Could Bitcoin Hit $250K in 2022?

As Bitcoin battled with the crucial level of support at $30K, Bitcoin bull, Tim Draper confirms that he still believes that a price target of $250K is possible within 2022, however, it may not be for the reasons many are expecting.

Ethereum mining activity recorded a new all-time high last week and gas fees continued to drop on the network to fresh 10-month lows.

Elsewhere, one of Dubai’s leading property developers confirmed that over $50M worth of deals had been completed using cryptocurrencies, and leading finance execs warned that consumers should brace for economic turbulence.

- Tim Draper doubles down on $250k Bitcoin price prediction

- Ethereum hashrate hits new all-time high as gas fees hit a 10-month low

- Dubai real estate developer completes $50M worth of deals using cryptocurrencies

- Finance execs tell the world to prepare for an economic “hurricane”

Tim Draper doubles down on $250K Bitcoin prediction

The American Venture Capitalist, Tim Draper, who has previously correctly predicted the price movements of Bitcoin, confirmed in an interview last week that he still believes Bitcoin can reach $250K by the end of 2022.

Draper is well known within the cryptocurrency community and through his numerous organizations, which include Draper Venture Network, and Draper Associates, has invested in multiple crypto-focused companies.

The VCs initial entry into the cryptocurrency industry occurred during a 2014 U.S. Marshals Service auction where Draper acquired thousands of Bitcoins. He then predicted that Bitcoin would reach $10K which later came true in 2017. In 2018, Draper subsequently predicted that the price per Bitcoin would reach $250K by 2022, and this is a prediction the VC has stood by ever since.

During an interview that took place last week, Draper once again confirmed his unwavering belief in a $250K Bitcoin prediction, however, his reasons for the prediction were not what some in the industry were anticipating. Draper justified the high price target due to the future influx of women into the industry.

“One thing that will possibly likely happen — and I don’t know exactly when — is that the women will start using bitcoin.” After explaining that only 1 in 6 Bitcoin holders were currently women Draper continued, “Women control about 80% of retail spending and retailers haven’t yet realized that they can save 2%. They can save 2% just by accepting bitcoin instead of taking a bank-issued credit card. And that can change everything.”

With this new influx, Draper believes that the Bitcoin price could likely soar straight through his predicted $250K level.

Ethereum hashrate continues to break records as fees fall to a 10-month low

Although Ethereum’s hashrate spiked in May to form a new all-time high, the blockchain has once again eclipsed previous records reaching a new hashrate peak of 132 PH/s. Even with The Merge on the horizon, mining activity is continuing to increase.

After reaching a peak of 127 PH/s in Mid-May, which occurred in parallel to the Terra Luna fallout, Ethereum’s hashrate remained consistently high. However, on Saturday, June 4th, Ethereum’s hashrate spiked once again to reach a new all-time high level of 132 PH/s – a 3.93% increase from May levels. The ethermine.org mining pool continues to be the largest contributor to hashrate, accounting for approx. 23% of the total supply.

The new all-time high figures come only months before the Ethereum blockchain is expected to transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This transition, known as The Merge, will remove the need for miners within the network. In May Ethereum developers at the Permissionless conference estimated that The Merge could take place as early as August. All mining pools that compose the majority of Ethereum’s hashrate will need to focus their computing power on other PoW blockchains, such as Bitcoin.

At the same time as recording a new hashrate high, Ethereum gas fees fell to a 10-month low. Gas prices fell to $2.90 during the week, which is the lowest fees have been since July 2021. Fees on the network have been consistently falling since February 2022, which many believe is due to the lower transactional activity associated with the current market slump.

Dubai real estate developer completes $50M worth of deals using cryptocurrencies

DAMAC properties, one of the United Arab Emirates’ largest property developers confirmed that the company had concluded up to $50 million worth of deals using cryptocurrencies since the start of 2022. It is the first real estate developer to begin accepting crypto within the country.

In an interview, the Chief Operating Officer of DAMAC, Ali Sajwani, explained that the company was able to readily accept cryptocurrencies thanks to using trusted middlemen.

“The payment process is made through a trusted financial intermediary approved by the Abu Dhabi Global Market, the ‘Heaven’ company, where the customer pays the value of the property in bitcoin or ethereum, as they are among the most traded digital currencies in terms of safety and trust, and then the financial intermediary transfers the amount to our digital wallet in dirhams or dollars.”

