Bitcoin Bounces as US Debt Ceiling Talks & BTC Wallet Rumours Shake Markets

Bitcoin faced a turbulent ride over the past week, initially boosted by lower-than-expected US CPI results, but later dragged down by rumors of bitcoin wallet movements and US debt ceiling talks.

However, despite the recent pullback, cryptocurrency investors now have a significant event to look forward to – the Bitcoin halving event – which is now less than 1 year away.

Meanwhile, Ethereum, the second-largest blockchain by market capitalization, suffered two outages in 24 hours, raising concerns among developers and end-users about the finality of the blockchain.

- Bitcoin boosted by CPI but dragged lower by US debt ceiling talks

- Bitcoin halving 2024: less than 1 year to go

- Ethereum blockchain struck with finality issues

Bitcoin boosted by CPI but dragged lower by US debt ceiling talks

Bitcoin, like most other cryptocurrencies, has experienced a bumpy ride over the past week. Positive CPI results provided some relief to the crypto market, but rumored movements of bitcoin wallets and ongoing debt ceiling talks in the US have caused concern among investors.

On Wednesday, US CPI results came in lower than expected with a year-on-year inflation rate for April of 4.9%. This is the lowest yearly figure the US has seen for two years.

In addition to the low result, economists also noted that the housing and shelter component of the CPI had begun to decrease – an element of the CPI that is often the last to roll over.

Unfortunately, while the thought of the Federal Reserve pumping the brakes on interest rate hikes due to cooling inflation was warmly welcomed, celebrations were short-lived.

Late on Wednesday, a tweet from a Twitter account known as “beetle”, posted that ‘US government bitcoin wallets’ were on the move. Although later disproven by members of the crypto community – with the tweet subsequently removed – the initial panic was enough for the price of BTC to drop $1,000 in a matter of minutes.

Uncertainty was then compounded heading into the back end of the week as investors grew anxious over talks regarding the US debt ceiling.

The US debt ceiling is the maximum amount of money that the federal government can borrow to fund its activities. As the ceiling of $34 trillion was reached in January, a decision must now be made on whether or not to raise it.

There are three possible outcomes, including suspending the ceiling, making significant spending cuts, or defaulting on obligations.

While the probability of a default may be low, the mere possibility of it has had a profound effect on the markets. Should the US government default, it could have catastrophic effects on the US economy and, by extension, the global economy.

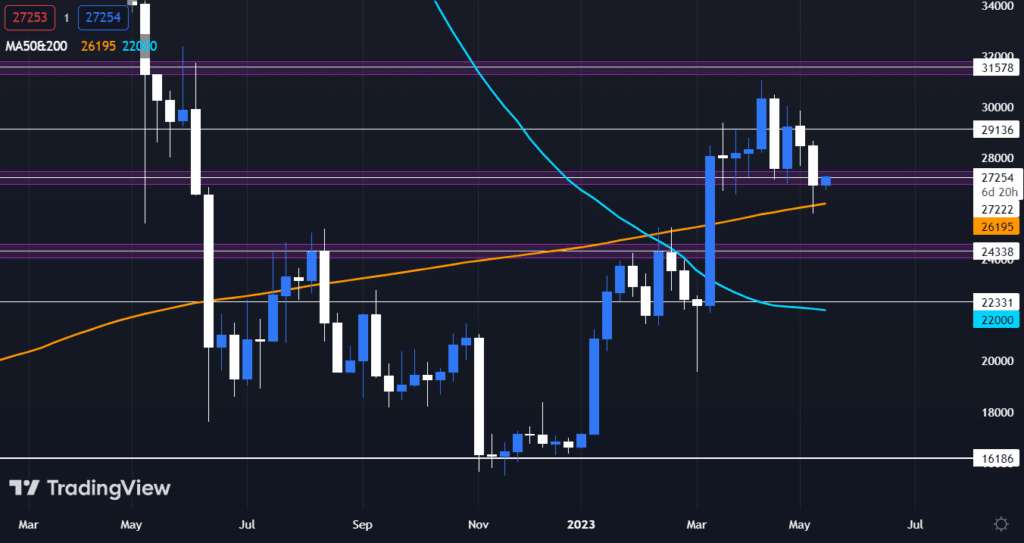

Ongoing concern resulted in Bitcoin’s price dropping below the $27,000 support level on Friday. The price also broke below the 50-day MA earlier in the week.

