Bitcoin Whales Accumulate Triggering Optimism

According to on-chain metrics, the actions of Bitcoin whales are beginning to form a bullish on-chain pattern that has not been seen since 2021.

Transitioning to the political arena, former President, Donald Trump, surprised everyone with an endorsement of Bitcoin.

Shifting gears, Reddit disclosed its cryptocurrency holdings and intentions to go public, and, lastly, AI-focused cryptocurrencies went on a meteoric rise, propelled by the dual catalysts of OpenAI’s groundbreaking Sora launch and NVIDIA’s stellar earnings report.

It’s been a busy week in the crypto arena, so let’s dive in.

Bitcoin whales are accumulating from ‘small fish’

A new trend is emerging that could signal significant price movements on the horizon.

Traditionally, the activity of large holders, often referred to as “whales” in the industry, has been closely monitored for its impact on Bitcoin’s price trajectory.

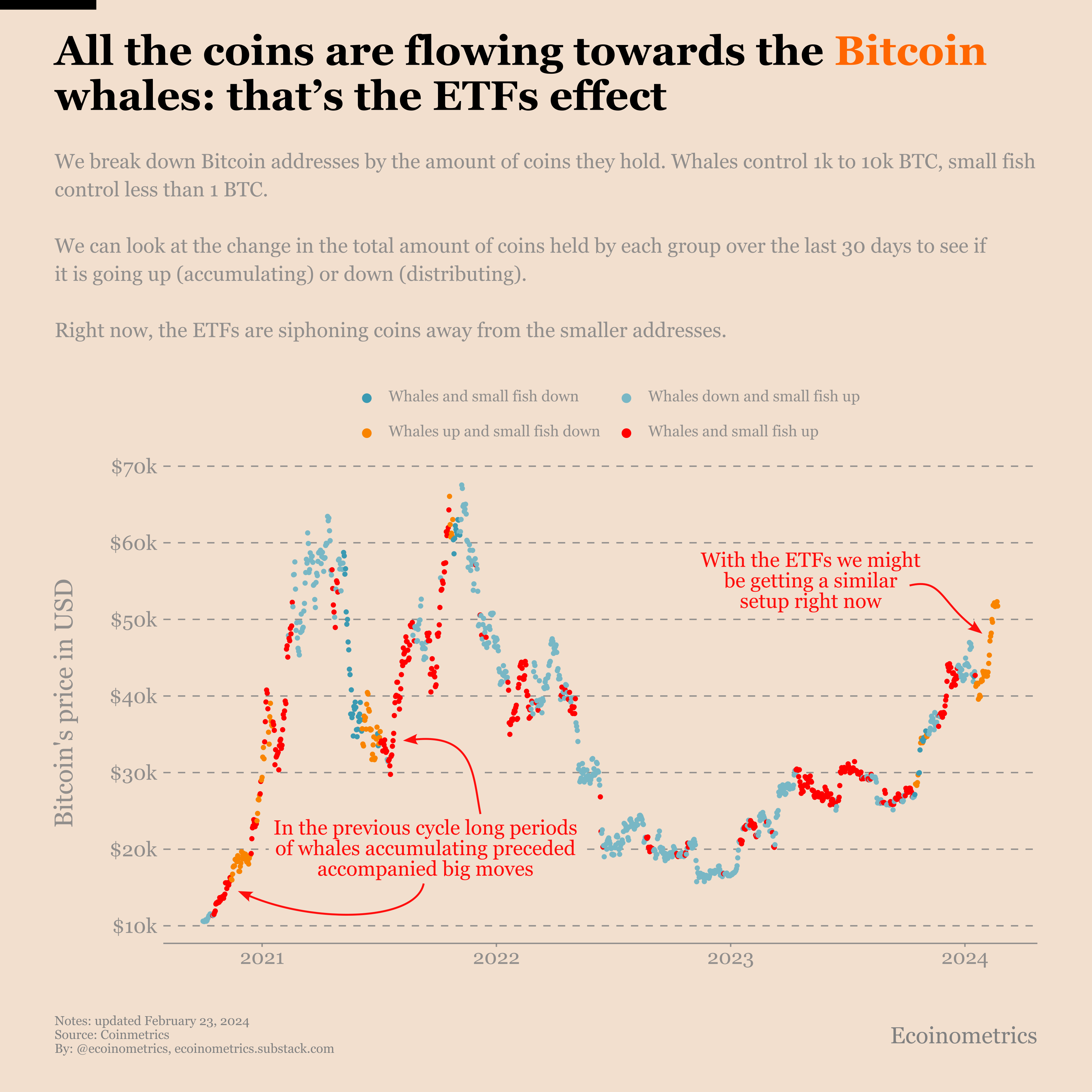

According to Ecoinometrics, these whales, typically comprising addresses with holdings ranging from 1,000 to 10,000 BTC, have historically influenced market sentiment and price action.

Recent data suggests a notable uptick in whale activity, particularly in the accumulation of coins.

This accumulation trend, highlighted by a confluence of orange and red points on market charts, has historically coincided with substantial price increases in Bitcoin.

