Bitcoin Climbs on Debt Ceiling Agreement & Hong Kong Announcement

Bitcoin and the broader cryptocurrency market rebounded last week as positive developments emerged on multiple fronts.

Firstly, the US government reached a tentative agreement to suspend its debt ceiling, alleviating concerns of a potential default.

Secondly, China surprised the market by confirming that retail investors in Hong Kong would soon be able to trade cryptocurrencies, signaling a shift in its previous stance on crypto.

Meanwhile, Ethereum witnessed a significant decline in its presence on centralized exchanges, with a dwindling supply indicating a growing preference among investors to hold and stake ETH rather than sell it.

- US default agreement helps relieve market uncertainty

- China confirms that crypto trading will return to Hong Kong

- Ethereum held on exchanges hits 5-year low

Bitcoin climbs as US debt ceiling agreement-in-principle is reached

Bitcoin and the broader cryptocurrency market bounced over the weekend as the US government reached a tentative deal to suspend its debt ceiling.

According to House Speaker, Kevin McCarthy, on May 27, he and President Biden had reached an agreement in principle that would resolve the months-long negotiations over the $31.4 trillion debt ceiling.

The stalemate over the debt ceiling had raised concerns about a potential US default, which could have had disastrous consequences for the economy.

President Biden echoed these concerns, warning of an economic recession, devastated retirement accounts, and job losses in the event of a default.

The Treasury Department had estimated that without a deal, the federal government could run out of money for all its obligations by June 5. This outcome had been hanging over the head of risk-on assets, including Bitcoin, which had fallen for consecutive weeks.

However, the new agreement – although still subject to congressional approval – would suspend the debt limit until January 2025 and introduce spending caps for the 2024 and 2025 budgets.

Additionally, it would involve reclaiming unused COVID funds and implementing additional work requirements for food aid programs.

As other markets were closed, the crypto market served as a signal for the overall market reaction, with Bitcoin climbing over 6% since the news was confirmed.

Bitcoin surpassed the $27,000 level during early trading hours on Sunday, accompanied by gains in other prominent cryptocurrencies such as Ethereum, XRP, and Dogecoin.

The resolution of the US debt ceiling issue brings temporary relief to the financial markets, including the cryptocurrency sector. However, it remains to be seen how this agreement will shape the broader economic landscape and influence investor sentiment in the long run.

China confirms a return of crypto trading to Hong Kong

In a surprising announcement, China confirmed last week that retail investors in Hong Kong will soon be allowed to trade cryptocurrencies.

The news, which was revealed on Chinese national television, marks a significant shift in China’s previous efforts to ban cryptocurrencies since 2013.

But far from banning cryptocurrencies, the Securities and Futures Commission in Hong Kong is now hoping to position the region as a hub for crypto development.

According to reports, starting from June 1st, 2023, new regulations will enable Hong Kong retail investors to trade major cryptocurrencies.

Although the specific cryptocurrencies eligible for trading are not yet disclosed, many believe that Bitcoin and Ethereum are probable candidates. Other large-cap cryptocurrencies could then follow.

The potential reentry of the Chinese economy back into the cryptocurrency industry has got many investors excited.

The Chinese economy was ranked the second largest in the world in 2022 with a staggering $18.3 trillion GDP.

Although the region of Hong Kong is smaller, many believe that this news could mark the first steps for China fully reentering the crypto space.

After news of the announcement, Bitcoin climbed over 3% back toward the local resistance level of $27,000.

As the crypto industry awaits further developments, the prospect of Hong Kong becoming a crypto hub and China’s potential return to the market is poised to reshape the landscape of cryptocurrency trading.

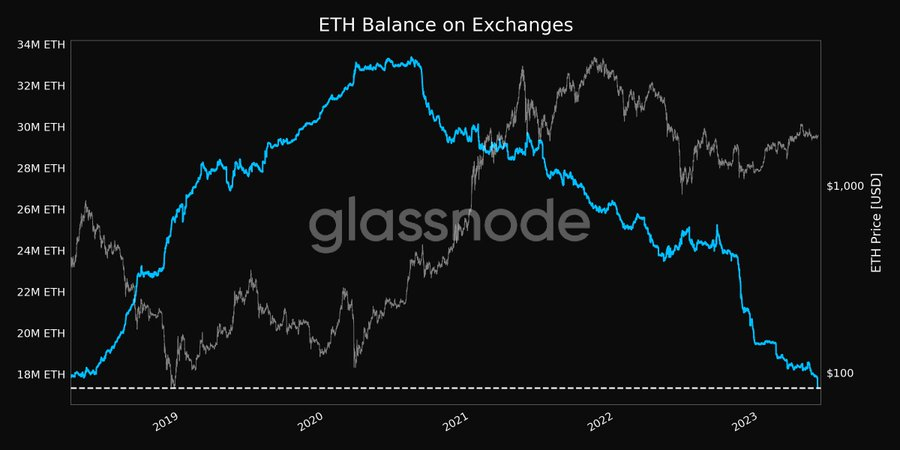

Ethereum held on exchanges hits 5-year low

Ethereum’s presence on centralized crypto exchanges has reached its lowest point in five years, with the balance of ETH dropping to a mere 17.86 million on May 26 – a decline in exchange supply that is reminiscent of levels not seen since April 2018.

Glassnode data reveals that currently, only 14.85% of the total Ethereum supply is held on centralized exchanges.

This marks a notable decrease from the 25-26% held during the cryptocurrency’s bullish run in 2021.

The dwindling ETH supply on exchanges has been an ongoing trend since September 2022, with a significant drop occurring after the FTX crisis in November.

Alongside the decline in exchange balances, the number of Ethereum wallet addresses holding more than 100 ETH has also hit a six-month low.

Crypto analysts believe the reduced presence of ETH on exchanges can be attributed to two key factors.

First, the collapse of the FTX crypto exchange prompted many users to transfer their assets from exchange wallets to self-custody wallets.

Second, the Shapella upgrade allowed validators to withdraw their staked ETH.

But contrary to expectations, only a minority of validators chose to unstake their holdings. The majority simply withdrew their staking rewards, resulting in a shift of ETH away from exchanges.

This movement of assets away from centralized exchanges is regarded as a positive signal, indicating that traders and investors are opting to hold onto their ETH rather than sell it at the current price.

The diminishing supply of Ethereum on exchanges also signifies growing confidence among market participants in the long-term potential of the cryptocurrency.

Instead of selling ETH, investors are choosing to hold and stake it, which could have implications for Ethereum’s future price dynamics and overall market outlook.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.