Bitcoin Whales Are Stacking as XRP Celebrates 11th Birthday

As the crypto market recovers from US debt ceiling uncertainty, Bitcoin Whales are accumulating. Fresh on-chain data released last week has sparked new speculation about what unique insights these large investors have and what it could mean for future price movements.

Accompanying interesting on-chain data, a transactional metric, known as the bitcoin option put/call ratio, showed a significant decline last week which historically aligns with a shift to a more positive market outlook.

Meanwhile, XRP, the world-renowned cryptocurrency, celebrated its 11th birthday with recent price increases and growing optimism surrounding a potential resolution to the Ripple-SEC lawsuit.

- Bitcoin whales defy market trend with continued accumulation

- Bitcoin options put/call ratio signals bullish outlook

- XRP celebrates its 11th birthday

Bitcoin whales defy market trend with continued accumulation

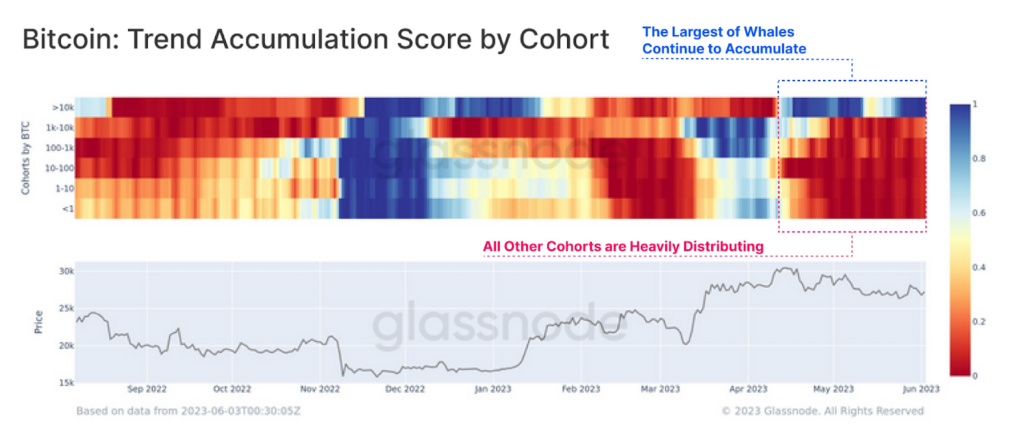

On-chain data from Glassnode revealed an intriguing trend last week among the largest Bitcoin whales (those holding over 10,000 BTC).

The key metric used to observe this fascinating trend is the “Trend Accumulation Score” – an on-chain metric that gauges whether investors buy or sell Bitcoin.

The Trend Accumulation Score takes into account two main factors: 1) changes in wallet balances and 2) the size of the investors making those changes. The larger the investor making a move, the more weightage they carry in the Trend Accumulation Score.

When the metric approaches 1, it indicates that more oversized holders are currently accumulating Bitcoin or that a significant number of small investors are exhibiting this behavior. Conversely, a value near zero suggests a distribution trend among investors.

Notably, the market’s investors are divided into six cohorts based on their BTC holdings: under 1 BTC, 1 to 10 BTC, 10 to 100 BTC, 100 to 1,000 BTC, 1,000 to 10,000 BTC, and above 10,000 BTC.

As we can see from the graph, since Bitcoin surpassed the $30,000 mark in mid-April 2023, the majority of investor cohorts have been selling, exhibiting what is called ‘moderate distribution behavior.’

However, whales holding above 10,000 BTC have chosen to buck that trend.

Instead of selling, the largest of Bitcoin whales have aggressively accumulated and expanded their wallets since April 2023. This is a move opposite to the direction of the general market.

This has left many analysts asking the question – do whales know something that the majority don’t?

The behavior of Bitcoin whales provides an intriguing glimpse into the dynamics of the cryptocurrency market. As these larger investors continue to stack BTC while the rest of the market distributes, their actions leave an intriguing question regarding the future price of the world’s most prominent digital asset.

