Ethereum is Up 20% TODAY and Here’s Why!

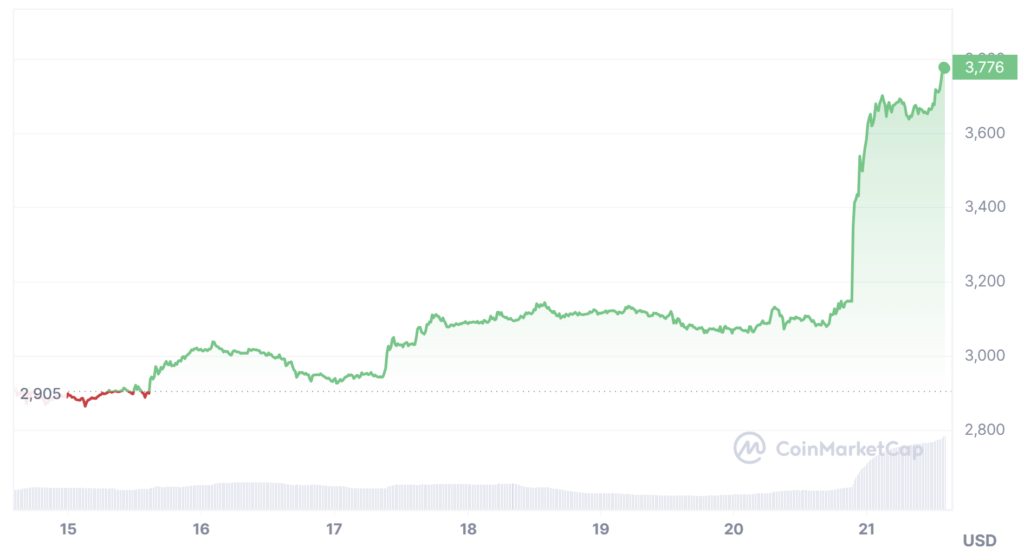

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a significant surge in value over the past 24 hours with no signs of stopping.

This article delves into the reasons behind Ethereum’s impressive 20% rise and explores the potential future trajectory of this popular digital asset.

We will also discuss the broader implications for the cryptocurrency market and provide insights into whether this is a good time to invest in Ethereum.

Why is Ethereum Surging?

Ethereum ETF Approval Speculations

One of the primary drivers behind Ethereum’s surge today is the growing speculation around the approval of an Ethereum Spot Exchange-Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

Previously, key analysts were skeptical about the approval due to regulatory uncertainties regarding Ethereum’s classification as a commodity or security. However, recent updates have significantly improved the odds of approval, now estimated at 75%, up from the previous 25% prediction by key Bloomberg analysts.

The prominent bloomberg analysts, Eric Balchunas and James Seyffart, have publicly announced this increased probability based on insider chatter and the SEC’s advisory to exchanges to update their filings for the Spot ETH ETFs.

This shift in sentiment has injected a wave of optimism into the market, fueling Ethereum’s price rally.

