Analysts Eye Positive Year for Ethereum as Dencun Goes Live on Testnet

Bitcoin miners, once in accumulation mode, initiated an unprecedented sell-off over recent days, offloading over 10,000 Bitcoins in a single day—a significant shift in reserves.

However, a silver lining emerged that the sustainability of Bitcoin mining operations has peaked to all-time high levels, showcasing the network’s trend towards eco-friendly practices.

Meanwhile, the success of Bitcoin Spot ETFs has not only attracted substantial inflows exceeding $2.6 billion but has also paved the way for Nasdaq and Cboe to file options trading applications.

Finally, analysts are predicting a bullish 2024 for Ethereum as the world’s second-largest blockchain network regains dominance.

As always in crypto, there’s a lot of moving pieces, so let’s jump in!

Bitcoin miners switch to ‘sell mode’

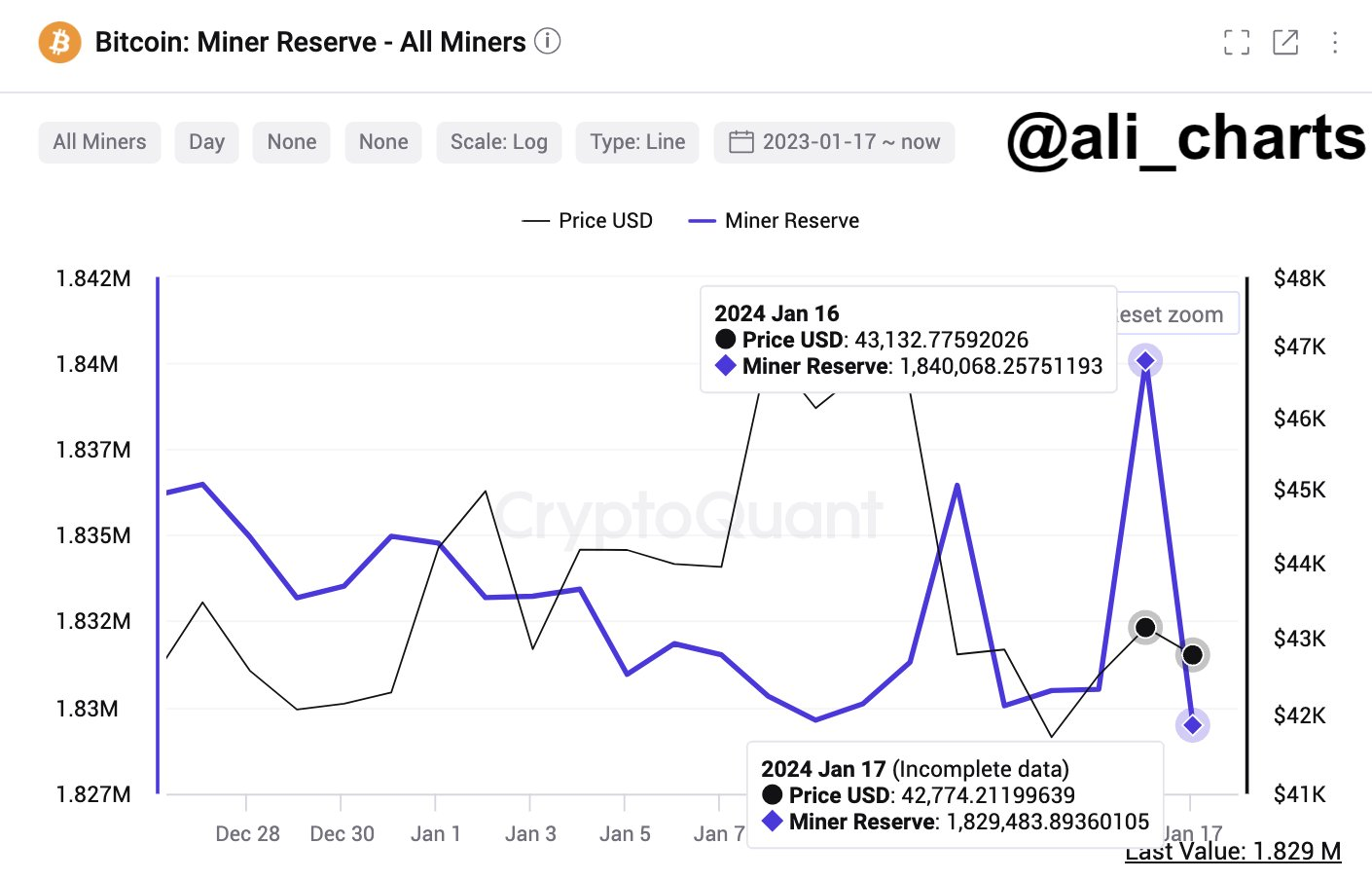

Bitcoin miners unleashed a massive sell-off this week, parting ways with over 10,000 Bitcoins in a single day, marking the most significant daily decline in miner reserves in over a year.

