Bitcoin Price Takes Aim at ATH on ETF Hopes

Bitcoin ETF support from the SEC sent bitcoin prices soaring through the final level of resistance last week and up to a six-month high. All focus is now on whether the leading cryptocurrency can move into new uncharted territory. Elsewhere, Bitcoin security was boosted as the latest bitcoin mining report was published by Cambridge researchers. Interest in the NFT sector was also heightened as global payment giant, Visa, launched one of the first digital artwork initiatives led by a traditional financial institution.

- Bitcoin prices back within the ATH range

- US, Kazakhstan, and Russia now dominate the bitcoin mining race

- Visa launches first NFT program

- Tether and Bitfinex charged $42.5 million by CTFC

Bitcoin prices are now 5% away from ATH

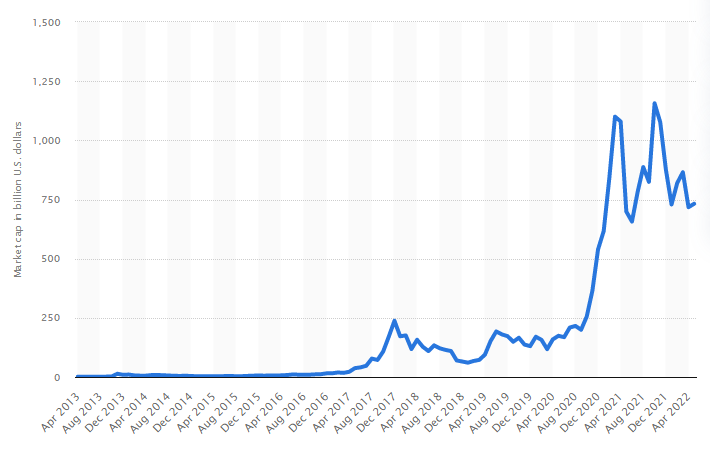

The price of the leading cryptocurrency dominated headlines last week as the coin recaptured a $1 trillion market cap. After struggling to climb above the psychological level of $60,000, prices soared through the level on Friday, boosted by ETF news.

The prominent surge higher came after the US Security and Exchange Commission (SEC) tweeted encouraging comments regarding bitcoin futures ETFs. As mentioned during last week’s crypto round-up, a bitcoin futures ETF is currently the most likely bitcoin derivatives product to be launched. The launch of a US ETF product could result in a flood of new investment into bitcoin.

The tweet from the SEC was posted on Thursday and reads: “Before investing in a fund that holds bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.” The remarks have led many to believe that a bitcoin futures ETF is almost a done deal – with added levels of investment only weeks, or perhaps days, away.

After the tweet from the SEC had surfaced, Valkyrie, the financial firm that completed an ETF filing in August, updated their bitcoin futures prospectus. The Nasdaq exchange also approved the listing of the fund on the same day. Bloomberg ETF analysts were quick to comment stating that this only occurs when a product is ready to progress to launch. Several other fund managers also applied to launch ETFs in August, including VanEck Bitcoin Trust, ProShares, Invesco, and Galaxy Digital Funds.

Bitcoin prices climbed 7% on the back of Friday’s news, pushing the leading cryptocurrency back to within a hair’s breadth of previous all-time highs. The coin has not been above $60,000 since April this year.

