Stock to Flow – a Reliable Predictor of Bitcoin’s Value?

What is the Stock to Flow model and how is it relevant to your crypto portfolio? Simply put, Stock to Flow (S2F) is a measure of how much of a particular commodity exists relative to the amount being created. It is the total amount of that commodity’s reserves, divided by the new amount produced per annum. It is typically applied to natural resources like gold, and centers around the concept of supply and demand.

The greater the S2F ratio, the lower the amount of the commodity entering the market relative to its total supply. Assets with higher S2Fs tend to retain their value over time. Consumable goods, by contrast, usually have a low S2F ratio because they are frequently used or disposed of by customers.

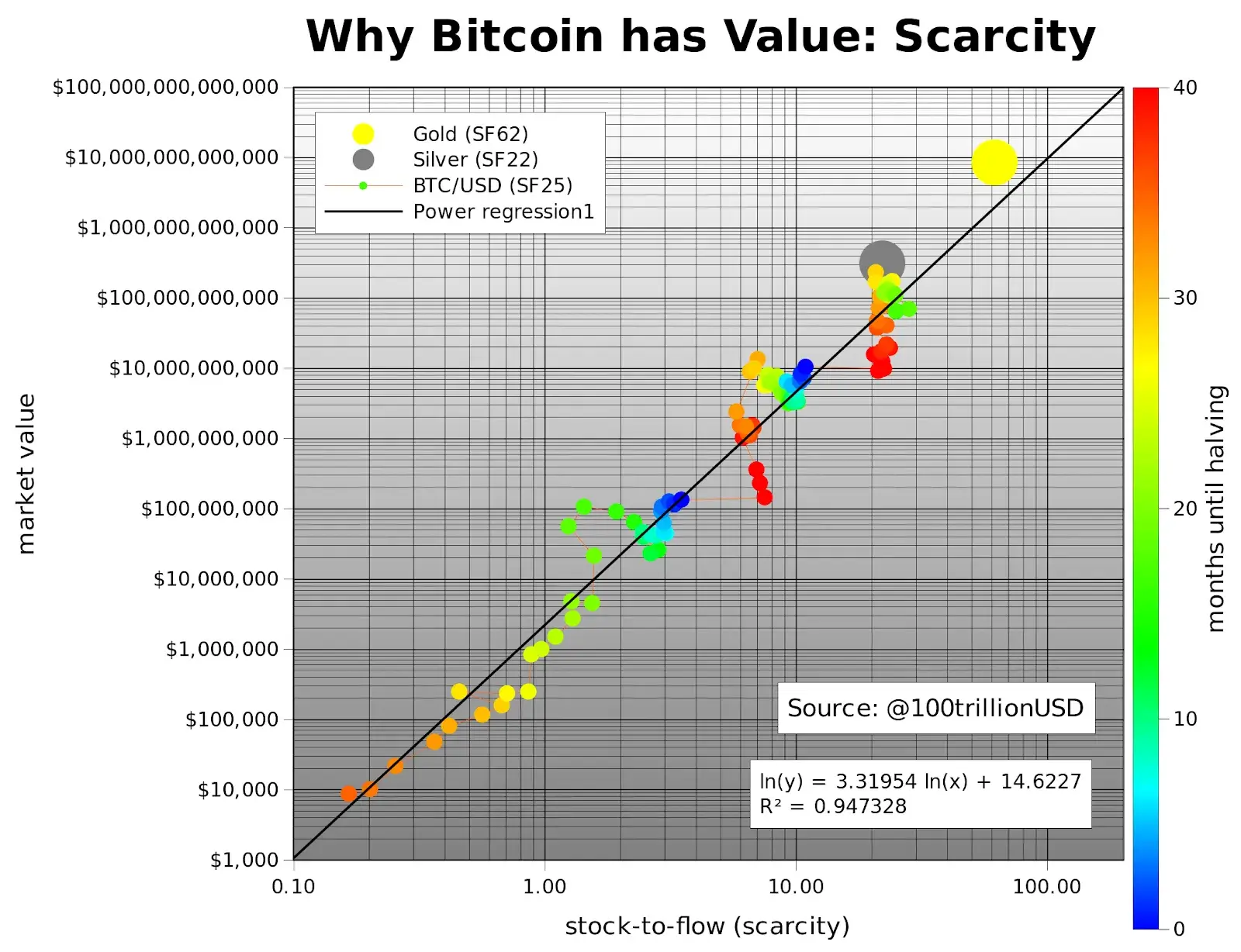

Given that Bitcoin is arguably the scarcest digital commodity in the world, with the S2F ratio, we can compare Bitcoin to commodities like gold and other precious metals and try to predict Bitcoin’s value over time.

What is the Stock to Flow ratio of Bitcoin?

Bitcoin is a store of value likely to retain its worth over a long period of time as a result of its decreasing supply. Halvings occur approximately every four years, reducing the rate that new bitcoin is created by a half. The fact that the currency is capped at 21 million coins ensures that the commodity will remain scarce and will be more difficult to obtain as time progresses and miners’ rewards are reduced.

