Your Guide to Investing in Crypto for Long-Term Gain

Are you interested in investing in crypto but not sure it’s the right time? Data shows that Bitcoin was the best performing asset class of the last 10 years. Considering that several large companies and investment firms have added Bitcoin to their investment portfolios, a long term crypto investment could well be worth it.

The cryptocurrency industry is one of the fastest-growing in the world, going from around $500 billion to almost $3 trillion in the last year alone. Today, serious investors cannot ignore the crypto and blockchain markets, given that they offer an opportunity to take a part in an industry with a great risk-reward ratio. The two biggest cryptocurrencies, Bitcoin and Ethereum, reached all-time highs in 2021, which led to further interest from retail, institutional investors, and even governments.

History of crypto investments

The first real-world crypto transaction was in 2010, in Jacksonville, Florida, when a person bought two pizzas for 10,000 Bitcoin. This probably wouldn’t be that much a story if the price of Bitcoin had remained roughly the same (one Bitcoin was worth around $0.0008 at the time). Instead, those two pizzas would today cost the equivalent $500 million, which is the perfect illustration of just how dramatically the value of Bitcoin has grown in a decade.

In recent years, interest in cryptocurrency has soared in both the private and public sectors. El Salvador recently became the first country to accept Bitcoin as legal tender. Big media companies like Discord, Twitter, Facebook, and Telegram have started developing their own coins and integrations with blockchain technology. Many large institutional investors have joined the industry as well. Tesla, Galaxy Digital Holdings, Square, Marathon Digital Holdings, and MicroStrategy, for example, own more than 180,000 Bitcoin combined.

RELATED: The Four Phases of the Bitcoin Market Cycle

Investing in crypto

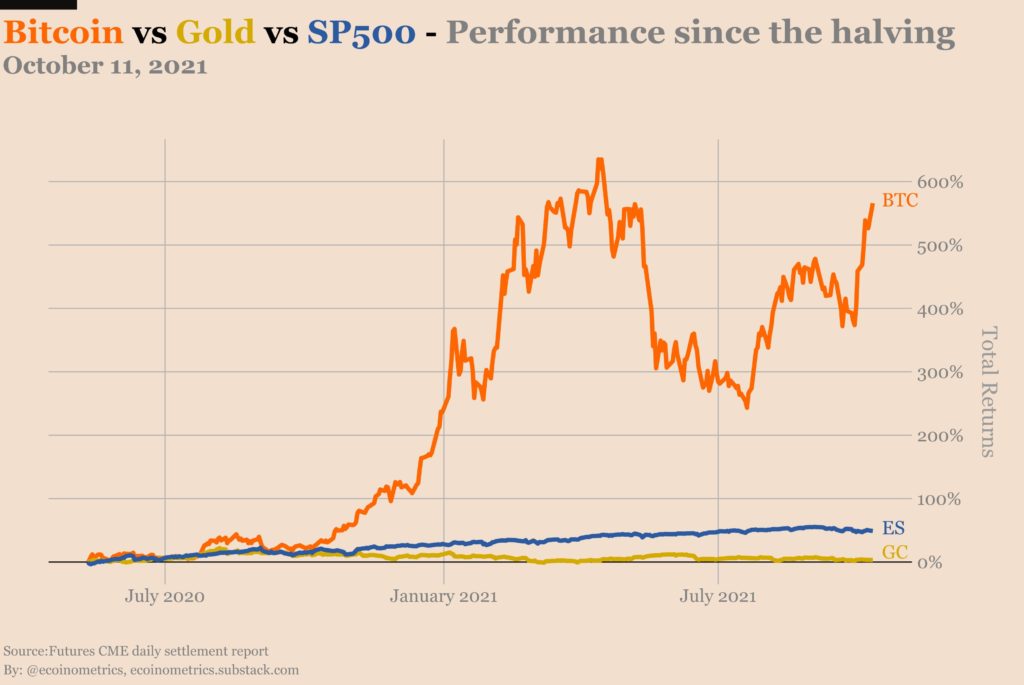

Many of those who want to invest in crypto markets may wonder if they’ve missed the crypto boat. But blockchain and cryptocurrencies are still a new and evolving market, with great potential returns. Even though crypto markets are highly volatile, with decreases or increases in price of around 20% in a single day, when we look at the last decade the performance of this asset class outperforms all others.

BTC/USD vs. gold. vs S&P 500 chart. Source: Ecoinometrics/Twitter

Over a 10 year period, Bitcoin has shown outstanding growth. If you invested $1,000 in Bitcoin in 2015, you would now have around $200,000. Some smaller currencies gave even larger returns in a far shorter period. For example, Dogecoin grew by 27,000% in the six months between November 2020 and May 2021. These kinds of returns over a limited timeframe do, though, mean bigger risk.

