We’re Witnessing the Birth of a Generation of “HODLERS”

With increasing credibility being placed in cryptocurrency by key institutional players and market demand growing larger, the amount of Bitcoin being held for longer is increasing at a rapid rate.

Firstly, for those that are not aware, the word “hodl” is a slang term used in the crypto community meaning to hold cryptocurrency long-term rather than spend or sell it.

If you plan to “hodl”, a word originally derived from an incorrect spelling of “hold”, you are a “hodler”.

Hodlers believe the price of a cryptocurrency is going to increase over time, therefore they conclude it is safer to just sit and ‘hodl’, rather than actively trade it and gamble on their ability to forecast swings in the market, a strategy we at Xcoins fully support.

Although this seems like a logical approach, Bitcoin and other cryptocurrencies have historically not been viewed as a long-term investment option by the broader financial community. Bitcoin hodlers have always been the exception rather than the norm, but over recent years this outlook has started to change.

The birth of the hodl generation

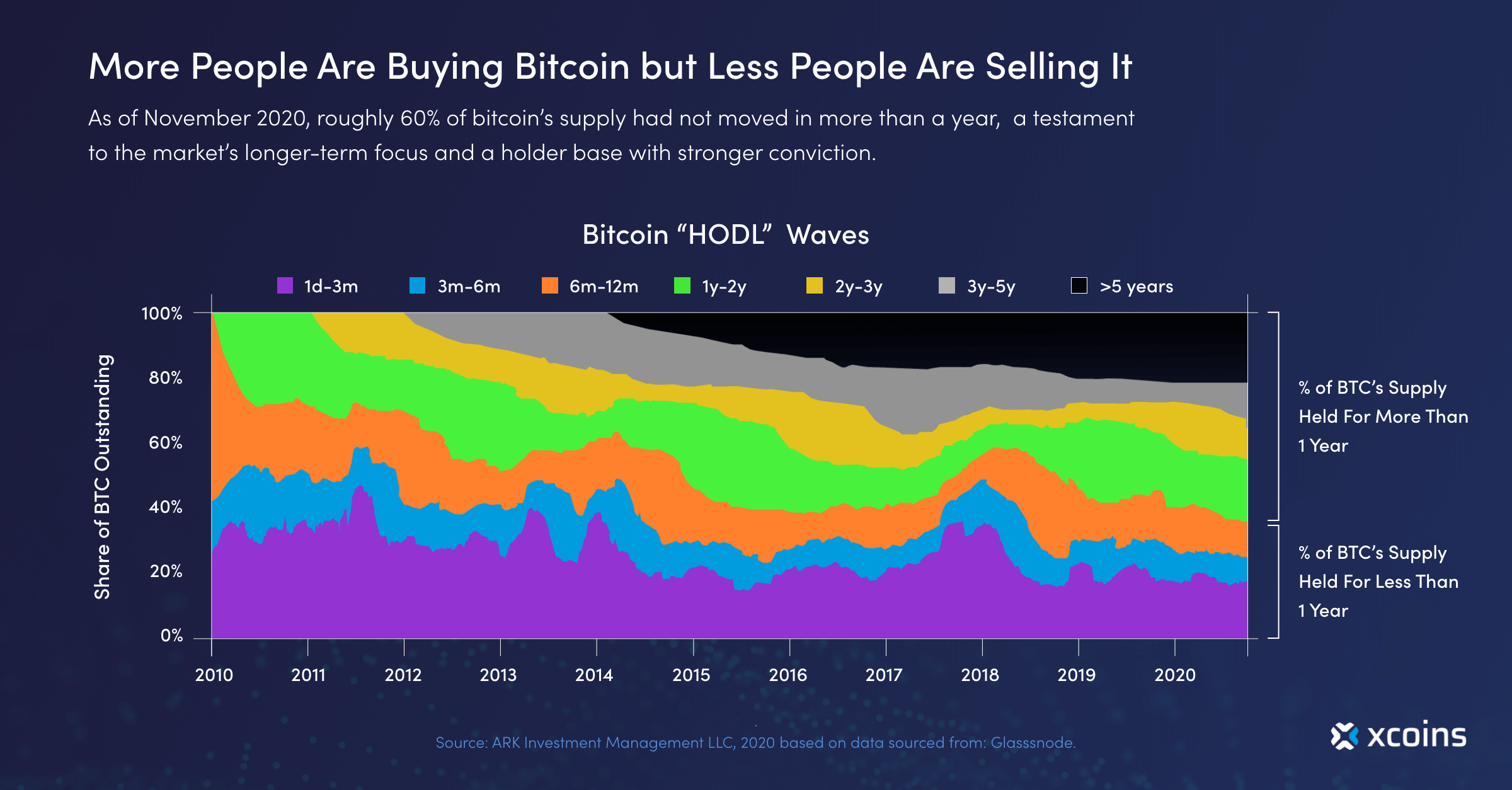

Data collected by Ark Invest earlier this year, included within their Big Ideas 2021 report, revealed that Bitcoin’s hodlers appear to be becoming the norm rather than the exception.

In the years following Bitcoin’s inception in 2009, the movement of Bitcoin was highly fluid. Almost all of the Bitcoin supply was held for less than a year before changing hands. As all Bitcoin transactions are recorded on a public ledger, this data is easy to track.

Bitcoin was being passed from miners to traders, to anyone else that was interested in the cryptocurrency space and that wanted a piece of the action. Even for the majority of early adopters, that were enthused by the technology, it was not generally viewed as a viable long-term investment, then it was mostly seen as an easy way to spend money online.

However, fast-forward nearly a decade, and the percentage of Bitcoin that is being held for less than a year has dropped by approximately 60%, as depicted in the graph above.

Whilst the percentage of Bitcoin being held for less than a year is decreasing, the percentage being held for far longer than a year is rapidly increasing, which suggests that a growing percentage of the crypto community are in it for the long haul.

