What Does the GameStop Saga Mean for Crypto?

Unless you’ve been living under a rock this week, you’ll have already heard about GameStop (GME) and WallStreetBets by now.

In summary, a group of users on Reddit, rose up in support of a flailing company’s stock, causing a surge in its value to the disbelief of Wall Street investors who had been shorting the stock and now lie facing financial ruin.

As noted by some, the activity is reminiscent of the early days of cryptocurrency, in which online forums galvanized members in support of Bitcoin.

In this article, we explore the reasons behind the so-called “GameStop surge”, how Wall Street reacted and what this could mean for cryptocurrency.

But first, let’s take a closer look at what actually happened.

A Reddit uprising

A member of the Reddit page r/wallstreetbets noticed that flailing videogames distributor GameStop (GME) was being bet against by large hedge funds taking short positions.

That member then began calling upon fellow r/wallstreetbets members to help the company out; to buy as much GME as possible and create a “short squeeze” forcing the short-sellers to pay up, big time.

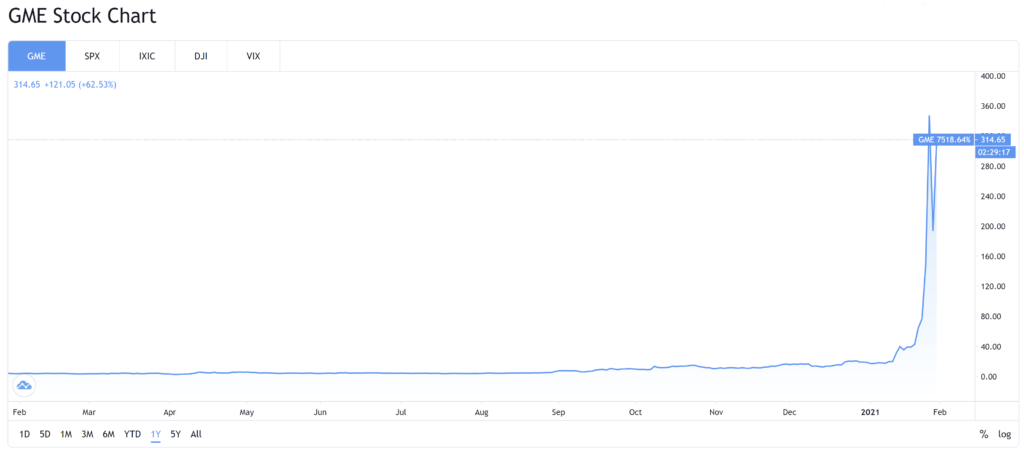

The results of this effort came to fruition and the impact was huge. GME surged significantly, hitting a high of $469 yesterday after opening the month at less than $20. That represents an increase of over 2200% this month and over 7000% this year.

No doubt, those that had been holding GME prior to the Reddit discussions were shocked whilst also now having made a healthy profit.

However, hedge funds that had been shorting GME now face liquidation. Some of those traders, seeing the uncharacteristic spike, decided to pile in more funds to short the stock’s now higher price. However, the Redditors didn’t give, forcing many short-sellers to close positions and accept heavy losses.

The large spike in trading activity saw a number of exchanges halt trading temporarily, including the New York Stock Exchange.

A controversial decision by Robinhood to suspend the buying but not selling of GME came under intense scrutiny, with some alleging financial ties the popular app has with investors that entered enormous short positions in the surging stock.

Wall Street in shock

Pit as a battle between David & Goliath, the individual retail investor, and the big players on Wall Street, the GameStop story has left the mainstream financial world in shock.

Some are calling for an investigation into the surge. They accuse Redditors of potential market manipulation, with the original Wolf of Wall Street, Jordan Belfont, suggesting the event was a modified version of a pump and dump.

Both the White House and the United States Securities and Exchange Commission (SEC) have said they are “actively monitoring” the situation.

However, there has also been an overwhelming pushback against this narrative, from all corners of social media and the cryptocurrency world.

In an interview with CNBC, Social Capital CEO, Chamath Palihapitiya, called the activity an important pushback against the establishment. He cites the anger that retail investors have towards Wall Street activity in 2008 as a reason for the ‘battle’.

He goes on to suggest that investors using Reddit are actually doing “frankly a better job” at performing the kind of fundamental due diligence that once upon a time was done on Wall Street, than the hedge fund analysts he works with.

“A lot of people believe that coming out of 2008 what happened was Wall Street took an enormous amount of risk and left retail as the bag holder. A lot of these kids were in grade school or high school when that happened. They lost their homes, their parents lost their jobs and they’ve always wondered, why did those folks get bailed out for taking enormous amounts of risk and nobody showed up to help my family?” Palihapitiya goes on to praise the Reddit investors for doing what they are doing transparently, rather than in “quiet whispered conversations amongst hedge funds in the Hamptons.”

CNN’s Chris Cuomo also chimed in to defend what he called the “little-guy” investors. Interviewing Vlad Tenev, CEO of Robinhood, he accuses the exchange of “shutting down the game to starve the little guy”.

Will this impact cryptocurrency?

To some extent, it already has. Dogecoin (DOGE) received the now customary post-hype event endorsement, a parabolic DOGE spike, with its price rising from $0.007 to $0.056 at press time.

Moreover, Tesla’s Elon Musk (who is also Dogecoin’s honorary CEO), changed his Twitter bio to #bitcoin after tweeting both about DOGE and GME. Bitcoin subsequently jumped over 10%.

Former White House Director of Communications, Anthony Scaramucci also made an interesting point about what this could all mean for Bitcoin. He described the GME surge as another “proof-of-concept” for the top-cryptocurrency that is mostly traded by individual investors.

In fact, the early days of Bitcoin saw a large use of forums promoting what was then new technology, including Reddit. If anything, the GME story is proof of the new power of social investing, which importantly is done transparently in public.

Whilst there is widespread contempt for the bets of Wall Street bankers online, the sentiment in these same online communities towards cryptocurrency is decidedly favorable.

Further, cryptocurrency acts as an antidote to the insider trading and dodgy dealings of Wall Street, as every transaction that exists on the blockchain is, much like the Reddit saga, conducted in public and completely transparently, unlike the money that flows between bankers and hedge funds on Wall Street.

We may well be witnessing the beginnings of the decline of Wall Street and the smoke and mirrors world of private hedge funds, and a new dawn of cryptocurrency and social investing, and if that is the new battleground opening up before us, we know exactly which side we would take.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter and enter your email address at the bottom of the page to subscribe.