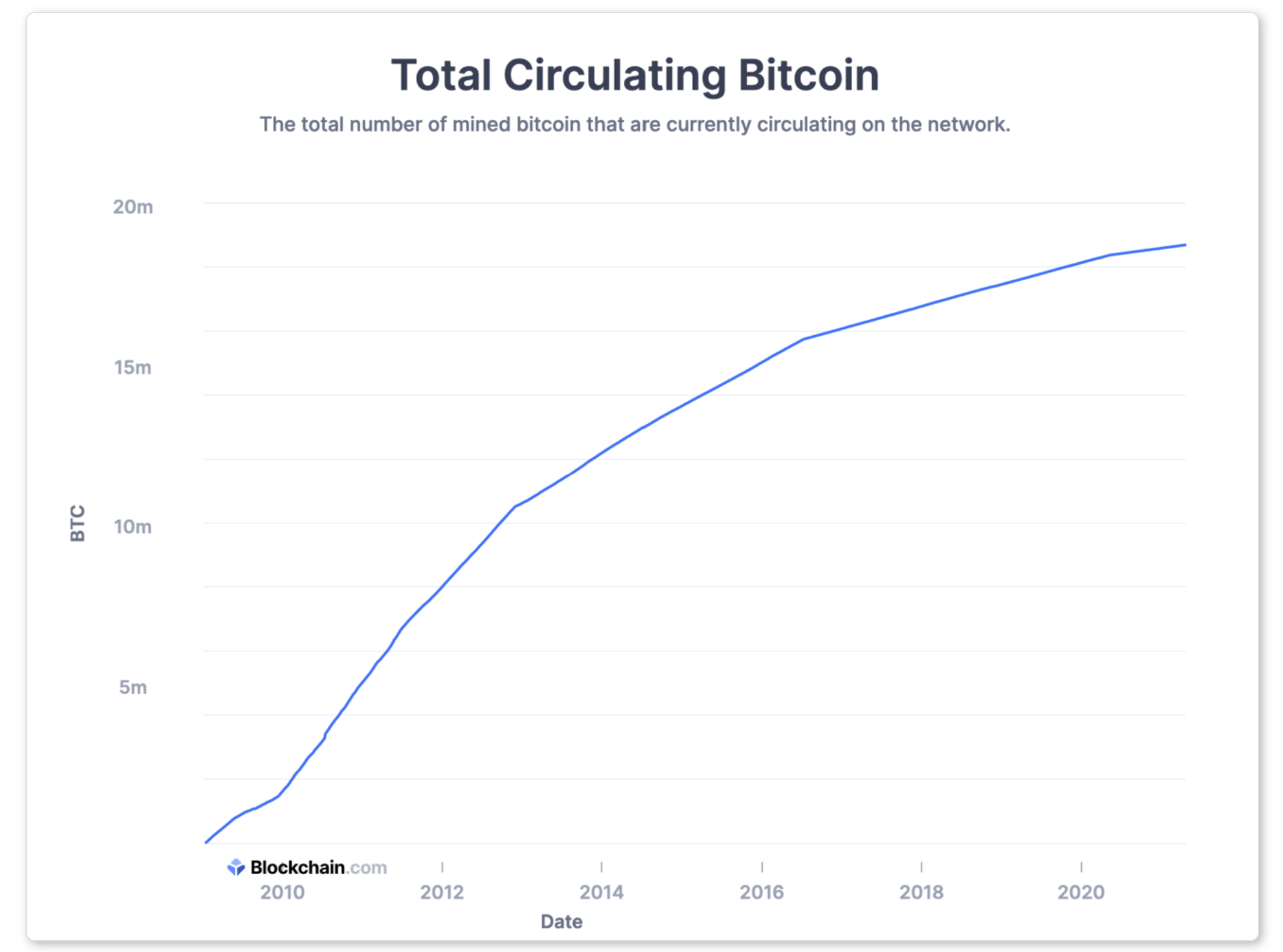

The current circulating amount of Bitcoin stands at 18 million, with an addition of roughly 0.7 million per year at present. Bitcoin’s current S2F ratio (as per crypto analyst Plan B’s calculations) is approximately 25. This is comparable to silver at 22, while gold sits at 62.

However, the crucial difference is that unlike silver and gold, Bitcoin’s supply is permanently fixed, and will decrease over time until the point where it stops being created completely.

S2F ratios for precious metals (Plan B)

This high S2F value is what enables gold to have such low price elasticity, indicating the slow speed with which its supply grows. Similarly, Bitcoin demands a rigorous extraction process from miners, involving high amounts of electricity to enable complex computations.