US takes lead in bitcoin mining

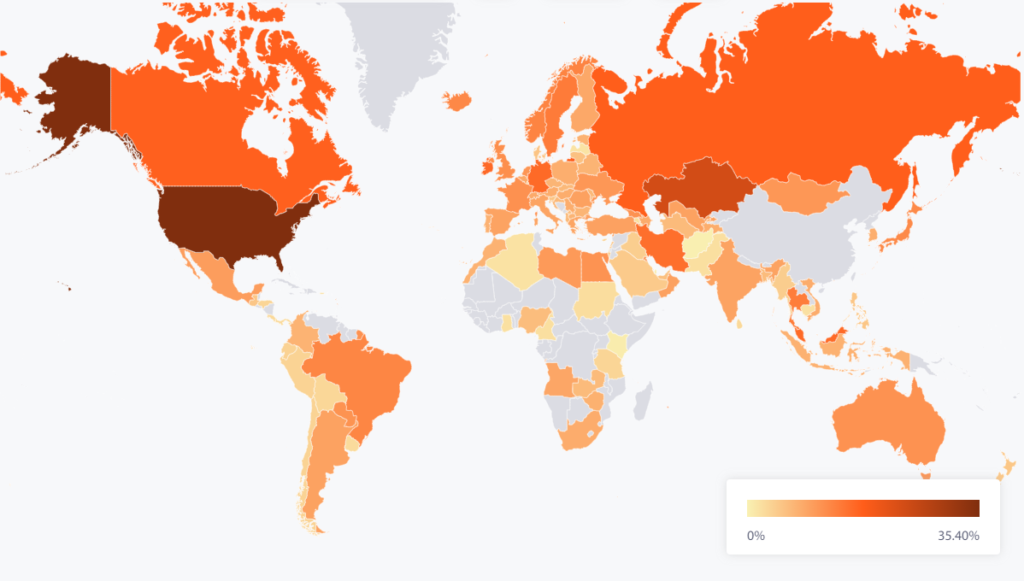

After China implemented a ban on bitcoin mining in May 2021, bitcoin miners have been migrating to other countries globally. While, initially, Kazahkstan took a significant proportion thanks to geographic proximity, data published last week indicates that the US has now moved into the number one spot.

Up until the ban, China had dominated bitcoin mining for several years. However, in July this year, researchers from the Cambridge Bitcoin Electricity Consumption Index (CBECI) posted data indicating that the bitcoin mining hashrate from China had significantly reduced. Miners and mining facilities were actively seeking new countries to establish a presence. Since then, the majority have now had enough time to establish new premises and begin contributing to the Bitcoin blockchain once again.

As a result of the migration, three countries were highlighted during the latest publication from the CBECI. “This new data (to the end of August 2021) shows the US with a global hashrate share of 35.4% (up from 16.8% at the end of April), Kazakhstan with 18.1% (up from 8.2%), and the Russian Federation with 11% (up from 6.8%). This confirms the hashrate trajectory identified in the last update (to end April 2021) which showed those three countries were already gaining market share prior to the crackdown in China.”

The effect of the China ban has ultimately led to a decentralisation of bitcoin mining. Prior to the ban, China was nearing majority control. Now, the distribution of mining power has filtered into different countries, increasing the security of the bitcoin blockchain.

Visa launches NFT platform

Visa, the global credit and payments company, has confirmed that it will be launching a new program to encourage the introduction of artists into the Non-Fungible Token (NFT) sector. Spearheaded by MLB player, Micah Johnson, who has now moved into the digital art space, it is hoped the program will “lower the barrier to entry for digital creators across the world.”

It is Visa’s belief that NFT technology will reduce the gap between everyday consumers and artists. Led by Johnson, who utilized NFTs to launch his own NFT brand Aku, Visa is planning to sponsor a group of new artists that will be taught the different aspects of blockchain technology. It is hoped that sharing information on blockchain and NFTs, will breathe new life into digital artwork.

The NFT sector has dominated the cryptocurrency industry for much of 2021. While blockchain-based platforms and cryptocurrency exchanges have introduced new platforms and initiatives to capture NFT market share, the move from Visa signifies one of the first made by a larger traditional financial institution.

CFTC fines Tether and Bitfinex parent company $42.5 million

The company behind the Tether stablecoin, Tether Holdings Limited, and the company behind the Bitfinex cryptocurrency exchange, Ifinex, were ordered on Friday to pay a combined $42.5 million fine. Both fines were issued by the US Commodity and Futures Trading Commission (CFTC). Tether was fined $41 million and Bitfinex was fined $1.5 million.

The fine for Tether was the result of “making untrue or misleading statements and omissions.” Meanwhile, the charge against Ifinex was the result of Bitfinex “engaging in illegal, off-exchange retail commodity transactions in digital assets with U.S persons on the Bitfinex trading platform and operated as a futures commission merchant (FCM) without registering as required.”

The investigation into Tether, which is meant to hold US dollar reserves for every USDT stablecoin it issues, showed that the company only held sufficient reserves on 27.6% of days over a 26 month period between 2016 and 2018. The remaining reserves were held with third parties, including Bitfinex. Bitfinex held reserve funds with the exchange’s operational and customer funds. As a result of the misleading statements and commingled reserves, both companies were charged by the CTFC.

The CTFC acting chairman, Rostin Behnam, commented on the developments during the week. “This case highlights the expectation of honesty and transparency in the rapidly growing and developing digital assets marketplace. The CFTC will continue to take decisive action to bring to light untrue or misleading statements that impact CFTC jurisdictional markets.”

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter, Instagram, LinkedIn, and sign up at the bottom of the page to subscribe.