Bitcoin Catches Its Breath As Miner Fees Reach 2021 Heights

After 8 weeks of ‘up-only’, Bitcoin has paused to catch its breath.

Despite rebounding on the news of a Fed interest rate pause, the world’s leading crypto has continued to correct falling back towards $41,000.

However, Bitcoin’s transaction fees continue to hit 20-month highs and Bitcoin miner revenues are peaking at levels not seen since 2021.

Simultaneously, BlackRock has revised its spot Bitcoin ETF application to help facilitate the participation of major Wall Street institutions and stablecoins are projected to surpass Visa in 2024 according to Bitwise’s predictions for 2024.

With new market dynamics on the cards, let’s dive in.

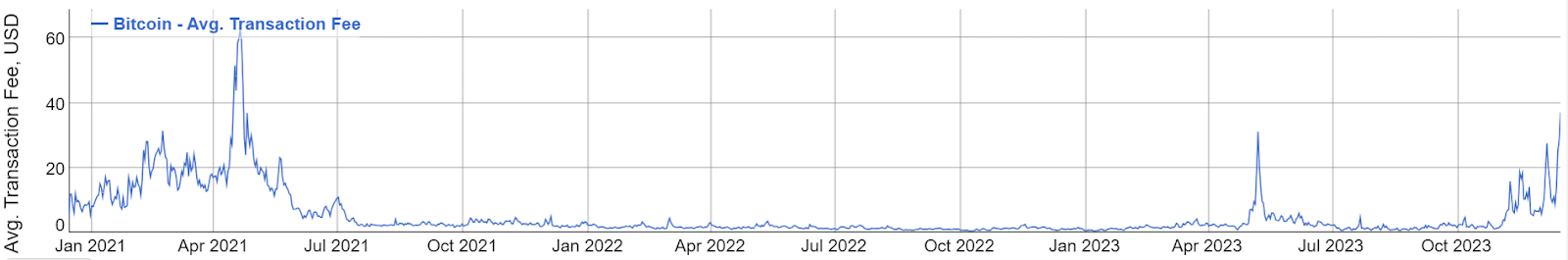

Bitcoin transaction fees skyrocket to 20-month high

Bitcoin transaction fees have reached a 20-month high, soaring to nearly $40, mirroring levels that preceeded the previous all-time high of BTC at $69,000.

Recent data from BitInfoCharts indicates that the average transaction fee as of December 17 has hit a level not seen since April 2021, creating a divide in the crypto community.

The surge in fees is attributed to the latest wave of Bitcoin Ordinals inscriptions, resulting in elevated transaction costs for all network users.

According to BitInfoCharts, sending BTC on-chain now costs just over $37, putting pressure on smaller investors for whom casual on-chain spending is becoming increasingly expensive.

But remember – as an Xcoins user, you have the option to batch your transactions and pay a network fee several times lower if you are happy to wait up to an hour to receive your Bitcoin. To do this, simply select “normal” when paying for your order, rather than “fast”.

