5 Reasons Bitcoin Could Pump in 2023

Bitcoin (BTC) has been in the news lately, with investors keeping a close eye on the digital currency’s price movements, which have been heavily influenced by increasing Federal interest rates.

While much of the focus is on the day-to-day fluctuations in BTC price, it’s important to also consider external factors that could impact BTC in the longer term.

Here are five factors that could drive up the price of BTC in 2023 and early 2024.

The FED Will Lower Interest Rates

The Federal Reserve (FED) has the power to lower interest rates, which can impact the economy in a variety of ways.

Lower interest rates can stimulate economic growth by encouraging borrowing and spending, but they can also lead to inflation.

In the past, BTC has been seen as an alternative investment option when interest rates are low. If the FED lowers interest rates in 2023, as is broadly expected, it’s possible that BTC could become an even more attractive investment option.

The FED Will Inject Liquidity (QE)

Quantitative easing (QE) is a monetary policy tool used by the FED to inject liquidity into the economy by buying assets like government bonds. QE can help stimulate economic growth, but it can also lead to inflation.

In the past, BTC has been seen as a hedge against inflation. If the FED injects liquidity through QE in 2023, it’s possible that BTC could see increased demand as a result.

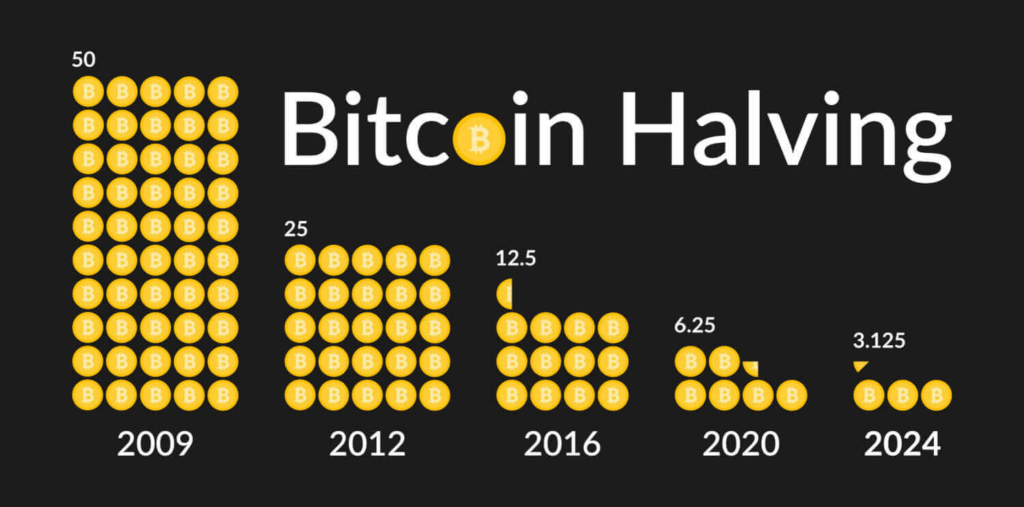

BTC Halving Scheduled for 2024

The halving event is a scheduled reduction in the number of new BTC created every 10 minutes.

This event occurs roughly every four years and is designed to limit the total supply of BTC to 21 million.

The next halving event is scheduled for 2024, but the effects of the event can be felt in the years leading up to it.

In the past, halving events have been associated with an increase in BTC price. If history repeats itself, BTC could see increased demand and price in 2023. Also, don’t forget to watch out for the LTC halving which is approaching much sooner!

Sovereign Currency Wars

Sovereign currency wars occur when countries engage in behaviors such as competitive devaluations of their currencies in an effort to gain an advantage in international trade. A battle is heating up to unseat the dollar as the global reserve currency.

These currency wars can lead to increased interest in BTC as a store of value. If currency wars occur in 2023, it’s possible that BTC could see increased demand as a result.

SEC/CFTC Crypto Regulations

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are responsible for regulating the crypto market in the United States.

A lack of clarity between these two agencies and their positions towards cryptocurrencies has pushed leading US exchanges overseas recently.

Any new regulations could impact the crypto market, including BTC. If new regulations are put in place in 2023, it’s possible that BTC could be impacted, either positively or negatively.

But most spectators seem to agree that the expected clarification of regulations can only be a good thing for the price of Bitcoin.

Bitcoin price prediction

While short-term BTC price movements are important to consider, it’s also important to pay attention to external factors that could impact BTC in the longer term.

Factors like FED policy, the halving event, currency wars, and regulatory developments could all play a role in shaping the future of BTC and the interplay between these factors makes making an accurate prediction impossible.

That said, a range of $100,000 to $200,000 per Bitcoin in 2024 is within the realm of possibility according to many analysts. However, this assumes favorable market conditions and sustained demand.

As always, this article does not constitute financial advice and you should be sure to do your own research and consult a professional financial advisor before making any investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.