Crypto Markets Forced Lower As Dormant Bitcoin Wallets Awaken

Bitcoin fell back below $30,000 last week due to increased regulatory scrutiny and threats from a large US crypto platform to move offshore.

Despite Texas passing a crypto-friendly bill late in the week, investors remained on high alert as two long-dormant bitcoin whales transferred large sums of BTC worth $7.8 million and $60.7 million after a decade of inactivity.

Meanwhile, Ethereum staking inflows have – so far – tripled in April compared to March after the Shanghai upgrade.

- Bitcoin falls below $30,000 as regulatory pressures weigh heavy

- Dormant Bitcoin wallets awaken for the first time in a decade

- Ethereum staking deposits increase in the week following the Shanghai upgrade

Bitcoin falls below $30,000 as regulatory pressures weigh heavy

Bullish momentum, spurned from the successful implementation of Ethereum’s “Shapella” upgrade, was stopped in its tracks last week, as the focus shifted back to crypto regulation.

With Bitcoin’s weekly candlestick closing out yesterday evening, the world’s leading crypto asset recorded one of its most bearish weeks since November 2022.

Investors’ minds were plagued by regulatory uncertainty within the US and threats from one of the US’s largest crypto platforms to move offshore. This was topped by the ongoing possibility of an early-May interest rate hike from the Federal Reserve.

Regulation was the topic of conversation for both the United States and the European Union last week.

In Washington, the Securities and Exchange Commission (SEC) continued its crackdown on crypto businesses, with 1,500 firms targeted to date, according to a tweet by SEC Chair Gary Gensler on Monday.

Meanwhile, the European Union passed the Markets in Crypto Assets (MiCA) bill with 517 votes in favor, 38 against, and 18 abstentions on Thursday. The legislation unifies the approach to crypto among the bloc’s 27 member states.

While promising moves were made in Europe, one of the US’s largest crypto platforms, Coinbase, confirmed that it had secured a license to operate in Bermuda. News of the license was accompanied by a tweet from the company’s CEO, Brian Armstrong, that said crypto firms will be forced to develop “offshore havens” if regulatory clarity is not achieved.

Despite threats from Coinbase, a final glimmer of hope came on Friday from the US state of Texas, where the House of Representatives approved a crypto-friendly bill that requires local crypto exchanges to maintain reserves sufficient to fulfill all obligations to customers.

However, this was not enough to prevent both Bitcoin and Ethereum sustaining heavy losses. While Bitcoin occasionally rose above $30,000, it fell on Wednesday and now stands at $27,740 – down 9.1% from last week. Ethereum’s price trajectory was similar, occasionally staying above $2,100 until midweek before dropping to $1,851 – a seven-day loss of 10.1%.

If Bitcoin continues to fall, many technical analysts are now looking for either the 200-week moving average (approx. $26.100) or the $24,000 structural price level to act as key support.

1W chart of BTC/USD

Dormant Bitcoin wallets awaken for the first time in a decade

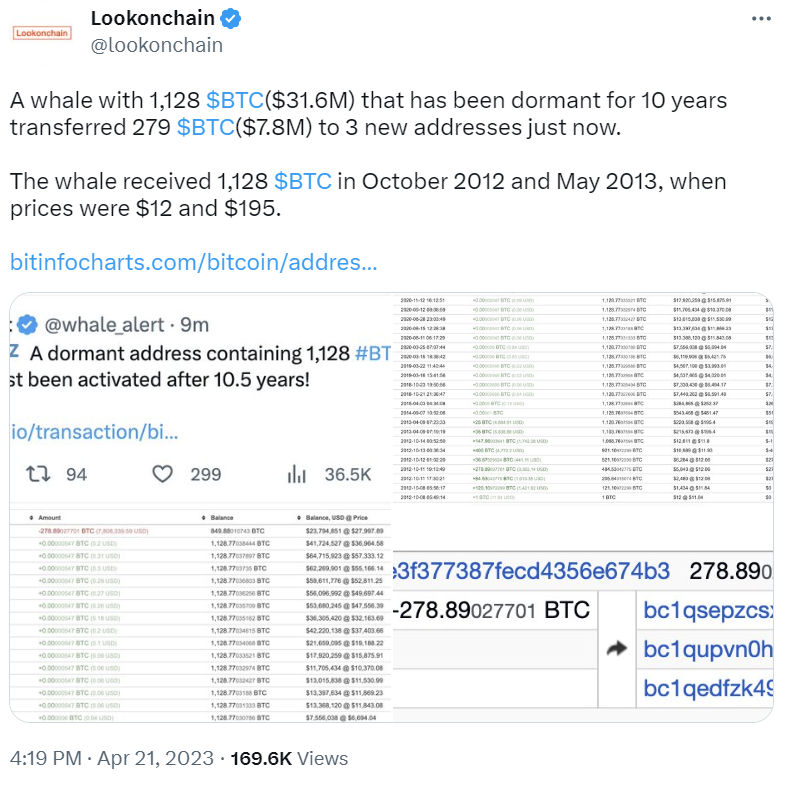

According to a tweet from on-chain analyst, Lookonchain, a long-dormant bitcoin whale transferred 279 bitcoins worth $7.8 million to three fresh addresses on Friday.