Bitcoin options put/call ratio signals bullish outlook

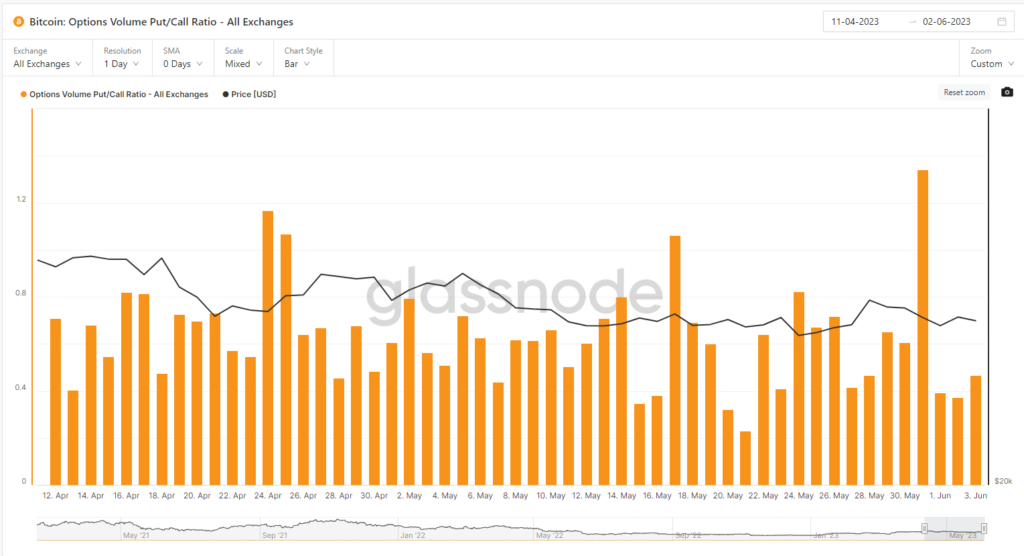

In a promising turn of events for the cryptocurrency market, the bitcoin options put/call ratio has witnessed a significant decline, indicating an important shift in investor sentiment.

Bitcoin options contracts are derivative products that allow investors to profit from future price movements. Puts provide the buyer the right to sell an asset at a predefined price in the future, while calls provide the buyer the right to buy an asset at a predefined price.

Therefore, the bitcoin options put/call ratio highlights if there are more investors preparing for more downside or more upside.

If uncertainty is plaguing the market, the metric tends to increase in value. Meanwhile, if investors are more positive, the metric tends to decrease in value. A value below 1 suggests that investors currently hold a positive market outlook.

According to data collected by Glassnode, the value of the metric dropped from 1.34 at the start of June to a current value of 0.47.

In particular, the volume of purchased puts and calls revealed a notable decrease in traders seeking downside protection against potential price declines.

This decline in the ratio metric comes as worries surrounding the debt deal, which sparked concerns among investors, begin to fade.

In June, clashes between U.S. lawmakers over raising the country’s debt ceiling fueled uncertainty, leading to a spike in demand for protection.

However, with a US debt deal now on the cards, the decline in the bitcoin options put/call ratio suggests that crypto investors are feeling less apprehensive compared to the previous month.

XRP celebrates its 11th birthday

XRP, the world-renowned cryptocurrency, turned 11 on June 2nd. Confirmed by members of the XRP community, XRP holders celebrated the coin’s anniversary and firm position as a key player in the blockchain industry.

Over the past decade, XRP has captured the attention of investors and enthusiasts, showcasing its enduring value in the ever-evolving landscape of digital finance.

As XRP embarks on its next chapter, it continues to generate excitement among long-time supporters and newcomers to the world of cryptocurrency, which was reflected in the coin’s recent price increases.

Over the last seven days, the coin’s price has increased by more than 10%, with each XRP now worth $0.53.

Alongside news of its anniversary, optimism surrounding a resolution between Ripple and the SEC has helped to lift prices higher.

The Ripple vs SEC lawsuit, which began in December 2020, initially caused a sharp decline in XRP’s price, causing the coin to plummet to $0.16.

However, as the legal battle potentially nears its conclusion, XRP has made significant gains, with enthusiasts eagerly anticipating a positive outcome.

With XRP’s total market cap surpassing $27 billion, stakeholders now eagerly await the final verdict as the resolution of the Ripple-SEC lawsuit holds the potential to both reshape the trajectory of XRP and set a precedent for other cryptocurrency projects within the US.

In another positive twist, HSBC, one of the largest banks in Europe by total assets, mentioned that the XRP Ledger was one of the future options for cross-border payments.

Edward Farina, a crypto-enthusiast and educator, tweeted on Wednesday explaining that the financial institution had referred to Ripple’s XRP Ledger directly, and sees huge potential in Distributed Ledger Technology as a whole.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.