Bitcoin’s Dominance Closes At 2-Year Highs

Regulatory scrutiny rocked the crypto industry during a volatile week as the SEC targeted leading players with legal action.

Although many altcoins showed resilience and stability throughout the week, Saturday brought a sharp decline leaving investors speculating about the cause.

However, amidst the chaos, Bitcoin’s dominance in the market surged to nearly 50%, highlighting its reputation as a secure investment option during uncertain times.

Meanwhile, Vitalik Buterin unveiled a new roadmap for Ethereum that should help to cement the blockchain’s position within the world.

- Crypto market recoils as SEC charges are evaluated

- Bitcoin dominance closes at 2-year high

- Ethereum’s roadmap is revealed by Vitalik Buterin

Crypto market recoils as SEC charges are evaluated

In a turbulent week for the crypto industry, the United States Securities and Exchange Commission (SEC) has escalated its regulatory efforts by taking legal action against major players.

Binance, the world’s largest cryptocurrency exchange, is facing a barrage of charges from the SEC for allegedly violating US securities laws. In the court filings, the regulatory body specifically mentions 13 crypto tokens, including those offered by Binance, that the government body believes to be securities.

Meanwhile, Coinbase, another prominent crypto platform, is grappling with a separate lawsuit that was filed by the SEC 24 hours after Binance.

The allegations against Coinbase include operating as an unregistered national securities exchange, broker, and clearing agency, as well as selling unregistered securities through its staking-as-a-service program.

Although crypto markets briefly dived as charges were announced on Monday and Tuesday, the majority of cryptocurrencies remained stable throughout the week, with Bitcoin, Ethereum, and XRP leading the way.

However, on Saturday, in a sudden and unexpected move, major tokens in the crypto market plummeted by up to 20%.

Solana (SOL), Polygon (MATIC), and Cardano (ADA) were hit particularly hard, experiencing drops of up to 25% in just a few hours.

Speculation among crypto enthusiasts on Twitter suggested that a significant crypto fund may have sold off its holdings on Friday, leading to these dramatic price movements. However, these claims remain unsubstantiated.

While investors continue to speculate on the real cause of the weekend crash, contributing factors may include Robinhood’s decision to delist specific cryptos in response to the SEC’s charges and Crypto.com’s decision to suspend its institutional investment services in the US.

Despite these challenges over the weekend, Bitcoin showed increased resilience, closing the week out with a moderate increase of 0.39% on Sunday.

According to reports, Bitcoin’s relative stability is thanks to minimal selling interest as investors monitor upcoming factors such as interest rates, stablecoin outflows, and regulatory developments in the United States, China, and Europe.

While Bitcoin continues to hold support at $25K, this week, market participants will be watching the upcoming Federal Open Market Committee (FOMC) meeting where the Fed will make its next interest rate decision.

As the crypto industry faces increased scrutiny and regulatory challenges, it remains to be seen how these developments will shape the future of digital assets.

Bitcoin dominance closes at 2-year high

Bitcoin’s dominance in the cryptocurrency market surged to nearly 50% on Saturday, reclaiming its role as the undisputed leader.

As altcoins like SOL, MATIC, DOGE, and ADA faced substantial losses, BTC only experienced a modest 3% decline, showcasing its resilience and appeal as a safe haven asset during times of turbulence.

Investors seeking stability amidst the altcoin sell-off turned to bitcoin, the world’s largest and most liquid cryptocurrency.

The flight to safety propelled bitcoin’s dominance rate, which has been steadily rising since November and accelerated during the March US banking crisis.

However, over the weekend, BTC.D broke convincingly outside of a 2-year trading range to record a brand new 2023 high.

Analysts anticipate that this upward trajectory could indicate continued outperformance by bitcoin in the months ahead.

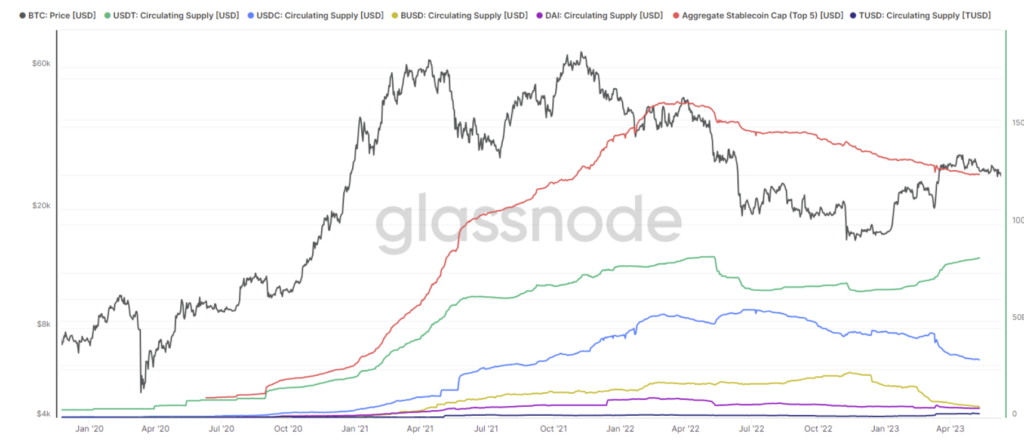

In a parallel trend, Tether, the leading dollar-pegged stablecoin, also enjoyed a boost in dominance as investors turned to it for shelter.

Data released by Glassnode revealed that USDT’s dominance rate surged to 7.82%, reaching the highest level since January 2023, which underscores the market’s inclination towards stability and risk aversion during uncertain times.

The latest data suggests that while altcoins offer unique opportunities, bitcoin’s reputation as a safe bet in turbulent times remains unrivaled.

Ethereum’s roadmap is revealed: scaling, security, and privacy are targeted

Renowned Ethereum co-founder Vitalik Buterin has unveiled an ambitious new roadmap for Ethereum’s future.

In his recent blog post titled “The Three Transitions,” Buterin speaks to the importance of addressing key issues such as scalability, wallet security, and privacy, and believes that tackling these aspects simultaneously is vital to prevent the potential failure of the world’s second-largest blockchain.

According to Buterin, layer 2 scaling stands as a crucial aspect of Ethereum’s success.

Buterin warns that failure in this area would result in products targeting mass adoption circumventing the chain and resorting to centralized alternatives.

Notably, Ethereum has experienced significant growth with the emergence of various layer-2 networks, including Polygon and Matter Labs’ ZK rollups.

The forthcoming Dencun upgrade, set for later this year, will also introduce proto-danksharding, which aims to enhance the affordability of layer 2 technology.

After layer 2 scaling, Buterin then discusses the second component of Ethereum’s roadmap which is wallet security.

He argues that migrating user wallets to smart contract wallets is necessary to instill confidence in users when storing their cryptocurrency payments and data on-chain. Without such measures, users might gravitate towards centralized entities, undermining the decentralized nature of Ethereum.

Privacy then emerges as the final critical component in Ethereum’s roadmap.

He underscores its significance, as Ethereum’s failure to prioritize privacy could expose users’ on-chain activities to the public.

Buterin’s new roadmap was warmly welcomed by members of the cryptocurrency community and by focusing on scaling, security, and privacy, Ethereum could continue to cement its position as a leading blockchain platform.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.