You should now have a greater understanding of the potential for growth in the crypto market, particularly when it gains even further worldwide adoption and there’s more clarity on regulation. Many people see Bitcoin as a store of value and believe that crypto markets will eventually replace gold and fiat currencies.

So, what are some things you should be aware of and what should you be considering when building a long term crypto investment portfolio?

Understand the market

The cryptocurrency market has more than 15,000 currencies on around 500 different exchanges. The first thing you’ll need to be clear about, as with any other asset class, is what exactly you’re investing in. As a first step, it’s important to try to understand the technology behind crypto and the problems they’re trying to solve, then you can begin to formulate a crypto investment plan for yourself.

Achieving long-term gains means investing in cryptocurrencies that have demonstrated they can stand the test of time. Holding your cryptocurrency long-term requires holding your nerve through the inevitable ups and downs of the market. Remember, you’re playing the long game.

Focus on the future

When people look into crypto markets, they often feel like the good times are over and it won’t be possible to get the same returns as seen in the past, but then this has been a concern of investors since the early days of crypto. Just recently, however, the DeFi and NFT booms have begun to take off, and now we’re in a huge expansion of blockchain gaming and the metaverse.

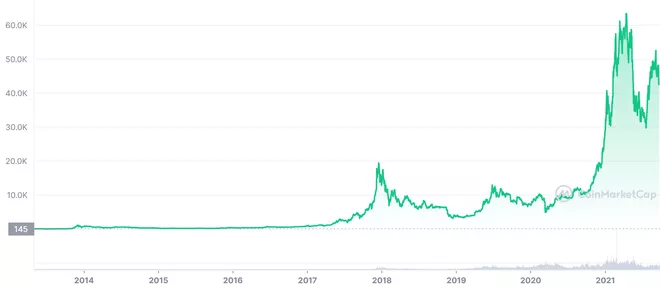

With crypto being an emerging industry, there’s still plenty of time to see the growth of different sectors. It’s worth remembering that, at around $2 trillion, the whole market cap remains small in comparison to gold and stocks, which sit around $11.511 trillion and $93.797 trillion respectively. When looking at crypto markets from a long-term growth perspective, it’s easier to understand where markets may be heading, and why HODLing has been shown to be so effective.

Bitcoin’s growth over time. Source: Investopedia

Count on volatility

Even though the volatility is going down as the total market size grows and blockchain gains adoption, there are still price movements of around 20% in a single day. We can see a noticeable change in price in a matter of seconds, often right after somebody influential has tweeted something or some major news has been released.

If you’re new to the crypto world, you need to be aware that this is a game of big players who are trying to shake out the weak hands and liquidate people who are not experienced or knowledgeable traders.

In these market conditions, big companies are buying low and selling high. Smaller players can misjudge what the right action is, and often purchase Bitcoin or other cryptocurrencies at its top and sell when the price goes down because they’re scared of experiencing losses.

Looking at the long term, whether you buy Bitcoin at $40,000 or $50,000 is probably irrelevant. According to the widely respected PlanB stock-to-flow model, the expectations are that the Bitcoin price will one day go above $1 million.

RELATED: 5 Mistakes to Avoid When Investing in Crypto

Security

In 2021, there was around $7.7 billion stolen in the cryptocurrency markets. Rug pulls accounted for $2.8 billion, which shows that there were more scams than ever before. Unfortunately, teething problems are to be expected when entirely new markets are being created. The best way to protect yourself and your crypto investment from rug pulls is to buy trusted coins from a trusted platform.

All investors in the cryptocurrency markets should be aware there are numerous scams in the industry, whether it’s the fake user on a telegram group, a hack of a wallet like MetaMask, or somebody hacking an exchange.

Whatever you’re doing in the crypto space, you should always think about the security aspect, because if you lose the crypto or access to it your cryptocurrency investment becomes zero.

When buying crypto from a centralised exchange, they will, in most cases, initially have custody of your coins, so make sure you use a safe and reputable one. If you’re a custodian of your own tokens, see to it that you research all the security measures and safely store your private key. Buying a hardware wallet from a trusted brand like trezor or ledger is a great security precaution as well.

Research, research, research

There are many things to take into consideration when building a long-term crypto portfolio. The earlier you invest, the more time and opportunities there will be in front of you, and the longer you hold, the better your potential returns. Blockchain is disrupting many industries, and even though we still don’t know which projects will succeed in the long term or have real-world applications, the opportunities in this burgeoning industry are numerous.

As always, this article does not constitute financial advice and you should be sure to do your own research and consult a professional financial advisor before making any investment decision.

Sign up to Xcoins today and start buying and selling leading cryptocurrencies instantly and securely.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.