes will be on the US Bureau of Labor Statistics’ release on Wednesday.

Analysts are currently predicting a year-on-year figure for April of 5%, which would be the same as the year-on-year figure for March.

Investors remain hopeful that it may take a shockingly high inflation print for the Fed to execute another rate hike, which is why CPI data is under such a spotlight.

Bitcoin’s dominance rate reaches 22-Month High

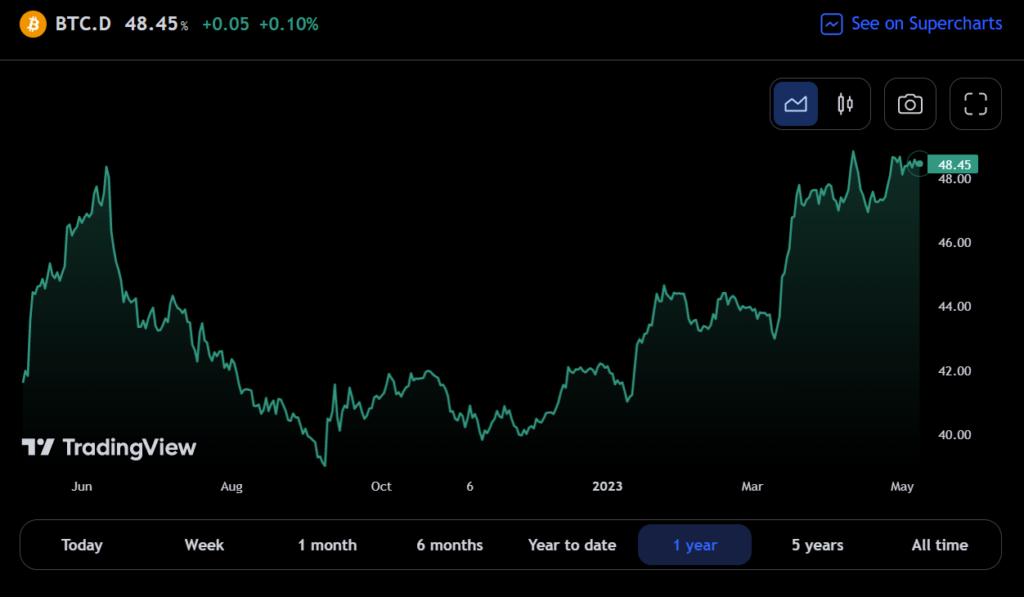

Bitcoin has surged to a 22-month high in its dominance rate amid the ongoing banking crisis in the US.

According to data tracked by the charting platform, TradingView, since early March, Bitcoin’s dominance rate has increased from 42% to 49%. The Bitcoin Dominance chart, ticker BTC.D, is used to track this and compares the market capitalization of Bitcoin against the total market capitalization of all other altcoins.

As Bitcoin’s dominance increases, it indicates more liquidity is flowing into the world’s leading cryptocurrency.

The rise in Bitcoin’s dominance has led some experts to suggest that BTC is becoming the anti-dollar liquid play for investors, particularly at a time when banking stocks are plummeting. Investors often turn to alternative assets like gold, oil, and Bitcoin during times of financial concern.

Speaking earlier in the week, Lewis Harland, portfolio manager at Decentral Park Capital, said, “You see outperformance of BTC within the crypto market when regional bank share prices collapse. This signals that BTC is the high-quality, anti-dollar liquid play for investors as the crisis unfolds further.”

Although the US Federal Reserve Chairman Jerome Powell said last week that the banking sector is “sound and resilient”, the SPDR S&P regional banking exchange-traded fund (ETF) tanked by 35% over the same time frame.

If Bitcoin’s dominance rate continues to rise and breaks the 50% mark, many believe it could signal a new market regime of prolonged BTC outperformance within the market.

Memecoin craze triggers Ethereum burn rate surge

The recent craze around meme coins has caused an explosion in activity on the Ethereum blockchain, resulting in a rapid increase in the burn rate of Ether (ETH).

According to Ultrasound.money, a website that tracks Ethereum’s post-Merge analytics, the Ethereum network has burned a whopping 130,852 ETH in the past 30 days.

This accounts for 23% of the total ETH burned since the Merge occurred 231 days ago.

Far from excitement regarding new meme coins subsiding, the fear of missing out has propelled ETH burning even further, with 45,000 ETH coins burned over the last 7 days.

As activity increases on the Ethereum blockchain, traders require higher and higher bids for block space to ensure that a transaction gets completed quickly. This drives up gas fees.

However, after the implementation of new burn mechanics through EIP-1559, a proportion of all gas fees are now burned in the process.

Out of all platforms, the Uniswap decentralized exchange was the top burner for the month, as it has been the service provider most have turned to for access to meme coins. As a result, the DEX has burned approximately 32,800 ETH through transactions in the last 30 days.

Despite the higher gas fees, Ethereum continues to dominate the DeFi space, with a 24-hour volume of $1.12 billion. It also continues to be the preferred network for new meme coins like PEPE, WOJAK, and TURBO. These new coins have surpassed over $3 billion in cumulative trading volume and are still continuing to climb.

If the current meme coin trend continues to boost gas fees, ETH fee burns are expected to keep climbing, which could take even more ETH out of circulation.

![[filename]](https://xcoins.com/wp-content/uploads/2023/05/image-17-1024x330.png)

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.