Bullish Market Conditions

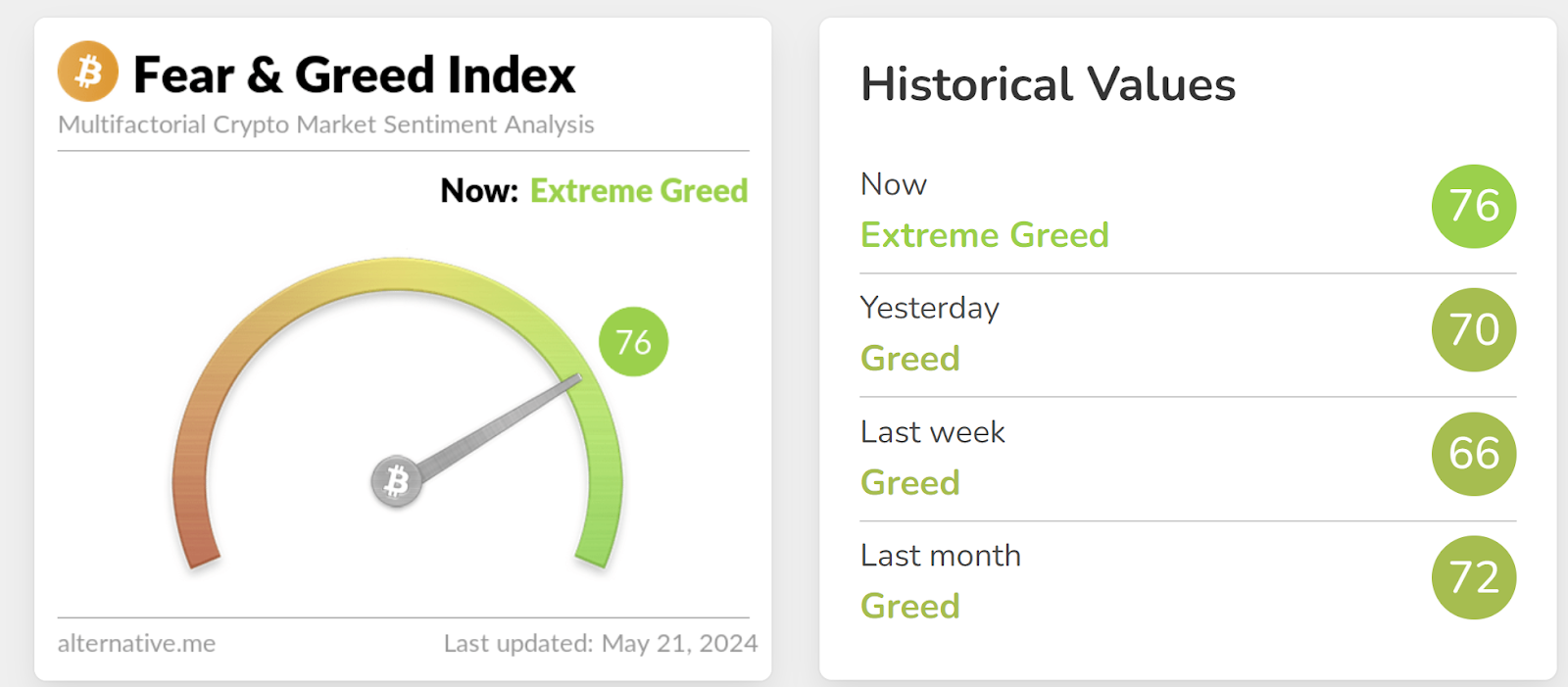

The cryptocurrency market has also recently shifted from a neutral to a bullish sentiment, with a notable improvement in the fear and greed index. The index, which gauges market sentiment, currently stands at 76/100, indicating a strong bullish sentiment.

This shift has contributed to the overall market recovery, pushing the total crypto market capitalization to $2.4 trillion and increasing 24/hr trading volume to $81 billion.

How High Can Ethereum Go?

Short-Term Ethereum Price Predictions

The bullish momentum in Ethereum’s price suggests that it could easily reach the $4,000 mark within 48 hours.

Crypto analyst Oliver Isaac highlighted that Ethereum’s current price movements are today forming the largest daily candle seen in five years, a supremely bullish indicator.

![[filename]](https://xcoins.com/wp-content/uploads/2024/05/image-4.png)

Long-Term Projections

If the Ethereum Spot ETF receives approval, it could lead to even more substantial gains. The approval would likely act as a major catalyst, driving institutional investment into Ethereum and pushing its price higher.

Some analysts predict that Ethereum could reach as high as $10,000 in the longer term following ETH ETF approval. This bullish signal would likely additionally lead to a major price surge across the entire crypto industry!

Why This is a Great Opportunity to Buy Ethereum

Increased Institutional Interest

The potential approval of the Ethereum Spot ETF is a clear signal of growing institutional interest in Ethereum.

Institutional investments tend to bring more stability and confidence to the market, which can lead to sustained price increases.

For individual investors, this represents a unique opportunity to buy Ethereum instantly before it sees further institutional-driven gains.

Favorable Market Sentiments

The current bullish market conditions create a favorable environment for buying Ethereum. With the overall market sentiment improving and more positive news emerging, now might be an excellent time to invest.

The fear and greed index is a useful tool to gauge market sentiment, and its current level suggests that investors are confident and optimistic about the future of cryptocurrencies, particularly Ethereum.

Diversification Benefits

Investing in Ethereum can also provide diversification benefits to your crypto portfolio. While Bitcoin remains the dominant player in the market, Ethereum offers unique value propositions, such as its smart contract functionality and widespread adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

By holding both Bitcoin and Ethereum, investors can mitigate risks and potentially increase their returns.

When to Buy Bitcoin and Will Bitcoin Keep Going Up?

Timing Your Investments

While this article focuses on Ethereum, it’s essential to consider the broader cryptocurrency market, including Bitcoin. Timing your investments is crucial.

Historically, periods of significant price increases are often followed by corrections. Therefore, it’s wise to monitor market trends and consider buying during dips to maximize potential returns.

Bitcoin’s Future Prospects

Bitcoin’s price movements often influence the entire cryptocurrency market, including Ethereum. As Bitcoin once again approaches its all-time high (ATH) target of $73,750, it could lift the prices of altcoins like Ethereum.

Analysts remain optimistic about Bitcoin’s long-term prospects, citing factors such as increasing adoption, limited supply, and the potential for future ETH ETF approvals to help drive Bitcoin higher.

Seize the Opportunity

Ethereum’s current price surge is a result of favorable market conditions and growing optimism around the potential approval of an imminent Ethereum Spot ETF.

This presents a significant opportunity for investors to capitalize on the current bullish momentum. With institutional interest on the rise and the broader market showing signs of recovery, now might be an ideal time to consider adding Ethereum to your investment portfolio.

In addition to Ethereum, keep an eye on Bitcoin and other major cryptocurrencies. Diversifying your investments can help you navigate the volatile crypto market and maximize your potential gains. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.

By staying informed and strategically investing, you can take advantage of the exciting opportunities in the cryptocurrency market.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, TikTok, and LinkedIn.