Presently, market observers are witnessing another wave of accumulation, potentially signaling the onset of a significant market shift.

The catalyst behind this accumulation appears to be the growing influence of ETFs in the cryptocurrency landscape.

These investment vehicles are increasingly channeling coins towards whale addresses, with a considerable portion of these assets originating from smaller investors’ addresses.

The prevalence of orange dots on market charts further reinforces this observation, indicating a transfer of assets from retail investors to larger institutional players.

The implications of this trend are multifaceted and invite speculation about the direction of the market in the near term.

While historical on-chain patterns have traditionally offered insights into market dynamics, the emergence of ETFs introduces a new layer of complexity.

Analysts remain divided on the reliability of these historical patterns in light of evolving market conditions. However, many view the current accumulation trend as a source of cautious optimism, dubbing it “hopium” amidst uncertain market conditions.

Trump signals positive sentiment for Bitcoin

In a recent Fox News interview conducted at a town hall event in Greenville, South Carolina, former President Donald Trump addressed the surging popularity of Bitcoin amidst speculation surrounding the upcoming presidential election.

Alongside US Senator Tim Scott, Trump delved into his views on the leading cryptocurrency, highlighting its growing acceptance and decentralized nature.

Contrary to his previous stance as US President, where he expressed skepticism towards Bitcoin and cryptocurrencies, Trump acknowledged the expanding adoption of Bitcoin, stating, “A lot of people are doing it.”

While reiterating his preference for the dollar, Trump emphasized the undeniable momentum behind Bitcoin, noting that it has taken on “a life of its own.”

Trump’s evolving perspective on Bitcoin comes amid a broader shift in political dynamics, with pro-crypto sentiments gaining traction among certain circles.

Speculation had already been rife regarding a potential change in Trump’s stance on crypto, particularly given the increasing support for digital assets among certain segments of the electorate.

The upcoming presidential election holds significant stakes, according to Trump, who emphasized the gravity of the current situation, asserting that the future of the country hangs in the balance.

Reddit reveals crypto holdings

In a recent SEC filing, popular social media platform Reddit has unveiled its intentions to enter the public market while also disclosing significant investments in the cryptocurrency realm.

The filing discloses Reddit’s acquisition of Bitcoin and Ethereum as part of its strategy prior to going public.

The company disclosed that it has diversified its assets by investing in Bitcoin and Ethereum, in addition to acquiring Polygon (MATIC) for transactions involving virtual goods.

This move signifies Reddit’s acknowledgment of the growing prominence and potential of cryptocurrencies in the financial landscape.

Reddit stated in its filing that the acquisition of these digital assets serves multiple purposes, including investment diversification and facilitating transactions within its platform. The company clarified that the current value of these holdings is deemed negligible in the financial reports.

Moreover, Reddit’s foray into the cryptocurrency space isn’t a recent development.

In 2020, the platform introduced Moons and Bricks tokens built on Ethereum’s blockchain, as a form of reward for users contributing to specific subreddits. While this initiative was discontinued later, it exemplifies Reddit’s early exploration of crypto-based incentives.

With plans to trade on the New York Stock Exchange under the ticker symbol RDDT, Reddit’s move to disclose its cryptocurrency investments and intentions to go public underscores the evolving relationship between traditional finance and the burgeoning crypto market.

Furthermore, Reddit has expanded its involvement in the digital asset realm by launching an extensive NFT avatars project on Polygon.

These NFT avatars, featuring the platform’s iconic “Snoo” mascot, have garnered immense interest, with over 34 million units minted to date. Collaborations with entities like the NFL highlight Reddit’s commitment to exploring innovative avenues within the cryptocurrency space.

AI-driven cryptocurrencies surge on dual boost

Cryptocurrency tokens centered around artificial intelligence experienced a significant surge, bolstered by two pivotal events.

Firstly, the launch of OpenAI’s text-to-video generator, Sora, injected fresh optimism into the AI sector, sparking a rally in related tokens.

According to CoinGecko data, AI tokens recorded an average jump of 7.7% over the subsequent weekend, with notable increases seen in Ocean Protocol and Fetch.AI.

Furthermore, Ethereum co-founder Vitalik Buterin’s endorsement of AI’s potential role in smart contract auditing via Twitter fueled additional gains.

The momentum in AI-focused cryptocurrencies then received a significant boost following NVIDIA’s robust fourth-quarter earnings report, which surpassed analysts’ expectations.

The chipmaker reported earnings per share of $5.16, exceeding the consensus estimate of $4.59, and revenue of $22.1 billion, higher than the projected $20.4 billion.

Jensen Huang, NVIDIA’s founder and CEO, highlighted the surging global demand for accelerated computing and generative AI, driving the company’s impressive performance.

NVIDIA’s bullish outlook further buoyed investor sentiment, with the company forecasting first-quarter revenue of $24 billion, surpassing analysts’ estimates of $22.2 billion.

The strong performance of NVIDIA shares, which surged over 7% in post-market trading, contributed to broader market optimism, with S&P 500 futures gaining 0.5%.

CoinGecko data indicates that the collective market capitalization of AI tokens has now exceeded $17.8 billion.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.