According to data from on-chain analytics provider CryptoQuant, on Jan. 17, Bitcoin miner reserves plummeted by 10,233 BTC, equivalent to approximately $450 million at current market prices.

The shift towards selling follows a period of accumulation by miners.

Beginning around mid-2023, miners started accumulating Bitcoin during times of lower prices and profitability. However, with the recent surge in Bitcoin’s value, miners have swiftly transitioned into selling mode, a historical pattern observed when prices and profitability reach new highs.

The price of Bitcoin has been oscillating in the $41,000 to $42,000 range in recent days, prompting miners to seize the opportunity to replenish cash flow or capitalize on higher prices in the ongoing rally.

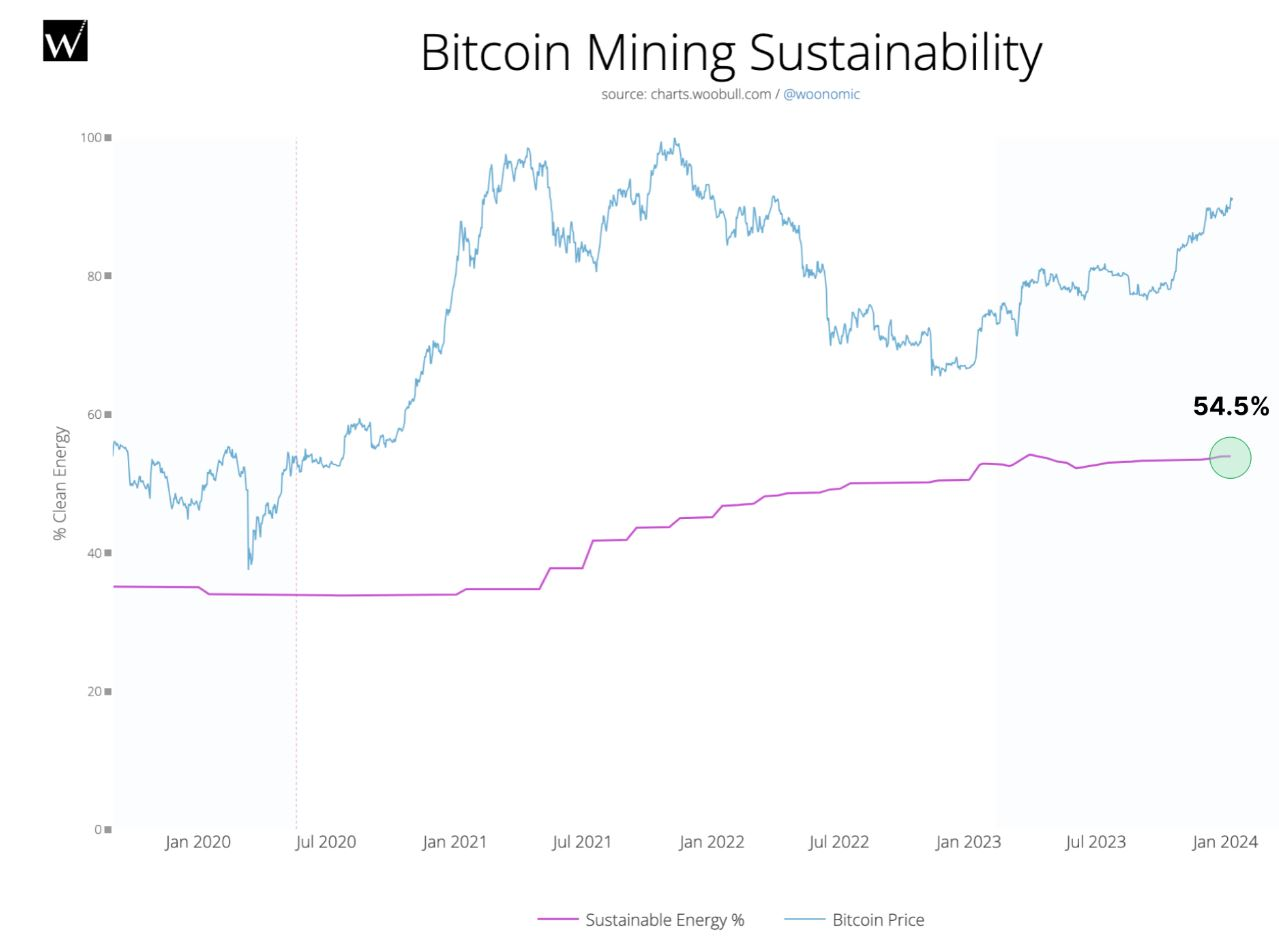

Sustainability energy usage peaks for Bitcoin blockchain

Amidst the concerns surrounding the sell-off, the latest data from the Bitcoin ESG Forecast reveals that Bitcoin mining has achieved an all-time high in sustainable energy usage, reaching an impressive 54.5%.

This substantial increase in sustainable mining represents a 3.6% uptick over the course of 2023.

The Bitcoin ESG Forecast analyzed data from its Bitcoin Energy and Emissions Sustainability Tracker (BEEST) model, comparing Bitcoin’s sustainable energy mix to other industries globally over the past four years.

Bitcoin mining emerges as a leader in sustainable energy usage, outpacing multiple subsectors with its 54.5% utilization of sustainable energy.

Notably, the Bitcoin network is mitigating 7.3% of all its emissions without offsets, showcasing a remarkable achievement and the highest level of non-offset-based emission mitigation across industries.

The research also shed light on innovative approaches by some mining companies, such as utilizing vented methane to generate electricity for Bitcoin mining.

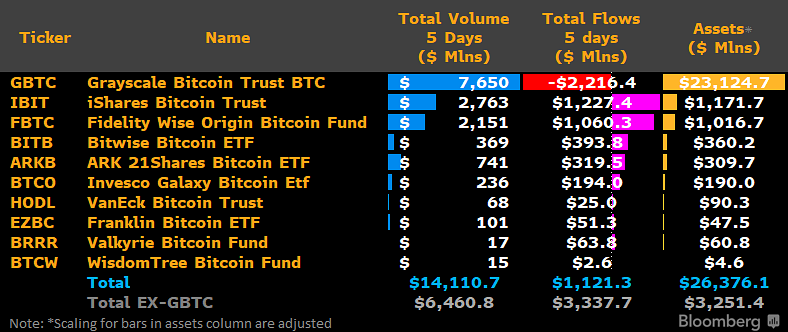

Bitcoin ETF success leads to options trading filings