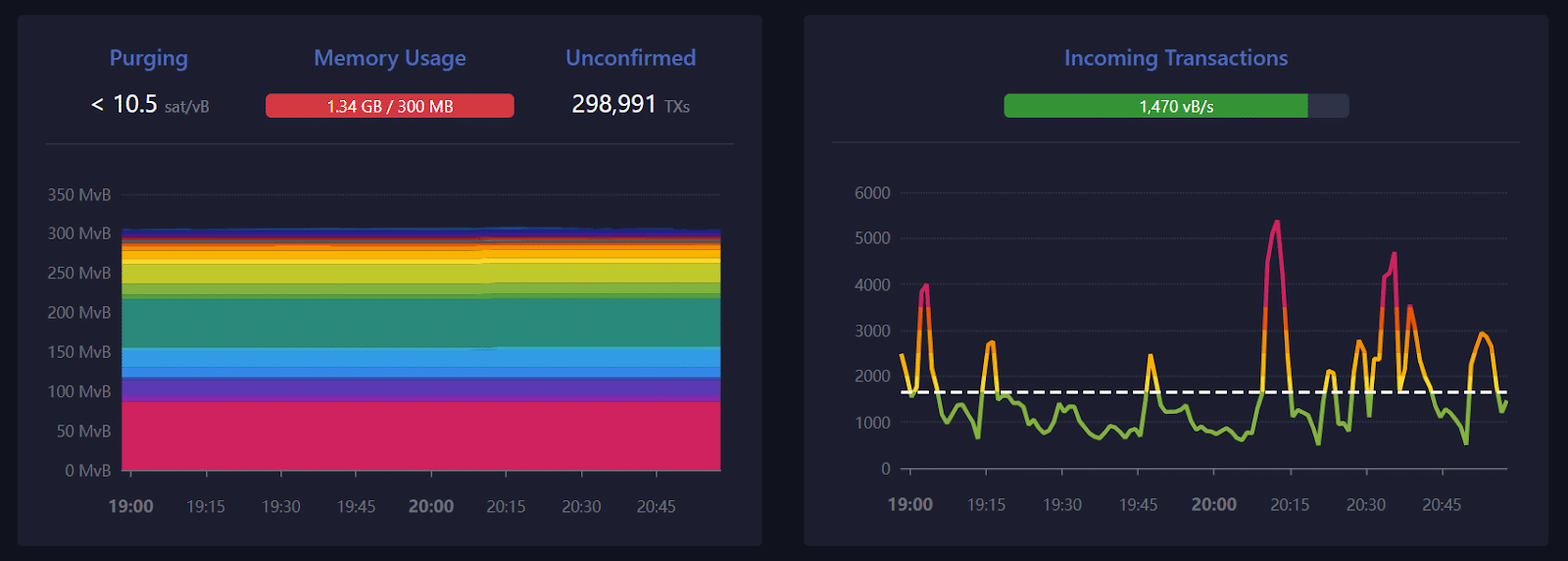

Bitcoin’s mempool, the backlog of unconfirmed on-chain transactions, has also expanded significantly, with almost 300,000 transactions awaiting confirmation at the time of writing, causing transactions with fees as high as $2 to have no on-chain priority.

Despite the discontent among users about the impact of Ordinals on fees, prominent figures in the Bitcoin community argue that double-digit transaction costs are indicative of a future trend.

Advocates suggest embracing layer-2 solutions like the Lightning Network, specifically designed for mass adoption.

This perspective aligns with Bitcoin veteran Adam Back, co-founder of Blockstream, who believes in expanding layer-2 capabilities rather than relying on alternatives beyond miner fee incentives.

Back states, “You can’t stop JPEGs on bitcoin. Complaining will only make them do it more. The high fees drive the adoption of layer 2 and force innovation. So relax and build things.”

Meanwhile, despite the escalating fees, Bitcoin miners are enjoying their best USD revenues in two years, according to data from Blockchain.com.

Miner revenue, comprising block subsidies and fees in USD, has reached levels not seen since Bitcoin’s all-time high of $69,000 in November 2021.