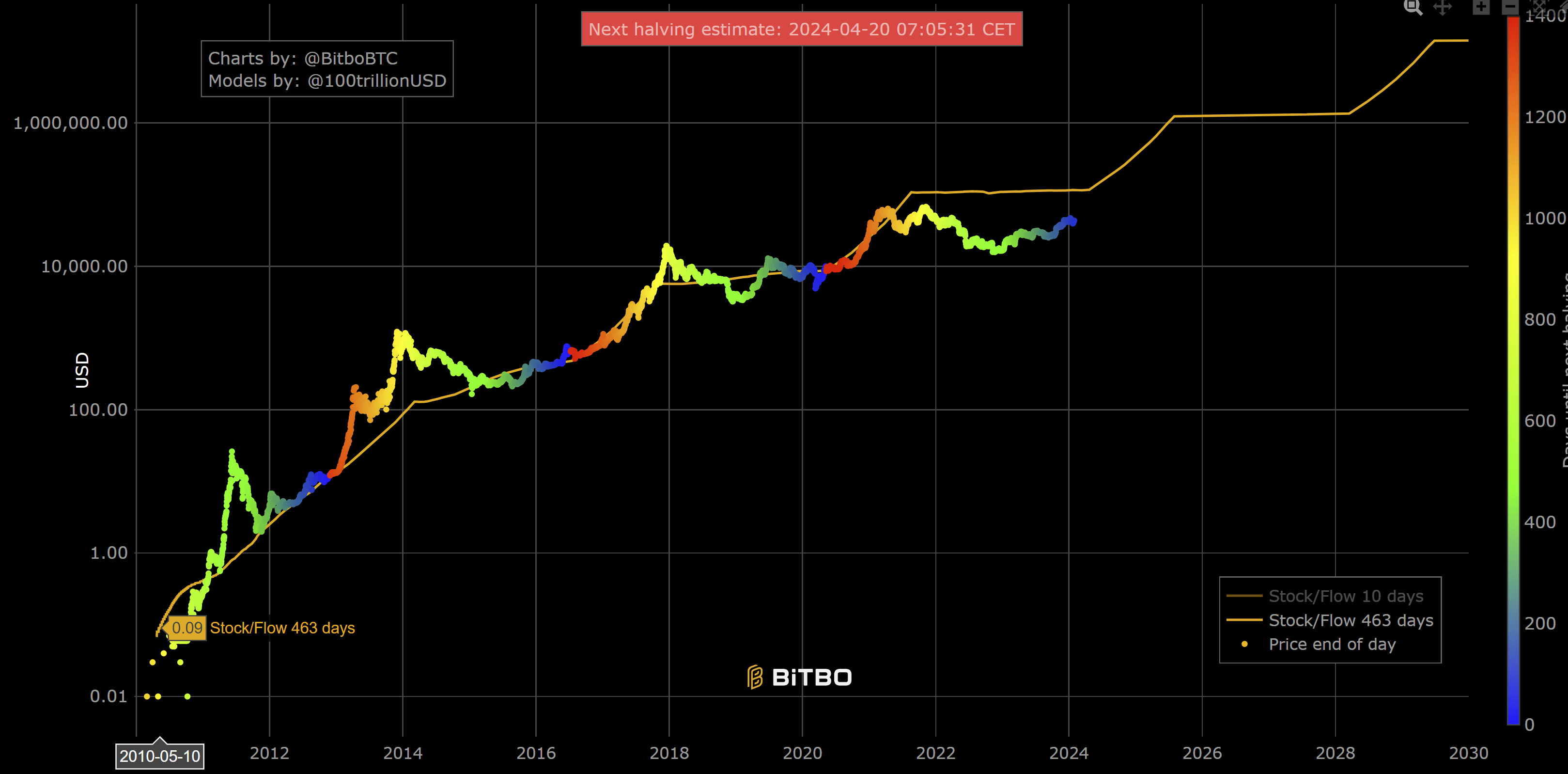

Bitcoin analyst Plan B, known for bringing the S2F model to Bitcoin, recently shared a prediction that the cryptocurrency will hit $100,000 by Christmas given its current value.

While many doubt this will be the case after Bitcoin’s drop during the summer following Elon Musk’s shenanigans, it certainly wouldn’t be the first time that Bitcoin boomed contrary to critics’ predictions. Given the success that the S2F model has demonstrated when it comes to predicting prices of gold, silver, and indeed Bitcoin to date, if enough users believe in the model’s viability with respect to Bitcoin, it could be a self-fulfilling prophecy.

Using the S2F model, Plan B suggested that roughly within a year of Bitcoin’s May 2020 halving, it would reach a valuation of $55,000 per BTC. By March 2021, one Bitcoin was worth $58,734.48. While only time can tell what its valuation will be by Christmas, given the success of the model in the past, if the model’s predictions continue to be reliable, it may be a good idea to invest before the next leap.

Limitations of the S2F model

While the S2F model could be a useful tool that enables us to compare Bitcoin to other commodities, it should not be looked at in isolation. The model operates under the assumption that scarcity should drive Bitcoin’s value, which is partially true – however, other factors and anomalous events can also contribute to Bitcoin’s value, not to mention Elon Musk’s infamous tweets.

S2F also cannot account for Bitcoin’s immense volatility. While the cryptocurrency has become more stable over the years, it still undergoes spikes as a result of the fact that it operates in a free market and is therefore under the influence of stakeholders that shape the market (its users, traders and investors). Its low liquidity compared to commodities like gold, further accounts for its fluctuations. Long-term valuations are also hard to rely on given that Bitcoin has only existed for about a decade.

The upshot

S2F can be a useful tool, as it enables us to quantify Bitcoin’s relative scarcity compared to precious metals and other commodities. Fundamentally, all models are limited by their inputs and S2F is no different. This means the model should be considered in conjunction with other factors, but given its success in predicting Bitcoin’s value in the past, the S2F model is certainly worth consideration.

As always, this article does not constitute financial advice and you should be sure to do your own research and consult a professional financial advisor before making any investment decision.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter, Instagram, LinkedIn, and sign up at the bottom of the page to subscribe.