Since the launch of Bitcoin Spot ETFs on January 11th, net inflows of BTC have climbed above $2.6 billion, with BlackRock and Fidelity leading the pack among new contenders.

As a result of Spot ETFs early success, Nasdaq and the Cboe have submitted applications to the SEC to introduce options trading for the new exchange-traded funds.

The SEC swiftly acknowledged these proposals on January 19, marking a significant stride in the evolution of cryptocurrency trading.

Nasdaq’s proposal involves a rule change to facilitate the listing and trading of options on BlackRock’s iShares Bitcoin Trust.

Simultaneously, the Cboe sought approval to trade options on “ETPs [exchange-traded products] that Hold Bitcoin.”

Bitcoin ETFs commenced trading on both Nasdaq and Cboe on January 11, following SEC approval the day before.

According to a CNBC interview with Catherine Clay, the Executive Vice President at Cboe, expressed satisfaction with the performance, the exchange experienced “good inflows” into the BTC ETFs, aligning with the anticipated tracking of BTC prices.

According to Clay, options trading is now considered “the next logical step” for BTC ETFs, offering enhanced utility and risk mitigation.

Cboe filed for permission to list options just last week, and Catherine Clay acknowledged the uncertainty surrounding regulatory approval. “We’re really in this holding pattern to see what the regulators will do with our filing and other exchanges’ filings as well,” she explained.

Options products enable investors to buy or sell assets at predetermined prices and times and are expected to attract a diverse range of market participants.

According to James Seyffart, a leading market analyst who has been covering the Bitcoin ETF story for the past 10 months, the acknowledgment from the SEC has come quicker than usual.

He suggested that options trading approval might materialize before the end of February IF the SEC wants to move quickly.

