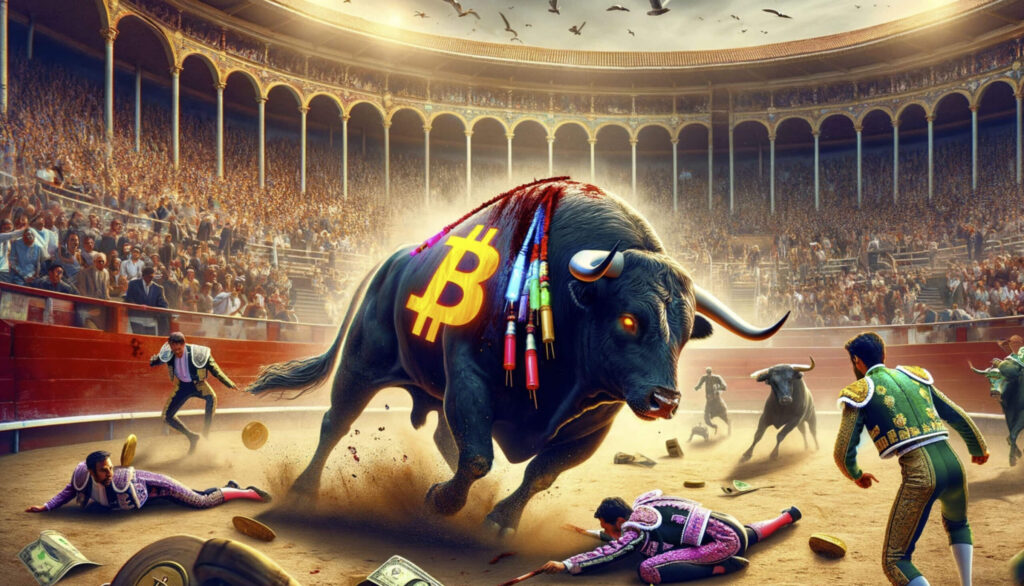

Bitcoin Shortsellers Wiped Out as Bitcoin Strikes $60K

In a faster-than-anticipated move that has left the cryptocurrency community buzzing, Bitcoin shortsellers have faced a staggering $150 million in losses overnight as Bitcoin has blasted past the $60K mark.

This financial shakeup preceded an impressive surge in Bitcoin’s price, propelling it to the key psychological $60,000 mark, a mere few thousand dollars from its $68,991 all-time high.

The Unprecedented Surge

Bitcoin’s ascent to $60,000 is a testament to the growing confidence and enthusiasm surrounding the top cryptocurrency. This remarkable rally is not just a number; it represents a significant shift in market dynamics, with increased trading volumes in Bitcoin ETFs signaling a broader acceptance among institutional investors.

The influx of retail investors, drawn by the ease of access provided by ETFs, has further fueled the momentum, setting the stage for a vibrant and more inclusive market.

The Halving Horizon: A Once-in-a-Lifetime Opportunity

The Bitcoin halving event, scheduled for 20 April 2024, is more than just a routine adjustment. It is a pivotal moment that could redefine the value and scarcity of Bitcoin.

By halving the reward for mining new blocks, Bitcoin effectively reduces its supply, making it an even more sought-after asset.

This event, the first since the introduction of Bitcoin ETFs, presents a unique investment opportunity.

The combination of massively reduced supply and massively increased accessibility for investors could catalyze a significant upward trajectory in Bitcoin’s value.

Bitcoin ETFs: Opening the Gates

The advent of Bitcoin ETFs has revolutionized the cryptocurrency landscape, breaking down barriers that once kept many institutional and retail investors at bay.

By providing a regulated and straightforward path to Bitcoin investment, ETFs have broadened the investor base, integrating cryptocurrency into the mainstream financial ecosystem.

This newfound accessibility is a game-changer, amplifying the impact of events like the halving on market dynamics and investor sentiment.

Navigating the Surge: Insights for Investors

For those contemplating whether to invest in Bitcoin, the current surge and the upcoming halving offer compelling considerations.

The historical context of Bitcoin’s price movements around previous halvings, combined with the enhanced market participation due to ETFs, suggests that we may be on the cusp of a significant market evolution.

Investors stand at the threshold of what could be a once-in-a-lifetime opportunity to capitalize on the potential price escalations in the wake of the halving.

Looking Ahead: The Future of Bitcoin Investment

As Bitcoin continues to chart its course through uncharted financial waters, the blend of technological innovation sped by recent AI developments, market expansion fueled by the new range of ETFs, and the regulatory advancements these developments are opening up paints a promising picture for the price of bitcoin and the broader crypto industry.

This particular halving event may prove to be not just a technical footnote in Bitcoin’s ledger; but a landmark moment that could very well shape the future of Bitcoin.

Why You Should Prioritize Direct Crypto Ownership

As you navigate the burgeoning landscape of Bitcoin investment, and weigh the prospect of ETFs, it’s crucial to consider the long-term implications of associated ETF fees carefully and to cherish the autonomy that comes with direct control over your crypto assets.

Choosing to buy Bitcoin directly and retain it securely in a non-custodial wallet is more than just an investment strategy; it’s a commitment to the core values of cryptocurrency: decentralization and self-sovereignty.

This approach not only protects you from the incremental drain of fees year after year after year, but also ensures that the full value and potential of your Bitcoin investment remain intact and unimpeded and you remain free to move and spend your cryptocurrency as your please.

As we stand on the brink of potentially groundbreaking increases in Bitcoin’s value, adopting the principle of self-ownership is not only wise for safeguarding your financial future but also serves as a homage to the transformative vision that Bitcoin embodies.

As always, this article does not constitute financial advice. You should be sure to do your own research and consult a professional financial advisor before making a major investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.