In fact, 20% of all Bitcoin in existence at the end of 2020 had been stored for more than five years. These figures suggest that a lot of crypto investors now believe Bitcoin is worth keeping long-term and the data indicates this trend is likely going to continue into the future.

Why are people hodling?

The landscape in 2021 is quite different from that seen during the bull run of 2017.

Institutions such as JP Morgan have u-turned on cryptocurrency and now praise Bitcoin in their investor notes. The endowment funds of Ivory League universities are buying bitcoin in droves. Payment providers such as PayPal, Visa, and Mastercard, are now implementing cryptocurrency payments within their platforms. Companies such as Tesla, MicroStrategy, and Square are continuing to build on the volume of Bitcoin in their balance sheets.

The level of institutional belief backing Bitcoin is growing at phenomenal speed in a way that was simply unheard of just a few years ago.

With the validation that these institutions provide, coupled with the deflationary, capped supply of Bitcoin, you can begin to understand why a new generation of Bitcoin market participants are deciding to hold onto the Bitcoin that they have. In hindsight, it was a somewhat inevitable outcome, as Elon Musk famously suggested.

Will the sentiment change?

If belief in Bitcoin continues to increase in 2021, the data from Ark Investments suggests that the amount of fluid Bitcoin on the market could become smaller and smaller. In the long run, this may drive prices up ever higher.

Nevertheless, there will likely always be periods where this will cease to be the case. Investors will need to take profits at some point, liquidate positions, and balance portfolios. Only a fool would expect the price of Bitcoin not to continue to be highly volatile, but it is impossible to say if we’ll ever see the return of pre-2020 Bitcoin prices.

Only time will tell whether this trend will continue long into the future and as all investors know, past performance isn’t an indicator of future success. But regardless of how the market acts over the coming months, it appears to be clear that a large subsection of Bitcoin holders have no intention of giving up their Bitcoin holdings however the market reacts. Whichever way one looks at it, the birth of the hodling generation is undoubtedly a promising development for Bitcoin’s role as a long-term store of value.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter and LinkedIn and enter your email address at the bottom of the page to subscribe.