Analysts predict a bullish 2024 for Ether after Dencun upgrade

Ethereum is poised for a potential surge in 2024, riding on the wave of the upcoming Dencun upgrade and a growing narrative around spot ETFs, analysts suggest.

The ETH-BTC ratio has already seen a 19% increase in the first three weeks of the year, rebounding from a 25% decline in 2023.

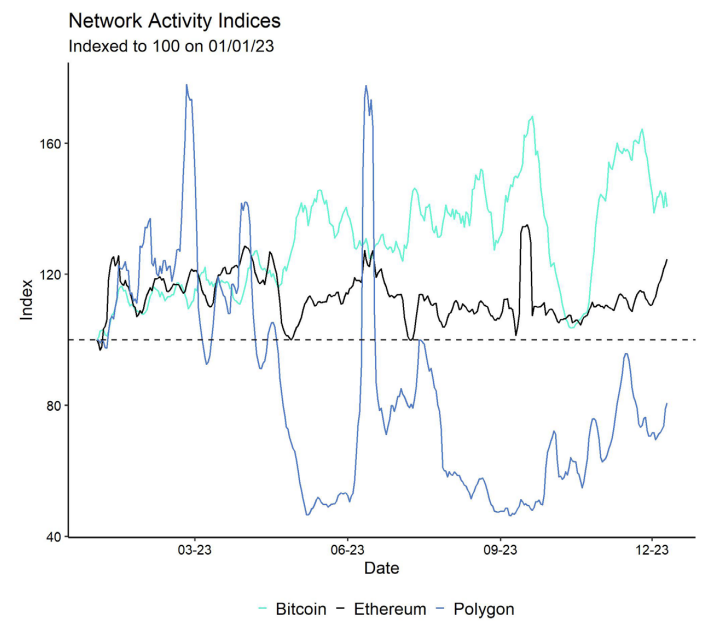

In 2023, Ether underperformed Bitcoin due to the latter’s smart contract and non-fungible token narrative, coupled with optimism surrounding spot ETFs.

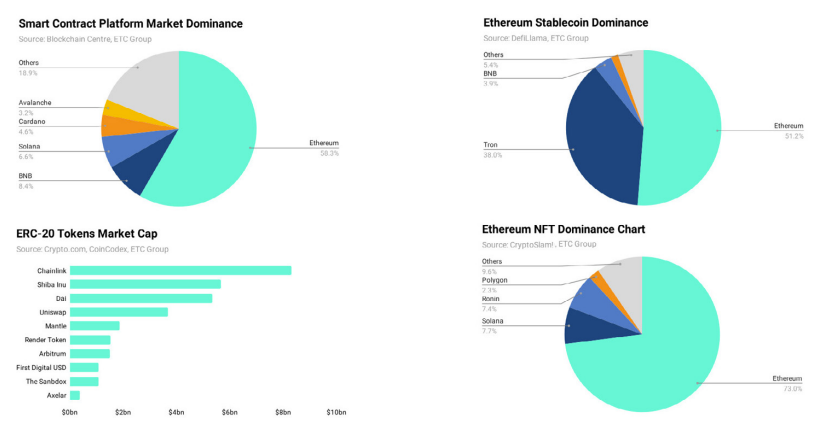

However, analysts anticipate a renewed interest in Ether this year as the spot ETF narrative gains momentum, and Ethereum continues to dominate the decentralized finance and NFT sectors.

Nasdaq-listed crypto exchange Coinbase expressed optimism, stating, “ETH could be poised for a breakout year,” especially with major players like BlackRock and VanEck exploring Ether-based spot ETFs following the success of Bitcoin ETFs.

Ethereum’s forthcoming Dencun upgrade, designed to enhance mainnet scalability with the introduction of “data blobs,” is expected to catalyze investor interest further.

The upgrade, already live on Ethereum’s Goerli testnet, introduces a mechanism where the network only needs to confirm the correctness of attached blob data instead of verifying each transaction individually.

Coinbase noted that this upgrade could potentially reduce network fees by 90% or more.

In addition, institutional demand for Ether remains robust, with ETC Group’s annual report emphasizing Ethereum’s continued dominance in building decentralized applications, NFTs, and tokenized assets.

The report highlights Ethereum’s ERC-20 tokens, boasting a cumulative market value of $21 billion, significantly surpassing the $1.6 billion market capitalization of the entire BRC-20 token universe on the Bitcoin network.

To stay up to date on all things crypto, like Xcoins on Facebook, and follow us on Twitter, Instagram, and LinkedIn.