Plans For Bitcoin City Announced as #BuyTheDip Trends on Twitter

After a week of bitcoin price retreat, potentially fuelled by confirmation of an Mt. Gox rehabilitation plan, the week ended with a bang thanks to events in El Salvador. After becoming the first country to adopt bitcoin as legal tender, the President has now confirmed that the country will be building a ‘Bitcoin City’ dedicated to the leading crypto. Elsewhere, as bitcoin mining power climbs back towards ATHs, Representatives are now fighting to update crypto tax provisions to make sure that crypto innovation is not hindered in the US.

- President of El Salvador announces plan to create ‘Bitcoin City’

- Bitcoin retreats as Mt. Gox pressure weighs – buy the dip trends

- Bitcoin mining power climbs back towards ATHs

- US Representatives seek to change crypto tax provision of $1 trillion infrastructure bill

El Salvador to create ‘Bitcoin City’

After becoming the first country to accept Bitcoin as legal tender, El Salvador has thrown even more conviction behind the world’s leading cryptocurrency. The President of El Salvador, Nayib Bukele, has announced plans to build an entire city dedicated to Bitcoin.

Confirmed during a Bitcoin Week Conference in El Salvador, the aptly named Bitcoin City will be shaped like a coin and will be focused on pioneering Bitcoin infrastructure. The city is set to be located on the West coast of El Salvador, next to the Conchagua volcano. Power from the volcano will be used to produce electricity for the city and for bitcoin mining facilities.

In addition, the venture will be funded by a $1 billion US ‘Bitcoin bond’. Half of the value will be used to help construct the city. The other half will be used to purchase more bitcoin. The country currently holds just shy of 600 bitcoins within its treasury. At the current price, a further purchase worth 500 million would take the country’s treasury up to 2000 bitcoins.

The city plans to encourage new residents of Bitcoin City by offering 0% income tax, 0% capital gains tax, 0% property tax, 0% payroll tax, 0% municipal tax, and 0% C02 emissions.

Bitcoin retreats as Mt.Gox pressure weighs – ‘buy the dip’ trends

After pushing to new ATHs bitcoin prices retreated last week falling as low as $55,000. The retreat is only the second time since the July 2021 bottom that prices have corrected. Although the correction has been quick, most in the community believe that it is just a required phase of the ongoing bullish market. This sentiment was shown as ‘buythedip’ trended during the week on Twitter.

Experts also suggested a fundamental reason why prices may have briefly reversed. Although speculative, many believe that confirmation of a rehabilitation plan for Mt. Gox creditors is why bitcoin prices have recently stumbled. Mt. Gox was one of the world’s largest cryptocurrency exchanges in 2014, accounting for up to 70% of all bitcoin transactions. However, after several hacking attempts, over 850,000 BTC was lost, which resulted in the exchange filing for bankruptcy in April 2014. Only 200,000 BTC was ever recovered.

However, after an unexpected turn last week, the Tokyo District Court’s trustee, Nobuaki Kobayashi, published confirmation that creditors may now see some of their lost BTC returned. The draft rehabilitation plan, created in May, passed approval by the majority of creditors which, according to external reports, could mean nearly 150,000 BTC is redistributed.

While encouraging for creditors, the news left many traders questioning the implications. The Kobayashi publication does not disclose when and how the funds will be returned. If the funds are returned as BTC, some believe that the price of bitcoin may fluctuate unexpectedly – a risk that many short-term traders would prefer not to take. As a result, experts believe some may have taken profits during the week pressuring prices lower.

While the short-term trading activity may have lowered prices, it did encourage many within the community to search for ‘buy the dip’ opportunities.

Bitcoin hashrate climbs back to ATHs

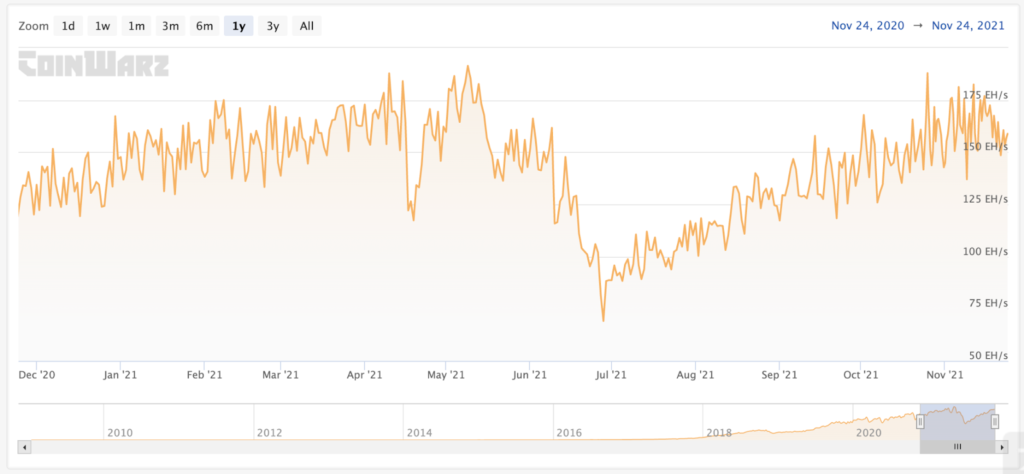

Due to the recent price advances above $60,000, bitcoin mining power has surged higher during the month of November. Older, less efficient mining rigs, which are unprofitable at cheaper prices, are now becoming profitable once again. This has resulted in many older miners rejoining the network which has subsequently boosted the overall hashrate. The total mining power is now just shy of the previous May ATHs of 191 exahash per second (EH/s).

Overall mining power dropped significantly during June and July as China banned bitcoin mining. In addition to the ban, Elon Musk also denounced bitcoin mining as being not environmentally friendly. However, since then mining power has nearly recovered all of the losses it sustained.

Ethereum has also experienced a similar rise in mining hashrate. Mining power surpassed ATHs back in September and has continued to climb throughout October and November. Last week saw Ethereum mining power extend to a new ATH of 934 terahash per second (TH/s).

US Representatives fight crypto-tax provision of infrastructure bill

In an encouraging move for the US crypto community, US lawmakers have introduced a new bill that seeks to re-define the crypto-tax implications of President Biden’s $1 trillion infrastructure bill. The infrastructure bill, which was passed by the House of Representatives in October and signed into law last week by the President, is due to impose taxes on anyone that the bill defines as a ‘broker’.

However, the definition of a broker is so broad that it could mean many in the industry, including miners and software developers are at risk. In the current infrastructure bill, a broker is defined as “any person who is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.”

As a result, Representatives Tim Ryan and Patrick McHenry have filed the ‘Keep Innovation in America Act’, which hopes to clarify the definition of cryptocurrency ‘broker’. The new bill hopes to change the definition of a broker to “any person who stands ready in the ordinary course of a trade or business to effect sales of digital assets at the direction of their customers.” If accepted, the change should help thousands within the industry avoid data collection and subsequent taxes – a scenario that would potentially see cryptocurrency innovation in the US grind to a halt and crypto businesses continuing to move overseas.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter, Instagram, LinkedIn, and sign up at the bottom of the page to subscribe.