The system in place allows the company to avoid as much market volatility as possible.

The COO went on to explain that although they were seeing promise, convincing everyone to use cryptocurrencies was not easy. Sajwani explained that it was difficult “convincing the old generation of decision-makers to take quick and proactive steps to invest in this new and unfamiliar world.”

The news comes weeks after the company announced plans to accept cryptocurrencies, including Bitcoin and Ethereum, for property purchases.

Finance execs tell the world to prepare for an economic “hurricane”

As global markets continue to feel the effects of rising interest rates, Executives from the world of finance continued to voice concerns last week that a recession is highly likely.

At the start of the week, ‘Big Short’ Investor and Hedge Fund Manager, Michael Burry, tweeted his concerns about a looming consumer recession and earnings trouble, which he believes will be caused by a severe reduction in US personal savings and a steep climb in consumer credit.

Burry explained that “US Personal Savings fell to 2013 levels, the savings rate to 2008 levels – while revolving credit card debt grew at a record-setting pace back to the pre-Covid peak despite all those trillions of cash dropped in their laps. Looming: a consumer recession and more earnings trouble.”

Robert Kiyosaki, the author of Rich Dad Poor Dad, subsequently echoed Burry’s comments. Kiyosaki explained via tweet that the reduction in oil production was to blame for the ongoing inflation. Alongside stock and bond market crashes, Kiyosaki believes that depression and civil unrest could be on the horizon. Kiyosaki has long been an advocate for the purchase of gold, silver, and bitcoin to combat the effects of inflation.

To round out the week, Soros Fund’s CEO, Dawn Fitzpatrick, and JPMorgan’s CEO, Jamie Dimon also shared their opinions on the state of the US economy.

In an interview with Bloomberg on Tuesday, Fitzpatrick said, “there’s a lot of discussion about a looming recession and the bottom line is a recession is inevitable. It’s a matter of when.” She continued, “I don’t think we’ll avoid a recession, I just think it will be further out than people expect.”

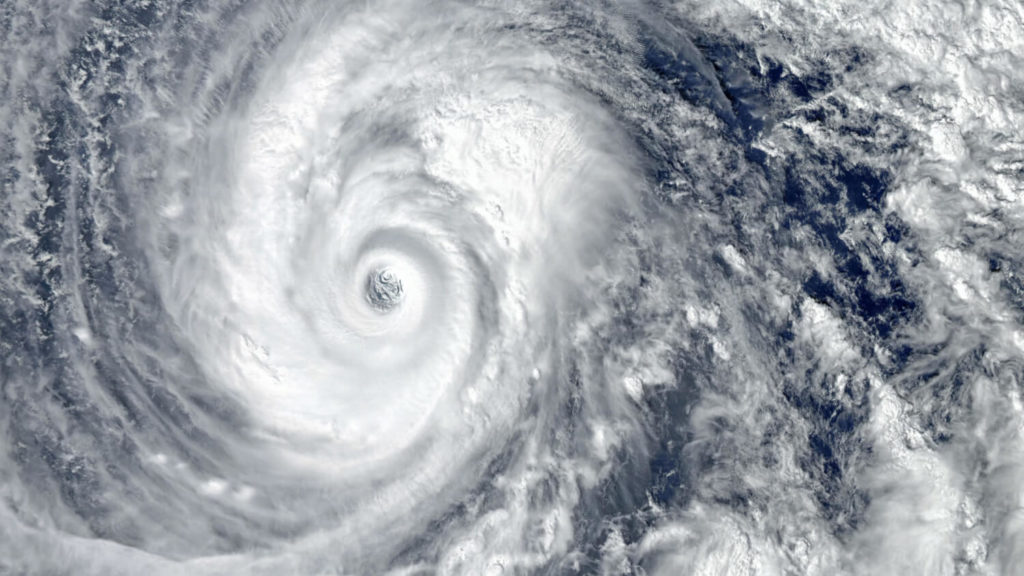

Meanwhile, Dimon compared the incoming economic problems to a “hurricane.” “That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy … You better brace yourself.” In particular, the CEO said that he was concerned about the reversal of the Fed’s bond purchasing program, quantitative tightening, and increasing oil prices.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.