This transfer comes after a decade of inactivity.

In October 2012 and May 2013, the wallet received 1,128 bitcoins when the price of bitcoin was around $12 and $195 per coin, respectively.

On the heels of this transaction, another long-dormant bitcoin whale transferred 2,071.5 BTC worth $60.7 million after nine years of inactivity.

The reason behind these moves remains unknown. However, there are speculations that some long-term crypto users may be moving old funds to new wallets as a precaution against a significant and mysterious wallet-draining operation targeting old wallets.

Also weighing heavy on Bitcoin prices last week was the threat of Mt. Gox BTC entering circulation. The deadline for creditors to provide their repayment information passed earlier this month which means that the repayment window is now open.

Mt. Gox is set to distribute an unknown portion of the 142,000 BTC ($3.9 billion), 143,000 BCH ($17.9 million), and 69 billion Japanese yen ($523 million) it holds via payments made in bitcoin, bitcoin cash, and fiat. This payout is expected to take place by October 31, 2023.

This series of events in the cryptocurrency market has raised concerns and questions about the intentions of these long-dormant bitcoin whales.

Moreover, it has sparked debate on whether the market is about to enter a bearish phase or if it’s just a temporary correction before a bullish trend.

Tweet from on-chain analysts, Lookonchain, describing the BTC movement of Bitcoin whales

Ethereum staking deposits increase in the week following the Shanghai upgrade

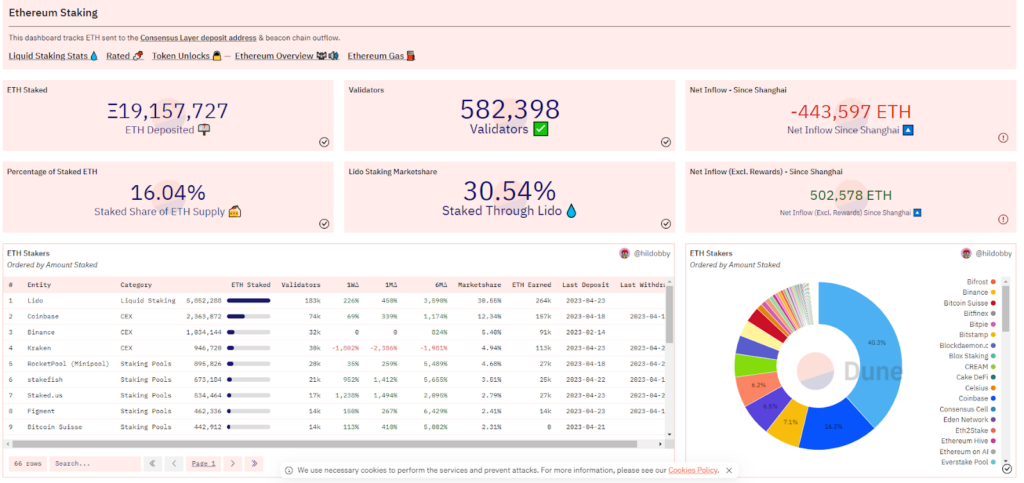

The recent Ethereum upgrade, also known as the Shanghai or Shapella upgrade, has sparked significant interest in staking among institutional investors.

According to CoinDesk, the upgrade has resulted in top institutional-grade ETH staking providers recording three times larger inflows in April compared to March. Around 80% of these inflows occurred after the Shanghai upgrade went live on April 12th.

The upgrade, which allows investors to actively unstake ETH coins from Ethereum’s Beacon Chain, enabled the withdrawal of approximately 18 million tokens worth $35 billion, which were previously locked in staking contracts.

Despite the initial withdrawal, Ethereum’s price rallied to $2,100 shortly after the upgrade – its highest level in 11 months.

The unlocking of staked tokens also reduced the liquidity risk associated with locking up Ethereum for staking, which has previously kept some investors away. Analysts expect this to naturally increase staking rates after the initial drawdown of ETH from long-term validators.

A survey conducted by Kiln, an institutional-grade staking service provider, showed that 68% of investors intended to start staking or increase their staked amount after the Shanghai upgrade. The survey was conducted in February, before the upgrade went live, but initial reports suggest that things are looking promising.

Kiln’s co-founder and chief operating officer, Thomas de Phuoc, reported a fresh wave of interest in staking, even from traditional finance firms. According to analytics extracted from Dune Dashboard, $47 million worth of ETH (24,640 ETH) has been deposited since the Shanghai upgrade.

While the above data is promising, it is still early to draw definitive conclusions, as not all staking providers have enabled withdrawals immediately.

Ethereum staking statistics from Dune Analytics

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.