ETH Staking Yields Rocket to All-Time High

Staking ether is resulting in impressive yearly yields of up to 25.5% as activity on the Ethereum network increased in recent days.

Not a bad ROI in a bear market where stock market returns are turning negative and centralized platforms like Gemini and Circle saw yields drop to 0% due to the FTX fallout.

Much like the Terra LUNA contagion in July, the recent FTX bankruptcy has again put decentralized finance (DeFi) in the limelight.

Users staking their ETH tokens at liquid staking service Lido may now earn up to 10.7% – an all-time high reached in recent days. That number has since fallen to 6.4% on the leading liquid staking platform Lido.

Lido lets users stake their ETH tokens and, in return, gives them an equivalent quantity of stETH (staked ETH) which is pegged to the value of the actual ETH token and can also be further used in DeFi applications.

Increase your liquid staking returns

Yields of stETH have jumped to an ATH since the Merge, via Blockworks.

Eth stakers with a keen appetite for risk can further stake their stETH in DeFi platforms and receive a higher yield still.

Index Coop’s Interest Compounding Ether (icETH) saw interest rates reach up to 25.5% in recent days, however, this number has since fallen to 9.72% as on-chain activity pulled back.

How it works

The Interest Compounding ETH Index (icETH) uses a leveraged staking approach to boost staking rewards. The technique uses stETH tokens (received by staking ETH on Lido) as collateral on DeFi lending service Aave to borrow wrapped ether (WETH) – a token that tracks ether – and then purchase additional stETH tokens recursively.

How icETH works illustration via Dune.

Since icETH leverages the value of stETH, which is dependent on activity on Ethereum, it saw a compounding effect on its APY due to increased activity on Ethereum in the past week. However, these high yields also come with risks.

“icETH is subject to similar systemic and idiosyncratic risks as the rest of DeFi—like currency risk, smart contract risk, oracle risk—but liquidation risk and interest rate risk are especially important for token holders to understand,” according to Indexcoop.

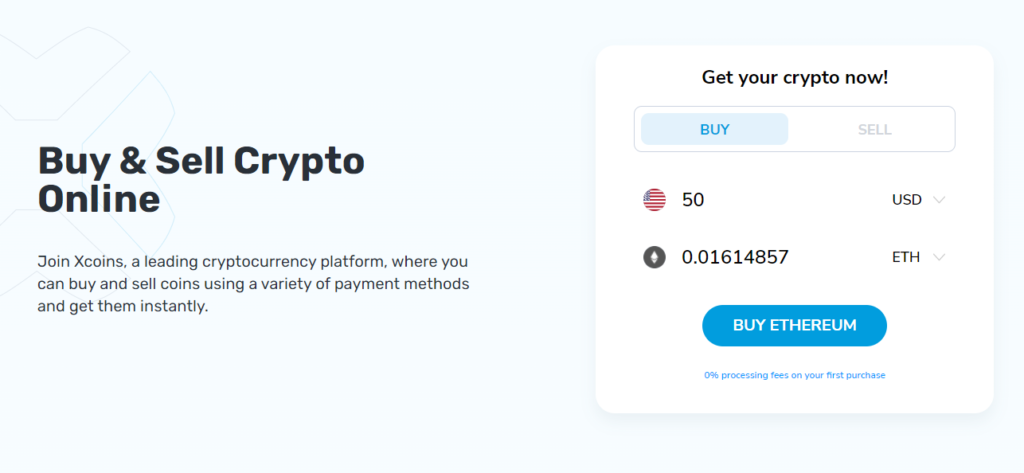

How do you buy Ethereum?

One of the easiest ways to buy and sell Ethereum is through a cryptocurrency exchange like xcoins.com. You can buy Ethereum with credit card or debit card, or a range of payment methods, securely and in a matter of minutes. Just follow these steps:

Step One: If you don’t have an xcoins.com account yet, it’s quick and easy to sign up.

Step Two: Once you’ve completed the verification process and your account is up and running, click “Buy Ethereum” or “Sell Ethereum”.

Step Three: Choose the amount of Ethereum you want to buy/sell and the currency you’d like to buy it in/sell it for, then select the payment method.

Step Four: Once payment has been approved, we’ll send your Ether to your own personal wallet or, for sales, the cash to your debit/credit card or bank account.

As always, this article does not constitute financial advice, and you should be sure to do your research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.