Traders Eye Interest Rate Decision – Which Way Will Bitcoin Go?

Bitcoin was hit with volatility last week as concerns were raised about large BTC transfers related to Mt.Gox and the US government. However, prices rebounded quickly as it was discovered more depositors had fled the traditional banking system.

Uncertainty remains about whether the correlation between banking system turmoil and rising Bitcoin prices is a coincidence or a new trend.

Elsewhere, global payment providers Mastercard and Paypal unveiled new integrations into the world of crypto, as investors prepare themselves for the Fed’s next interest rate decision.

- Bitcoin moves higher despite Mt. Gox flash crash

- Investors prepare for this week’s FOMC interest rate decision

- Payment providers step into the crypto ring at Consensus2023

Bitcoin moves higher despite Mt. Gox flash crash

Bitcoin moved higher last week as ongoing fragility in the banking world was revealed. However, this wasn’t before markets were sent reeling due to concerns about large Bitcoin transfers.

The world’s leading coin was first sent spiraling on Wednesday as concerns were raised that wallets related to Mt. Gox and the US government had transferred large amounts of BTC.

The popular crypto Twitter profile, DB, first publicised the news after receiving an alert from on-chain analytics provider, Arkham.

However, shortly after, it was confirmed that the alert had been sent erroneously by Arkham as a result of a bug fix.

Arkham claiming that the news was an error was not enough to shift Bitcoin prices, the price of the world’s leading crypto crashed over 7% in a single hour and caused over $211 million worth of liquidations.

But, Bitcoin reclaimed those losses extremely quickly as attention turned to the outflow of depositors from the traditional banking system.

Despite the US Federal Reserve calming investors in the aftermath of Silicon Valley Bank’s collapse and Signature Bank’s closure, the banking system continues to be held against the ropes.

Last week, it was the turn of First Republic Bank to be placed under the microscope.

A glimpse of troubles within First Republic Bank surfaced on Monday as the bank released it’s first quarter reports. In the reports, it was confirmed that the bank had lost $104.5 billion in deposits during the first three months of 2023.

On the reopening of the stock market on Tuesday, the bank’s stock price quickly fell 49% to record lows. As discussions continued to ensue between First Republic advisers and government officials, the stock price continued to fall, eventually recording a weekly loss of over 70%.

However, the panic caused within the traditional financial system, coincided with the price of Bitcoin climbing once again.

As news of First Republic’s failure surfaced, Bitcoin eroded losses sustained from the Mt.Gox flash crash and eventually recorded a weekly increase in price of over 5.5%.

It remains to be seen if turmoil in the banking system and rising Bitcoin prices is still a coincidence or a new correlation.

Investors prepare for this week’s FOMC interest rate decision

The volatility from last week could be eclipsed this week as investors’ eyes turn to the latest FOMC meeting.

On 3rd May the US Federal Reserve will decide whether or not to increase the Fed Funds Rate once again and, if so, by how much.

The Fed has been raising rates in response to inflation caused by excessive money printing. The rate hike cycle began in March 2022, and since then, the Fed has implemented several increases, taking the Fed Funds rate to its current level of 4.75-5%.

However, the Fed Chair, Jerome Powell, has suggested during subsequent Fed meetings that interest rates are nearing their maximum level.

It is for this reason that many economists and traders are predicting the Fed will implement one final 0.25% interest rate hike.

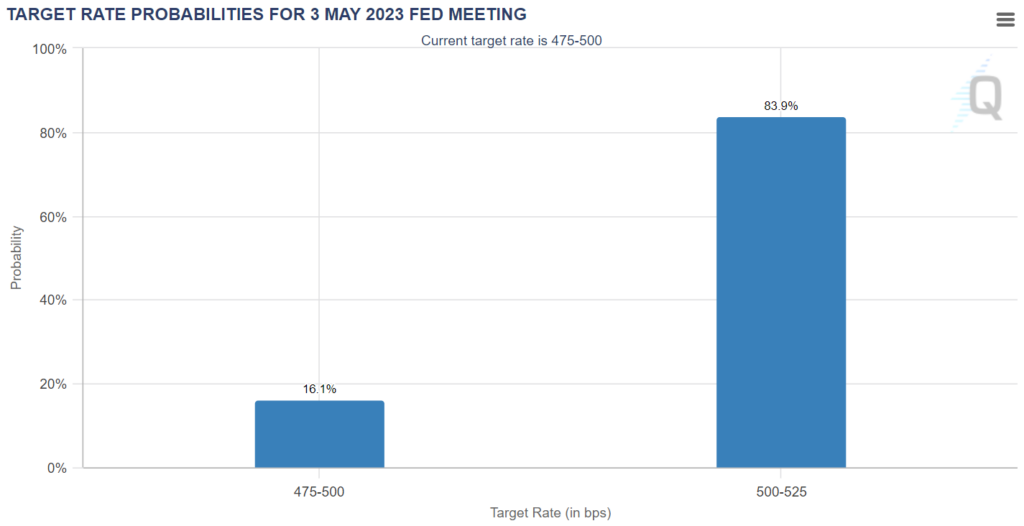

According to the CME’s FedWatch Tool, 83.9% of traders are expecting a 0.25% hike. While the remaining 16.1% are expecting no rate hike.

Traders are then expecting the Fed to hold rates at that level until September 2023 and then begin a cut. However, it is uncertain whether this will happen.

The Fed’s decision-making process is influenced by a range of economic indicators, such as inflation, unemployment, and GDP growth, among others. Crypto investors will continue to watch these indicators closely to gauge how the Fed is likely to act in the future.

What does this all mean for the price of Bitcoin? The anticipated 0.25% rise in interest rates is likely priced into markets already, however, a cut in interest rates is likely to lead to a surge in the price of Bitcoin.

Payment providers step into the crypto ring at Consensus2023

Global payment providers stepped up their crypto game last week at Consensus2023 – a crypto-focused conference in Austin, Texas.

In a move that shows the continued interest of large, global payment processors in crypto, Mastercard has teamed up with public blockchain developers to establish a new set of standards called Crypto Credential.

The project aims to create a way for trusted, compliant, and verifiable interactions to take place on public blockchain networks.

Mastercard is collaborating with public blockchain developers, including Aptos Labs, Ava Labs, Polygon, and The Solana Foundation, to help bring the standards to application developers in their ecosystems.

Wallet providers such as Bit2Me, Lirium, Mercado Bitcoin, and Uphold will also use the tools on an initial project to enable cross-border transfers between the US and Latin America and the Caribbean.

The move will enhance verification in NFTs, ticketing, enterprise, and other payment solutions. The company’s head of crypto and blockchain, Raj Dhamodharan, said, “Instilling trust in the blockchain ecosystem is a critical step towards realizing its full potential.”

During the same conference, PayPal also confirmed that it would be expanding its crypto services to Venmo’s more than 60 million US customers.

The company will now allow Venmo users to transfer supported tokens like bitcoin, ether, bitcoin cash, and litecoin to external wallets and exchanges. This comes a year after PayPal began allowing users to send cryptocurrencies to external wallets.

Venmo processed $245.3 billion in fiat currency transactions in 2022, according to a recent PayPal earnings statement.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.