BlackRock revises ETF to help Wall Street enter the crypto race

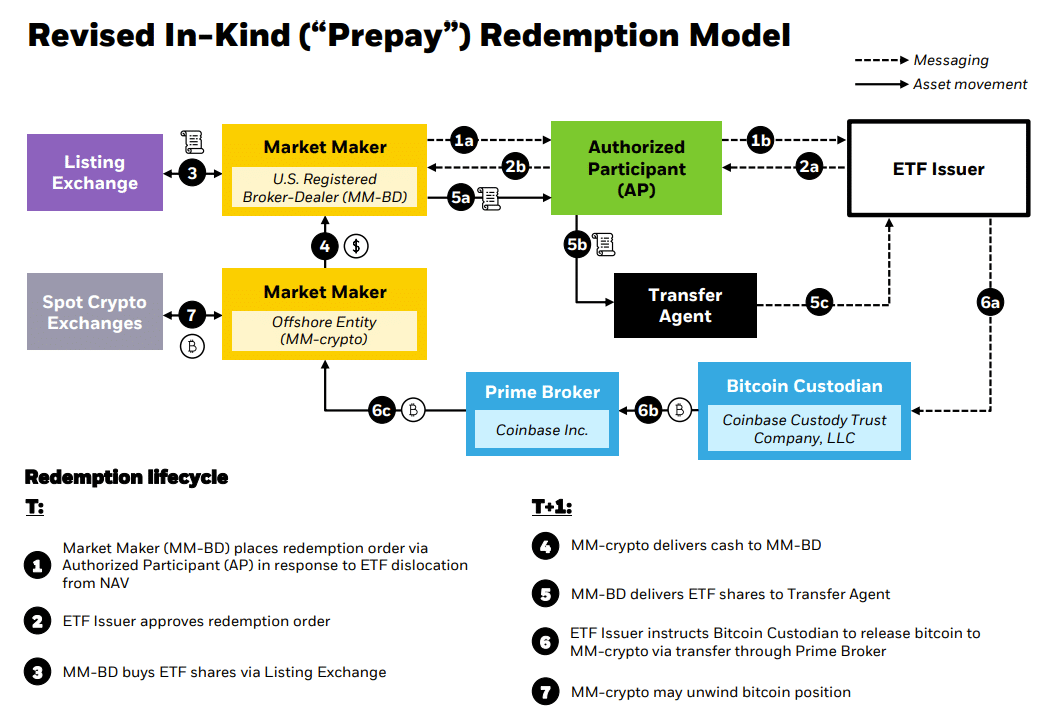

BlackRock has amended its spot Bitcoin ETF application to help streamline participation for major Wall Street institutions by introducing a novel in-kind redemption model.

This groundbreaking adjustment will allow financial behemoths like JPMorgan and Goldman Sachs to play a more active role in the fund.

Unlike the traditional method limited to cryptocurrency contributions, the new “prepay” model permits these banks to create fund shares using cash, bypassing the constraints preventing direct Bitcoin or crypto holdings on their balance sheets.

During a crucial meeting with the SEC on November 28, six BlackRock representatives and three from Nasdaq presented this innovative model.

If granted approval, this shift could open doors for trillion-dollar balance sheet banks, unable to hold Bitcoin directly due to regulatory restrictions.

Under the revised structure, authorized participants would transfer cash to a broker-dealer, which would then convert it into Bitcoin.

Subsequently, the cryptocurrency would be securely stored with the ETF’s custody provider—in this case, Coinbase Custody, a move aimed at enhancing security and regulatory compliance.

Furthermore, BlackRock emphasizes that this new redemption model boasts “superior resistance to market manipulation,” a critical factor that the SEC has cited in previous rejections of spot Bitcoin ETF applications.

The recent meeting on December 11 marked BlackRock’s third encounter with the SEC regarding this proposal.

