Crypto Markets Buoyant Despite Fed Warning & SEC Scrutiny

Despite a week of bearish macroeconomic news and SEC scrutiny, the crypto market remained exceptionally buoyant, with Bitcoin and Ethereum securing new highs for 2023.

Even with the Fed remaining steadfast in its view of higher for longer interest rates and the SEC targeting multiple companies and individuals within the crypto space, Bitcoin and Ethereum climbed to prices not seen since June 2022.

In other news, Amazon teased a potential entry into the NFT space which could further help to bring Web3 adoption to the masses.

- Bitcoin price rebounds from Fed’s hawkish narrative

- Crypto navigates further SEC scrutiny

- Amazon teases entry to NFT space

Bitcoin price rebounds from Fed’s hawkish narrative

This week was an eventful one in the world of cryptocurrency, despite the relatively stable appearance of Bitcoin and Ethereum prices.

Behind the scenes, major economic and regulatory events were taking place that could have significant long-term impacts on the industry.

One of the most significant events was the announcement by the Federal Open Market Committee (FOMC) of another 0.25% interest rate hike.

This move was not unexpected, but it has caused concern for some investors who worry about the impact on the market.

Alongside the 25 basis point hike, the FOMC also raised its Core PCE inflation estimates for 2023 to 3.3% from 3.1%, which could indicate that further rate hikes are likely in the future.

This scenario was further solidified as the Fed Chair, Jerome Powell, took to the stand during the subsequent Fed Press Conference.

Powell reiterated that the Fed remained steadfast in its position to bring US inflation down from its current standing of 6% to a target rate of 2%. He explained that this will require interest rates to stay higher for longer.

As a result of this hawkish stance, Bitcoin quickly tumbled to a weekly low of $26,700.

However, the dip was short-lived, as market participants began to question the credibility of Jerome Powell’s claims.

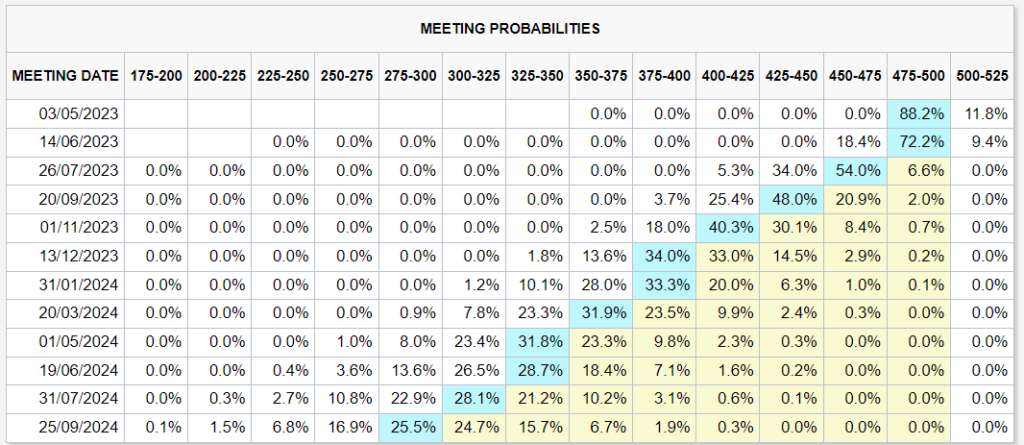

According to the CME’s Fed Watch tool, even after Powell’s comments, traders are still expecting the Fed to begin cutting interest rates as early as July 2023.

As a result, Bitcoin continued to push higher on Thursday and Friday, eventually securing a new 2023 high of $29,400, before briefly falling away over the weekend.

If the Fed surprises the market by maintaining high interest rates over the next few months, increased volatility should be expected.

Looking ahead, next week’s economic calendar includes important events such as the quarterly GDP data on March 30 and core personal consumption expenditure data on March 31. These events could have an impact on the market and influence investor sentiment.

FOMC future interest rate probabilities taken from CME FedWatch Tool

Crypto navigates further SEC scrutiny

On March 23, Coinbase, one of the largest crypto platforms in the US, received a Wells notice from the SEC last week indicating that the agency is investigating the company’s staking service, Earn program and Wallet.

A Wells notice is not a formal charge but a notification of an investigation.

After receiving the notice, Coinbase immediately released a blog post explaining the situation from its perspective and tried to reassure customers that its products and services would continue to operate as usual.

However, shares of Coinbase dropped more than 15% in after-hours trading, reflecting investors’ concerns about the outcome of the investigation.

Legal Officer Paul Grewal said in the blog post that Coinbase is confident in the legality of its assets and services and is prepared for a legal process if necessary. He also accused the SEC of not being fair or reasonable in its engagement with digital assets.

However, the SEC did not stop there, and on the same day, also issued serious charges against Tron founder Justin Sun.

The SEC alleges that Sun sold and airdropped unregistered securities, committed fraud, and engaged in market manipulation relating to Tronix (TRX) and BitTorrent (BTT) tokens.

The agency also accused Sun of manipulating TRX’s secondary market through an “extensive wash trading” scheme, in which he allegedly had his employees engage in more than 600,000 wash trades of TRX between two crypto asset trading platform accounts he controlled.

According to the SEC, Sun generated $31m in proceeds for himself and his companies by selling TRX into the market.

In addition, the SEC also charged several celebrities during the week, including Lindsay Lohan, Jake Paul, Soulja Boy, Lil Yachty, Ne-Yo, Akon, and Michele Mason, with illegal touting charges for promoting TRX and BTT without disclosure. Most of the celebrities settled the charges.

Despite the charges brought forward by the SEC, crypto prices seemed unphased. After a slight decline on Wednesday, both Bitcoin and Ethereum climbed by 4% and 6% respectively on Thursday.

Amazon teases entry into NFT space

According to reports from CoinDesk’s managing editor, Nikhilesh De, the e-commerce giant, Amazon, may be integrating digital tokens and a gallery onto its platform.

De received a confirmation email after a subscription to Amazon Prime Video was automatically renewed.

However, instead of just confirming the renewal, the email provided new insights into Amazon’s plans for Web3 expansion and the possible integration of NFTs.

De was told that a digital token had been deposited into a gallery on Amazon and was told that the token could be resold after it had been unlocked.

However, links in the email were broken, therefore, the details of how these NFTs will be integrated into the platform remained unclear.

Rumors have been circulating for weeks that Amazon is preparing to launch its own NFT marketplace.

According to crypto news site Blockworks, in early March Amazon confirmed that it was planning to create a new “digital assets enterprise” that will focus on “blockchain-based gaming and related NFT applications.”

The Big Whale also reported earlier this month that the NFT platform would be available on the site through a tab that says “Amazon Digital Marketplace” and will launch on April 24.

In January, Amazon Web Services also partnered with Ava Labs, the developers behind the Avalanche blockchain, so that it could enter the enterprise blockchain niche.

If Amazon does launch its own NFT marketplace, it could be a huge step toward the mass adoption of Web3 and blockchain technology.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.