This has caused some worry among investors, who fear that Bitcoin could drop further until it reaches the $24,000 support level.

However, on the weekly chart, the price successfully retested the 200-week MA over the weekend. This level has provided a strong support level in the past, marking the market bottom in 2015, 2019, and 2020.

Heading into the new week, all eyes will be on the 200-week MA to see if BTC prices can climb back toward the yearly high of $31,000.

Bitcoin halving 2024: less than 1 year to go

Despite Bitcoin’s recent pullback from yearly highs, cryptocurrency investors have a significant event to look forward to.

The Bitcoin halving event is scheduled to take place at a block height of 840,000. Based on current block production rates, halving countdown calculators are estimating that this would place the date of the event on 27th April 2024 – which means there is now less than 1 year to go.

To prevent inflation and add an element of scarcity, Bitcoin halving events were programmed into the Bitcoin blockchain’s underlying code.

As a result, every 4 years, the amount of BTC rewarded to Bitcoin miners is halved. In 2024, rewards will be halved from 6.25 BTC to 3.125 BTC.

In the past, the instant reduction in supply has sent shockwaves through the crypto markets. Using simple supply and demand mechanics, if demand remains constant but supply falls, the price of an asset must accommodate the difference. This logic has rung true to every previous halving event.

Bitcoin’s first halving event took place in 2012. In the subsequent year, the coin increased from $11 to $1,000.

The second halving event took place in 2016. In the subsequent two years, Bitcoin increased from $650 to $20,000.

Finally, the third halving event occurred in 2020. In the subsequent year, Bitcoin increased from $8,500 to $69,000.

But the real question remains – what will happen after the fourth halving event in 2024?

While it’s impossible to predict the exact outcome of Bitcoin’s fourth halving, many experts believe that the price of BTC will continue to rise.

The reduction in supply and the potential increase in demand could fuel a surge in Bitcoin’s price and make it a highly sought-after asset.

While there are no guarantees in the cryptocurrency market, the historical trends show that it is certainly an event to watch closely.

Ethereum blockchain struck with finality issues

Ethereum, the second-largest blockchain by market capitalization, suffered its second outage in 24 hours on Friday. The outage caused the network to stop finalizing blocks for over an hour.

According to the Ethereum Foundation, finality on-chain takes approximately 15 minutes and is the guarantee that transactions held within a specific block cannot be altered.

When blocks are not being finalized, there is a possibility that pending transactions might be re-ordered or dropped from the network.

So, when the finality of the blockchain stopped for an hour around midday on Friday, it raised concerns among Ethereum developers and end users.

The issue of finality followed a previous issue that occurred on Thursday, where blocks were being proposed but not validated for a 25-minute period.

The cause of both technical outages seems unclear which has sent crypto socials into a frenzy of discussions.

According to Toghrul Maharramov, a developer at the Ethereum infrastructure startup Scroll, “to be able to say whether or not the situation is the fault of the protocol design or an outcome of a bug, we need to first understand what actually happened.”

Meanwhile, Superphiz.eth, a self-proclaimed “Ethereum Beacon Chain community health consultant,” clarified on Twitter that the lack of finality technically had “zero impact on-chain activity.”

They explained that some of the services built atop Ethereum might be forced to modify operations due to finality issues but this may not be true for all.

For example, DYdX, a leading crypto exchange platform, temporarily paused deposits due to the lack of Ethereum finality and was “continuing to monitor and investigate this issue.”

Superphiz.eth also reassured the Ethereum community by stating that “the chain keeps going and eventually finalizes” and asked users not to worry.

At the time of writing, the blockchain is back up and running at full operational capacity.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.