Stablecoins to outpace VISA in 2024

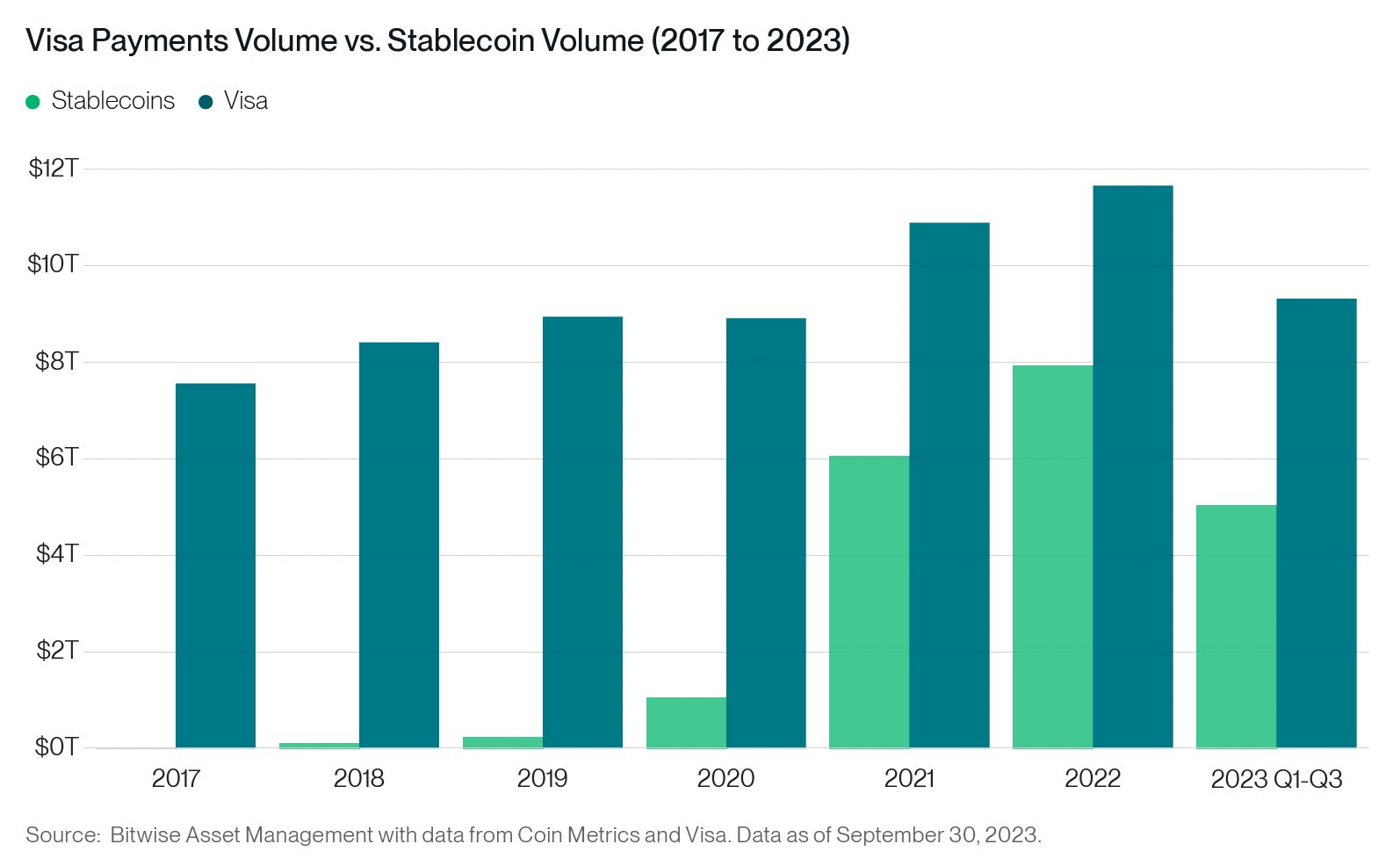

Hot on the heels of VanEck last week, Bitwise, the crypto asset manager, has revealed its predictions ahead of 2024.

According to Bitwise’s senior research analyst, Ryan Rasmussen, Bitcoin is on track to reach unprecedented highs of $80,000 and stablecoins could collectively outpace payment giant Visa in transaction volumes.

Published on Dec. 13, Rasmussen’s 10 bullish predictions for the crypto industry in 2024 highlight the explosive growth of stablecoins, positioning them as one of crypto’s standout success stories.

Bitwise anticipates stablecoins settling more transactions than Visa, marking a significant milestone for the industry.

As of the third quarter of 2023, Visa processed over $9 trillion in payments, while the trading volume of stablecoins soared to surpass $5 trillion.

Rasmussen also envisions a robust year for Bitcoin, predicting a price surge beyond $80,000 in 2024.

Key catalysts include the expected launch of the first spot Bitcoin ETF and the halving event scheduled for April.

However, Bitcoin price predictions for 2024 vary widely among industry experts, with projections ranging from $100,000 to as high as $1 million.

Bitwise speculates that the approval and launch of the spot Bitcoin ETF will not only materialize but will also become the most successful ETF launch ever, amassing $72 billion in assets under management within the next five years.

Beyond Bitcoin, Bitwise also believes that Ethereum is poised for significant improvement in 2024, with the asset manager betting on a 100% increase in revenue to $5 billion.

Federal Reserve pause momentarily boosts crypto

On Wednesday the Federal Reserve decided to pause interest rates and, therefore, keep the federal funds rate at 5.25%.

The decision to pause and potentially lower interest rates in 2024 is being hailed as a “green light” for the crypto market, opening doors to a potentially bullish period for cryptocurrencies and related stocks.

In particular, BlackRock fund manager Jeffrey Rosenberg, in a Dec. 13 interview with Bloomberg, characterized the Fed’s rate pause and hints at future rate cuts as a positive signal for investors.

The S&P 500 responded with a 1.37% rally on the announcement with crypto stocks following suit. Shares of Coinbase and MicroStrategy surged by 7.8% and 5%, respectively, while Bitcoin miner Marathon Digital experienced an impressive 12.6% jump.

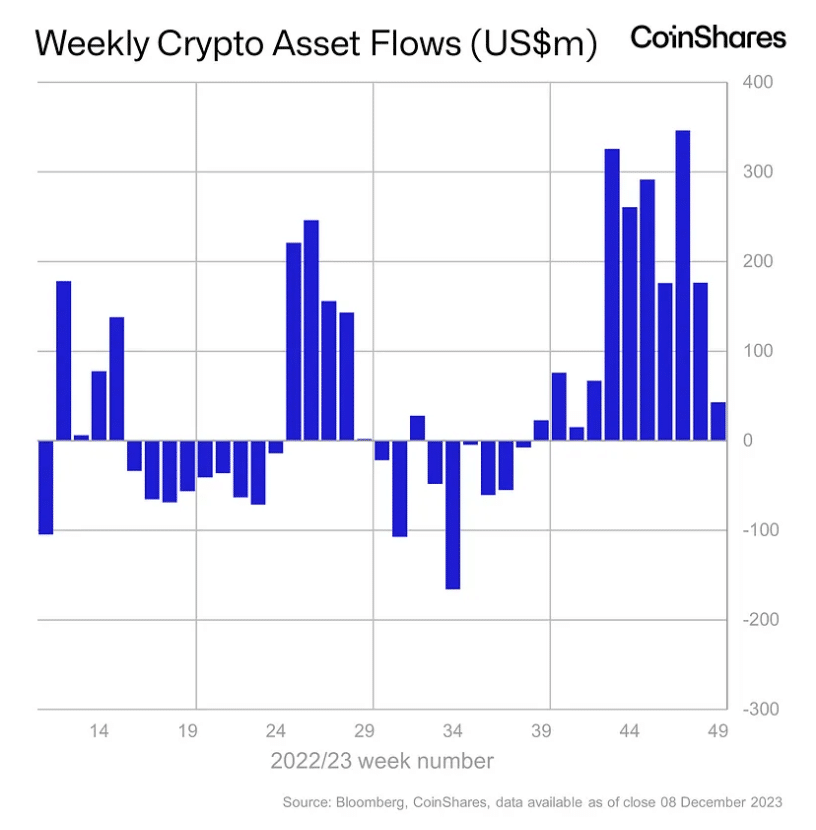

In addition to the interest rate pause, CoinShares revealed that blockchain equities observed record-breaking weekly inflows, with an astounding $126 million flowing into crypto-related stocks.

Digital asset investment products also marked their eleventh consecutive week of inflows, recording a weekly gain of $43 million.

Tina Teng, a market analyst at CMC Markets, highlighted that the Fed’s rate pause is likely to fuel market enthusiasm for crypto products.

She emphasized the positive impact on risk-on sentiment and improved expectations for future liquidity conditions, buoying crypto stocks.

Investors can anticipate bullish trends reminiscent of previous rate-cut cycles, further amplified by institutional interest in pending spot Bitcoin exchange-traded funds, with decisions expected in early January, according to Teng.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.